Rental Property Investment Strategy Made Simple Buy Low Rent High

Rental Property Investment Strategy Made Simple Buy Low Rent High From long distance real estate investing, to rental property made simple, this is the best book on rental property investing on the market! product details publisher : affordable real estate investments (august 13, 2018). Buy, rehab, rent, refinance, repeat (brrrr) is the five part real estate investing strategy that makes financial freedom more attainable than ever: you buy a property under market value, add value with renovations, rent it out to tenants, complete a cash out refinance, and then use that money to do it all over again.

The Ultimate Rental Property Investment Strategy The Formula You Need Investing in rental properties requires extensive knowledge of the market, plus a little bit of strategy. the brrrr method is a common real estate investment strategy used to buy fixer uppers. Brrrr refinance example. step 1: buy a duplex property for $100,000 in a neighborhood where the average home price is $200,000. step 2: through your cost estimation, you figure out that $30,000 of investment will bring the property to a rental ready state over the next 4 months. step 3: you then find tenants in 30 60 days to take over the two. This traditional rental strategy is the most common rental property investment strategy where investors make money by collecting monthly rent and by selling the appreciated real estate property in the future. buying an investment property and renting it out following the traditional strategy can be a good way for beginner real estate investors. The strategy of buying, rehabbing, renting and refinancing rental properties is hardly a new idea. real estate investors have been following this model for years – long before the name “brrrr” ever existed – but these catchy acronyms have a funny way of sticking, and because it's easy to remember, many real estate investors have grown.

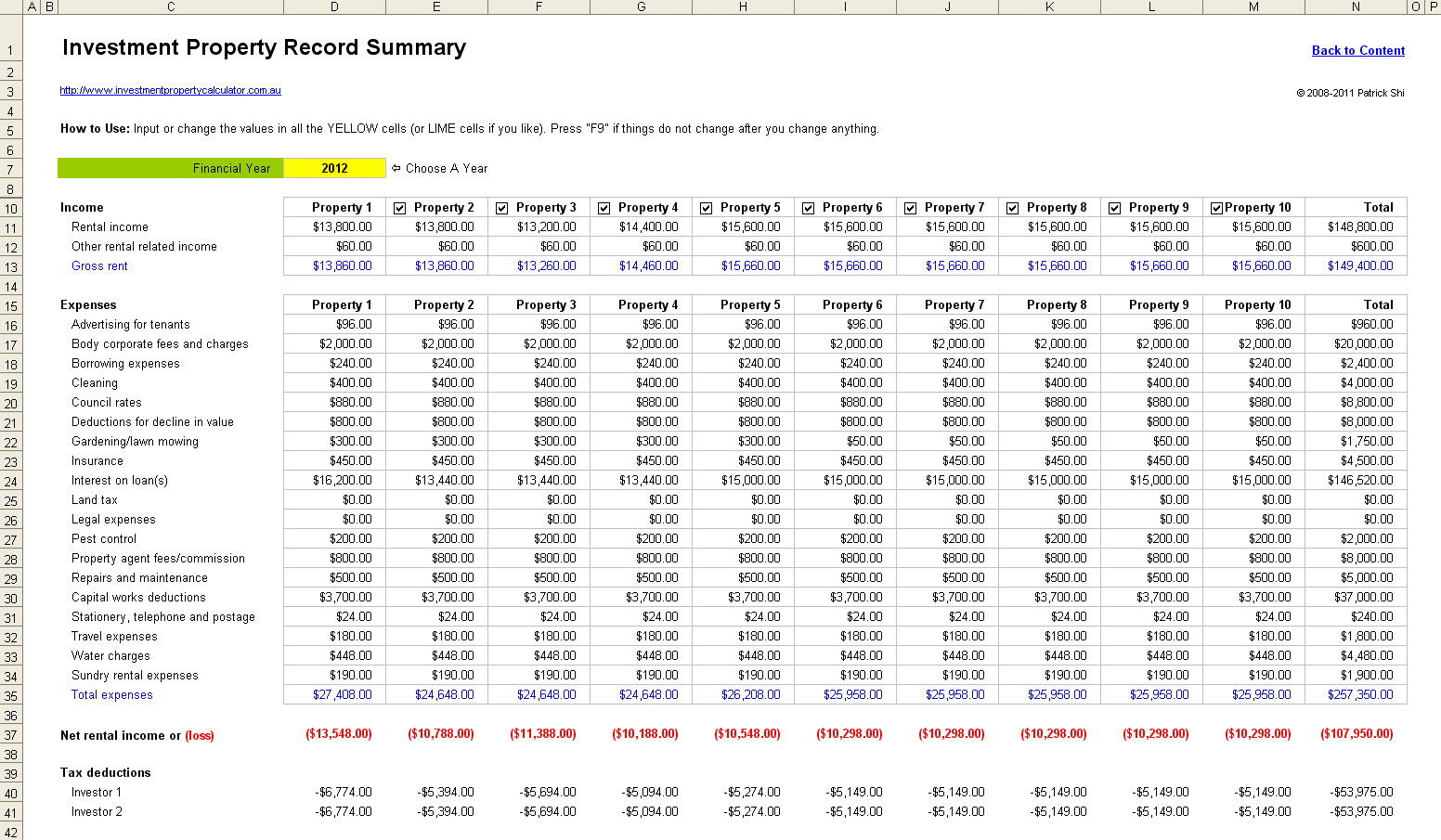

Commercial Property Investment Spreadsheet With Regard To Rental This traditional rental strategy is the most common rental property investment strategy where investors make money by collecting monthly rent and by selling the appreciated real estate property in the future. buying an investment property and renting it out following the traditional strategy can be a good way for beginner real estate investors. The strategy of buying, rehabbing, renting and refinancing rental properties is hardly a new idea. real estate investors have been following this model for years – long before the name “brrrr” ever existed – but these catchy acronyms have a funny way of sticking, and because it's easy to remember, many real estate investors have grown. Buy, rehab, rent, refinance, repeat (brrrr) is the five part real estate investing strategy that makes financial freedom more attainable than ever: you buy a property under market value, add value with renovations, rent it out to tenants, complete a cash out refinance, and then use that money to do it all over again. Rental property investment involves buying real estate to rent out for profit. investors earn income from tenant payments and potential property appreciation. it requires capital, market knowledge, and property management skills. the benefits of investing in rental property include regular cash flow, tax advantages, and portfolio diversification.

Rental Property Investment Strategy And Its Strategies Update 2023 Buy, rehab, rent, refinance, repeat (brrrr) is the five part real estate investing strategy that makes financial freedom more attainable than ever: you buy a property under market value, add value with renovations, rent it out to tenants, complete a cash out refinance, and then use that money to do it all over again. Rental property investment involves buying real estate to rent out for profit. investors earn income from tenant payments and potential property appreciation. it requires capital, market knowledge, and property management skills. the benefits of investing in rental property include regular cash flow, tax advantages, and portfolio diversification.

Comments are closed.