Real Estate Investing Strategies Definition Types And Steps

:max_bytes(150000):strip_icc()/most-important-factors-investing-real-estate.asp-ADD-FINALjpg-32950329a30d4500b6d7e0fd0ba95189.jpg)

How Does Real Estate Investing Work в 21st Century University In summary, there are several real estate investing strategies available to investors, including long term buy and hold, fix and flip, wholesaling, airbnb vacation rentals, and commercial real estate. each strategy comes with its own set of advantages, challenges, and risk factors. by carefully considering market conditions, location, capital. A real estate investment trust (reit) is created when a corporation (or trust) is formed to use investors’ money to purchase, operate, and sell income producing properties. reits are bought and.

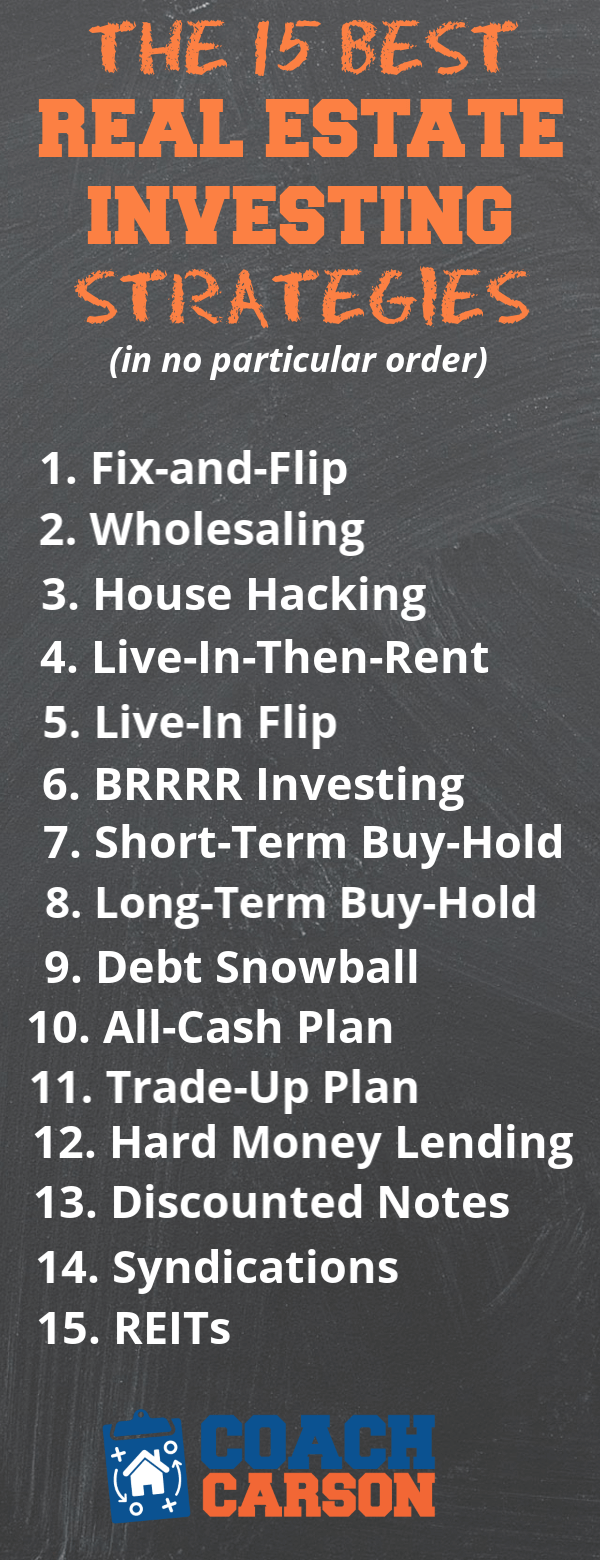

The 15 Best Real Estate Investing Strategies Coach Carson Definition and explanation. real estate investing involves buying, owning, managing, renting, and selling property for profit. at its core, it's a way to generate passive income through rental properties or to earn big returns by flipping houses after renovations. How to invest in real estate: 5 steps. 1. buy reits (real estate investment trusts) reits allow you to invest in real estate without the physical real estate. often compared to mutual funds, they. When it comes to real estate investing, you have a lot of options to choose from. we explore some of the most popular types of real estate investments below:. real estate investment trusts (reits): a real estate investment trust is a company that makes a profit through real estate, sometimes through income producing properties or office buildings. Key takeaways. real estate investing offers potential returns, diversification, and tax advantages. types of real estate investments include residential, commercial, and industrial. ways to invest in real estate include direct ownership and indirect investment vehicles like reits, crowdfunding platforms, and mutual funds.

The Basics Of Investing In Real Estate The Motley Fool 2022 When it comes to real estate investing, you have a lot of options to choose from. we explore some of the most popular types of real estate investments below:. real estate investment trusts (reits): a real estate investment trust is a company that makes a profit through real estate, sometimes through income producing properties or office buildings. Key takeaways. real estate investing offers potential returns, diversification, and tax advantages. types of real estate investments include residential, commercial, and industrial. ways to invest in real estate include direct ownership and indirect investment vehicles like reits, crowdfunding platforms, and mutual funds. Let’s say you manage to buy a house for $250,000 with 20% down, or $50,000. you do another $50,000 of renovations and then list the house for $400,000. you use the $400,000 to pay off the. If you’re looking to invest in real estate, here are five types to consider: 1. reits. publicly traded reits, or real estate investment trusts, are companies that own commercial real estate.

Comments are closed.