Roth Ira Basics Explained In 5 Minutes Ultimate Guide For 2024

Roth Ira Explained For 2024 Tax Free Retirement Account Youtube If, in 2024, you make less than $38,250, single, or $76,500 as a married couple, you could potentially receive a tax credit for 10 50% of your contributions to a roth ira. this credit is a dollar. The roth ira income limit to make a full contribution in 2024 is less than $146,000 for single filers, and less than $230,000 for those filing jointly. if you’re a single filer, you’re eligible to contribute a portion of the full amount if your magi is $146,000 or more, but less than $161,000. for those married filing jointly, the income.

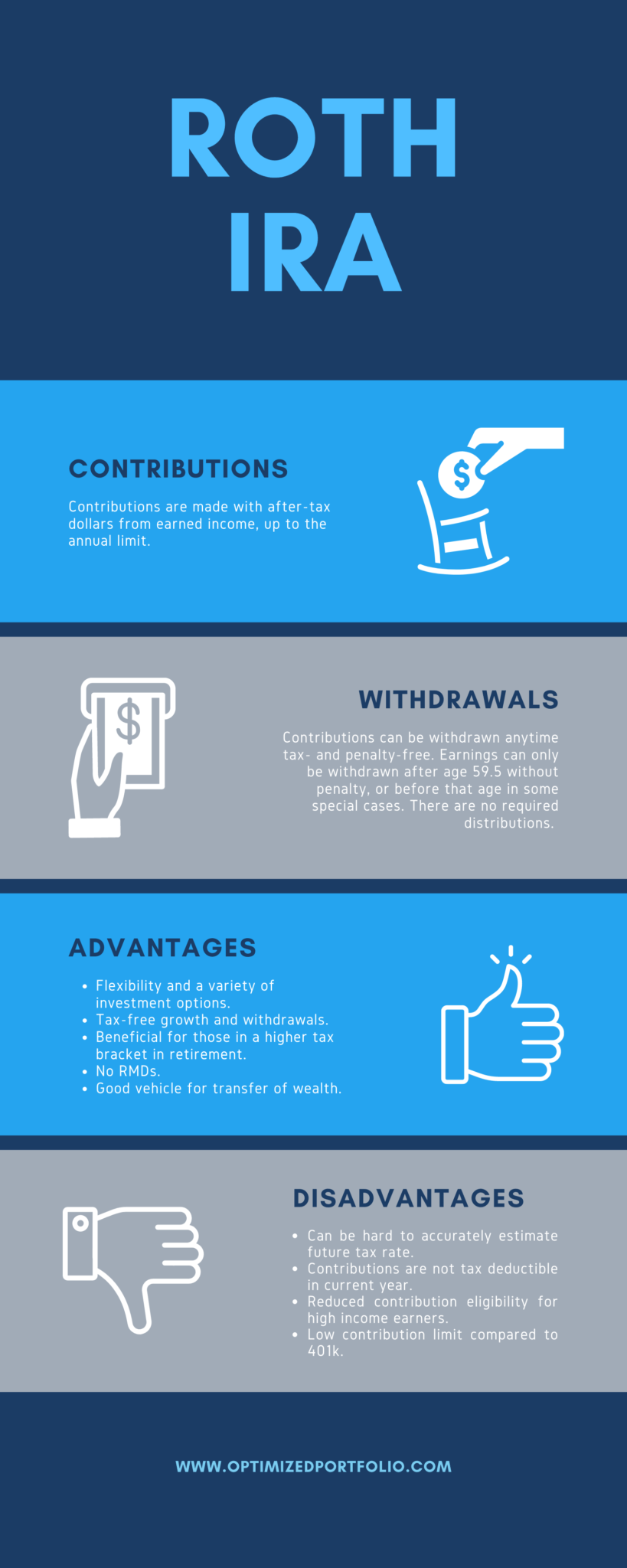

Roth Ira A Full Guide And Explanation Youtube Roth ira income limits 2024. roth ira contribution limits 2024. single, head of household, or married filing separately (if you didn't live with spouse during year) less than $146,000. $7,000. The contribution limit for a roth ira is $7,000 (or $8,000 if you are over 50) in 2024. those are the caps even if you make more, up to the phaseout level. earned income is the basis for. A roth ira is an individual retirement plan that bears many similarities to the traditional ira, but contributions aren't tax deductible, and qualified distributions are tax free. your guide to. The maximum amount you can contribute to a roth ira for 2024 is $7,000 (up from $6,500 in 2023) if you're younger than age 50. if you're age 50 and older, you can add an extra $1,000 per year in.

Roth Ira Explained For Beginners Youtube A roth ira is an individual retirement plan that bears many similarities to the traditional ira, but contributions aren't tax deductible, and qualified distributions are tax free. your guide to. The maximum amount you can contribute to a roth ira for 2024 is $7,000 (up from $6,500 in 2023) if you're younger than age 50. if you're age 50 and older, you can add an extra $1,000 per year in. A roth ira is an ira that, except as explained below, is subject to the rules that apply to a traditional ira. you cannot deduct contributions to a roth ira. if you satisfy the requirements, qualified distributions are tax free. you can make contributions to your roth ira after you reach age 70 ½. you can leave amounts in your roth ira as long. The roth ira contribution limit increases from $6,500 in 2023 to $7,000 in 2024. people 50 and older can make an extra $1,000 catch up contribution in both 2023 and 2024. individuals with high.

Roth Ira Basics Explained In Simple Terms Mгєtis Money Matters Money A roth ira is an ira that, except as explained below, is subject to the rules that apply to a traditional ira. you cannot deduct contributions to a roth ira. if you satisfy the requirements, qualified distributions are tax free. you can make contributions to your roth ira after you reach age 70 ½. you can leave amounts in your roth ira as long. The roth ira contribution limit increases from $6,500 in 2023 to $7,000 in 2024. people 50 and older can make an extra $1,000 catch up contribution in both 2023 and 2024. individuals with high.

Roth Ira Explained What Who When Where Why How 2024

Comments are closed.