Rental Property Calculator Cash Flow Analysis Dealcheck

Using Rental Property Cash Flow Calculator Excel Mashvisor Calculate cash flow and investment returns of rental properties, airbnb’s and vacation rentals. use the calculator for free. rental properties are the most common type of real estate investment, thanks to their ability to generate consistent passive income and build lasting wealth. dealcheck makes it easy to analyze buy & hold, rehab & hold. Calculate cash flow and investment returns of brrrr rental properties. use the calculator for free. brrrr stands for buy, rehab, rent, refinance, repeat and is a popular real estate investing strategy that seeks to minimize total invested capital when purchasing rental properties. dealcheck’s brrrr calculator was created specifically for.

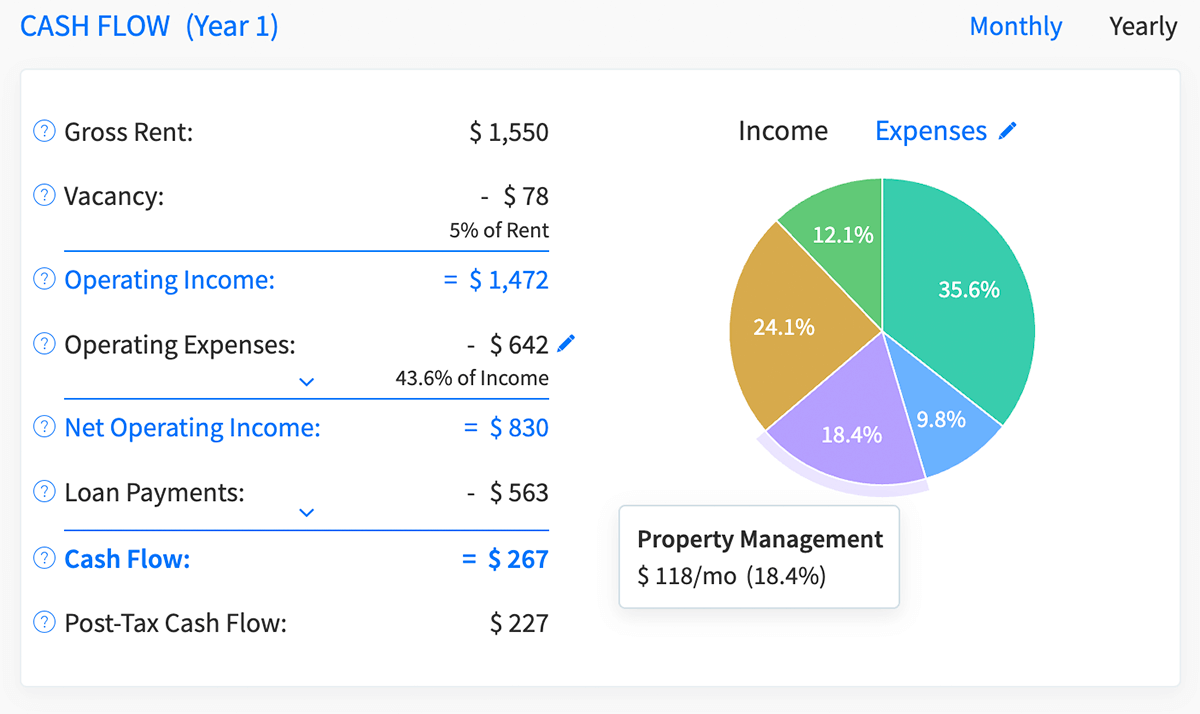

Rental Property Cash Flow Analysis Why It Is Important Use dealcheck to help you figure out how much passive income you will generate each month. “dealcheck is a must have tool for all serious real estate investors. it’s easy to use and is perfect for quickly analyzing deals. despite its simplicity, it offers many advanced features that will save you time and money.”. samantha white. san. Property analysis, simplified. analyze any investment property in seconds. calculate cash flow, profit, cap rates, roi and dozens of other metrics. look up recent sales and rental comps. compare properties and find the best real estate deals. Step 3: fill in the property description. the first step is to enter basic details about the property, including a name, property type and address. all of the fields here are optional, so you can fill in as many details as you want: here are the most important fields to fill in:. How to export property reports create professional investment reports and share them with your lenders, buyers, partners or clients. using the offer calculator to calculate offers to sellers use reverse valuation to calculate the highest price you can offer for each property. screening properties with custom investment criteria customize your.

How To Calculate Roi On Vacation Rental Haiper Step 3: fill in the property description. the first step is to enter basic details about the property, including a name, property type and address. all of the fields here are optional, so you can fill in as many details as you want: here are the most important fields to fill in:. How to export property reports create professional investment reports and share them with your lenders, buyers, partners or clients. using the offer calculator to calculate offers to sellers use reverse valuation to calculate the highest price you can offer for each property. screening properties with custom investment criteria customize your. Step 6: enter the rent & expenses information. use the rent & expenses section to enter the projected rent you're going to collect from your tenants, your operating expenses, as well as long term projections: first, customize the rental income: gross rent: the total gross rent you expect to collect from your tenants. The average cash flow on a rental property is 7% to 8%; however, how much cash flow you actually earn varies significantly by location, property values, cost of living, property amenities, and rental demand. in addition, each real estate investor has different thresholds for what they consider good cash flow.

Cash Flow Analysis Worksheet For Rental Property Step 6: enter the rent & expenses information. use the rent & expenses section to enter the projected rent you're going to collect from your tenants, your operating expenses, as well as long term projections: first, customize the rental income: gross rent: the total gross rent you expect to collect from your tenants. The average cash flow on a rental property is 7% to 8%; however, how much cash flow you actually earn varies significantly by location, property values, cost of living, property amenities, and rental demand. in addition, each real estate investor has different thresholds for what they consider good cash flow.

Using Rental Property Cash Flow Calculator Excel Mashvisor

Comments are closed.