Risk Reward Position Size Calculator вђ Indicator By Tradercreatorpro

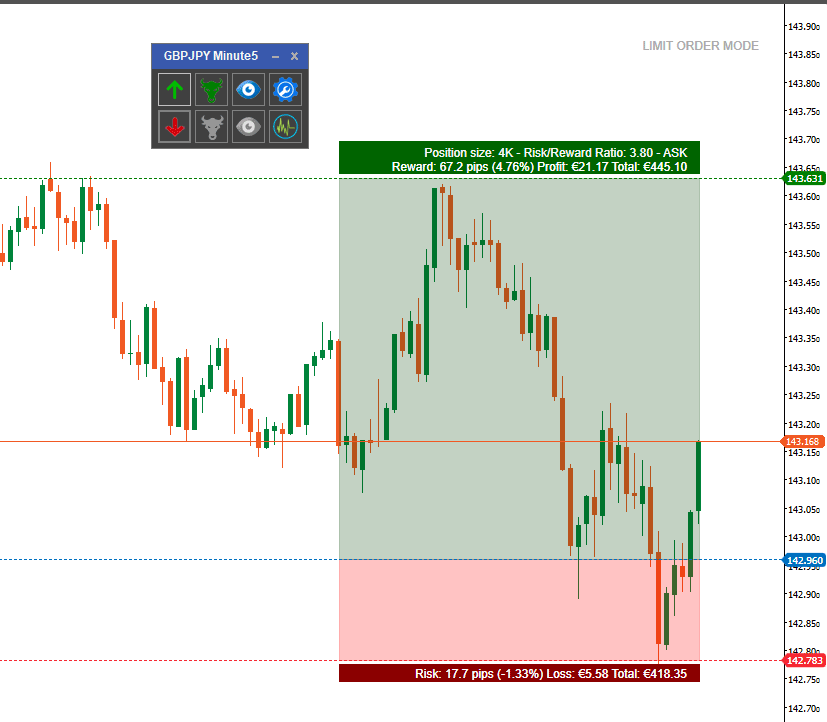

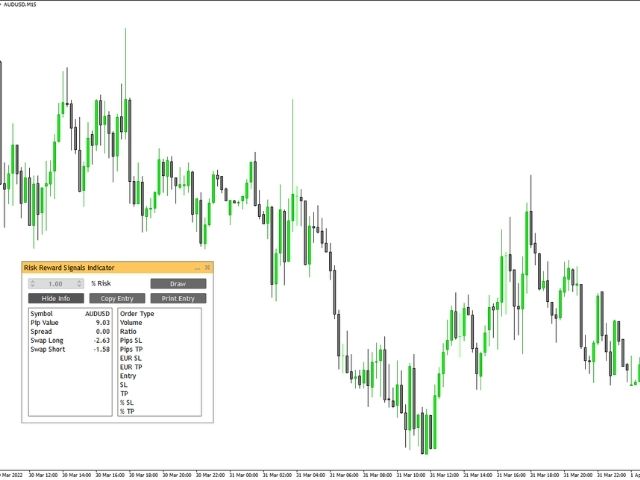

Risk Reward Position Size Calculator вђ Indicator By Tradercr This is a position size calculator. you must enter your account size, risk %, entry, stop, and target. then it will calculate your max position size, risk reward, dollar gain and more. it is completely customizable so you can change what you want the table to be showing. it also can plot your entry, stop and target that you enter into the settings. 53. add to favorites. the position size calculator (psc) is a comprehensive tool designed to assist traders in managing their trades risk by accurately calculating the optimal position size based on account settings, trade levels, and risk management parameters. this indicator helps traders make informed decisions by providing critical.

Calculating Risk And Reward With Position Size Calculator Youtub Atr position size automation. all you have to fill out is your account balance, the % amount of your account you want to risk, and the percentage of atr you want calculated. if you have 100% it will do a full atr calculation. so if the atr is $2 then your risk per share would be $2. if you had 50% in the same example it would be risking $1 per. Amount at risk: $200 (2% of $10,000) position size: 4,000 units. standard lots: 0.04. mini lots: 0.4. micro lots: 4. this calculation ensures that if the trade hits the stop loss level, the maximum loss will be limited to $200, preserving the majority of the account balance for future trades. This video shows how the position size calculator can help you to work with risk and reward parameters of your trades. the indicator offers advanced capabili. If you buy a stock at the price of $20, and your profit target for the stock is $25 with a stop loss of $18. let's calculate the risk reward ratio for this trade. risk = ($20 $18) $20 * 100 = 10. reward = ($25 $20) $20 * 100 = 25. risk reward ratio = 10 25 = 1 2.5. that means this trade will have a risk reward ratio of 1 2.5.

How To Trade Using A Risk Reward Tool This video shows how the position size calculator can help you to work with risk and reward parameters of your trades. the indicator offers advanced capabili. If you buy a stock at the price of $20, and your profit target for the stock is $25 with a stop loss of $18. let's calculate the risk reward ratio for this trade. risk = ($20 $18) $20 * 100 = 10. reward = ($25 $20) $20 * 100 = 25. risk reward ratio = 10 25 = 1 2.5. that means this trade will have a risk reward ratio of 1 2.5. How to use our risk reward ratio calculator. step 1: input the stop loss price: begin by entering the price at which you intend to exit your position to prevent further losses if the market moves against you. this is your ‘stop loss price’. step 2: enter the entry price: input the price at which you plan to enter the market. This is exactly what the breakeven win rate gives you. it is calculated through the following formula: breakeven win rate = risk rate (risk rate reward rate) so, if we have risk reward ratio of 2:8. 2 (2 8) = 0.20 or 20 %. this result shows that 20 % of all trades need to be winners for the trading system to be profitable.

Compre гљtilidad Comercial Risk Reward Calculator Indicator Para How to use our risk reward ratio calculator. step 1: input the stop loss price: begin by entering the price at which you intend to exit your position to prevent further losses if the market moves against you. this is your ‘stop loss price’. step 2: enter the entry price: input the price at which you plan to enter the market. This is exactly what the breakeven win rate gives you. it is calculated through the following formula: breakeven win rate = risk rate (risk rate reward rate) so, if we have risk reward ratio of 2:8. 2 (2 8) = 0.20 or 20 %. this result shows that 20 % of all trades need to be winners for the trading system to be profitable.

Comments are closed.