Return On Common Stockholders Equity Roce Formula

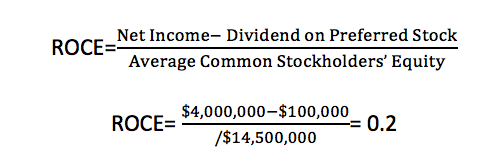

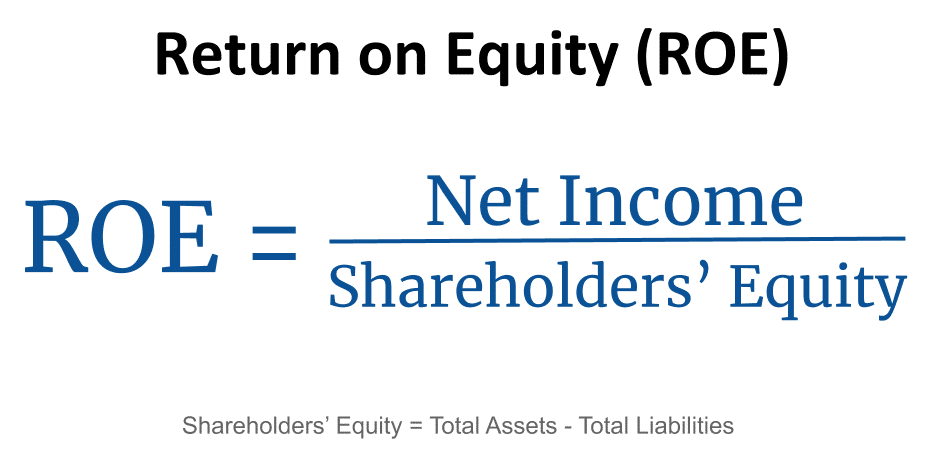

Return On Equity Roe Formula Examples And Guide To Roe How to calculate return on common equity. return on common equity (roce) can be calculated using the equation below: where: net income = after tax earnings of the company for period t. average common equity = (common equity at t 1 common equity at t) 2. as discussed above, the ratio can be used to assess future dividends and management’s. Here’s how the calculation would unfold: adjust net income for preferred dividends: $200,000 – $30,000 = $170,000. determine average shareholders’ equity: ($1,000,000 $1,200,000) 2 = $1,100,000. the roce would then be: ($170,000 $1,100,000) * 100 = 15.45%. this result indicates that for every dollar of common shareholder equity, the.

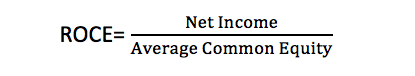

Return On Common Stockholders Equity Roce Formula Example Roe considers profits generated on shareholders' equity, but roce is the primary measure of how efficiently a company utilizes all available capital to generate additional profits. it can be more. Roce is a financial metric that calculates the return generated by a company on its common equity, which is the shareholders’ equity less preferred dividends. it shows the percentage of profits earned from each dollar of equity investment by the shareholders. roce provides a measure of how efficiently a company utilizes its shareholders. The roce formula is as follows: examples of return on common equity. let's illustrate roce with a scenario: henry owns shares in a company named ex. he aims to evaluate ex's performance relative to industry peers. ex reported a net income of $2 million and distributed $800,000 as preferred dividends in 2022. the average common equity for ex. To calculate the return on common equity, use the following formula: roce = net income ( ni ) average common shareholder’s equity. in order to find the average common equity, combine the beginning common stock for the year, on the balance sheet, and the ending common stock value. these values are then divided by two for the average amount in.

Return On Common Stockholders Equity Roce Formula Example The roce formula is as follows: examples of return on common equity. let's illustrate roce with a scenario: henry owns shares in a company named ex. he aims to evaluate ex's performance relative to industry peers. ex reported a net income of $2 million and distributed $800,000 as preferred dividends in 2022. the average common equity for ex. To calculate the return on common equity, use the following formula: roce = net income ( ni ) average common shareholder’s equity. in order to find the average common equity, combine the beginning common stock for the year, on the balance sheet, and the ending common stock value. these values are then divided by two for the average amount in. Return on capital employed (roce) is a financial ratio that measures a company's profitability and the efficiency with which its capital is employed. roce is calculated as:. It includes the value of the company's common stock, retained earnings, and other equity accounts. the formula for calculating this ratio is as follows: return on common equity = ( net income average common equity) x 100. where: net income = total revenue – total expenses. average common equity = (beginning common equity ending common.

Return On Equity Roe Formula Definition And More Stock Analysis Return on capital employed (roce) is a financial ratio that measures a company's profitability and the efficiency with which its capital is employed. roce is calculated as:. It includes the value of the company's common stock, retained earnings, and other equity accounts. the formula for calculating this ratio is as follows: return on common equity = ( net income average common equity) x 100. where: net income = total revenue – total expenses. average common equity = (beginning common equity ending common.

Return On Common Equity Roce Calculation Formula

Comments are closed.