Roth Ira Conversion A Smart Move Right Now

Roth Ira Conversion A Smart Move Right Now Youtube For 2021 medicare part b premium costs range from the low of $148.50 to a high of $504.90. any roth conversions done for the tax year 2021 could affect your 2023 premiums. ultimately, though, what. Roth ira conversion: a smart move right now? by dan caplinger – jan 11, , current low levels might make now a great time to convert an ira that owns those stocks.

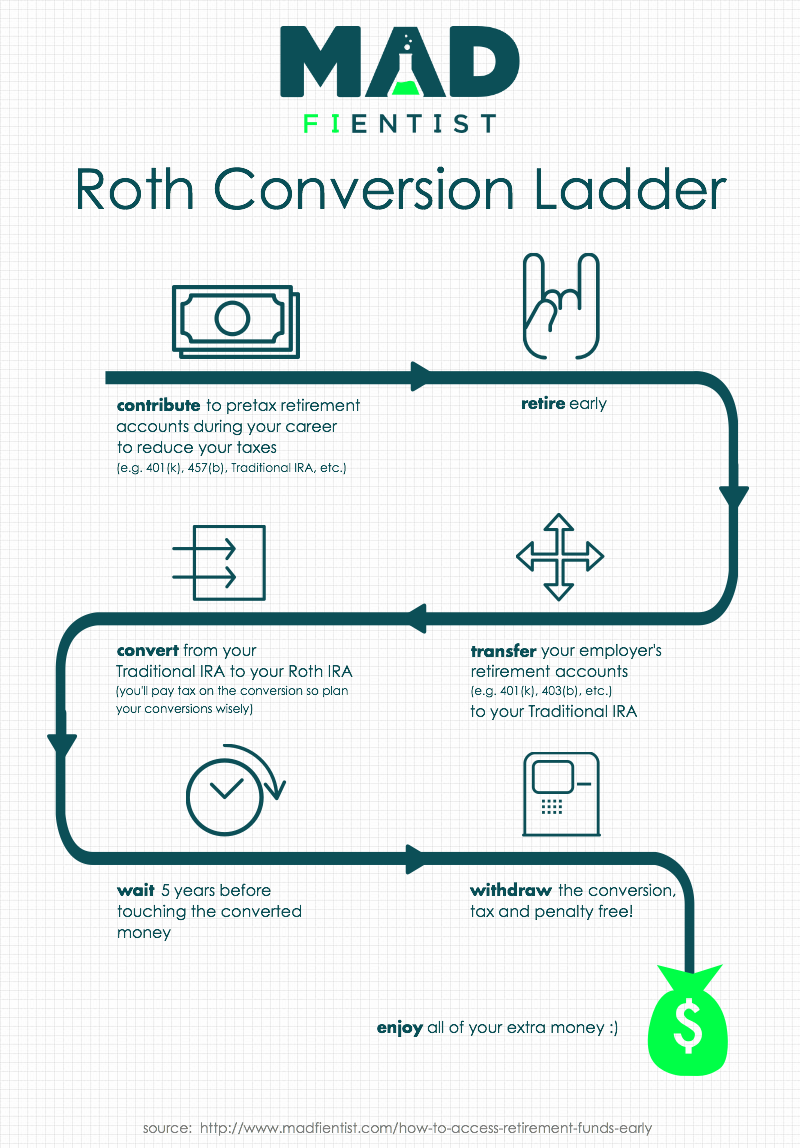

Roth Conversion Ladder And Sepp How To Access Your Retirement Accounts When it comes to a roth individual retirement account (ira), the answer could be yes. a roth ira is funded with after tax dollars, and qualified withdrawals are entirely tax free. 1 additionally, roth iras aren't subject to required minimum distributions (rmds), which gives you greater control over your taxable income in retirement. The conversion would be part of a 2 step process, often referred to as a "backdoor" strategy. first, place your contribution in a traditional ira—which has no income limits. then, move the money into a roth ira using a roth conversion. but make sure you understand the tax consequences before using this strategy. review roth ira income limits. A roth ira conversion, in which you transfer money from a traditional ira into a roth ira, can be a smart way to manage your tax bill. but there are a bunch of moving pieces you need to get a grip. A roth ira is a tax advantaged retirement account. with a roth ira, you deposit after tax money, can invest in a range of assets and withdraw the money tax free after age 59 1 2. tax free.

Is A Roth Conversion A Smart Move Youtube A roth ira conversion, in which you transfer money from a traditional ira into a roth ira, can be a smart way to manage your tax bill. but there are a bunch of moving pieces you need to get a grip. A roth ira is a tax advantaged retirement account. with a roth ira, you deposit after tax money, can invest in a range of assets and withdraw the money tax free after age 59 1 2. tax free. A roth conversion involves moving funds that are held in either a traditional ira or a standard 401 (k) into a roth ira. the benefit of doing a roth conversion is twofold: a lower tax burden in. Before converting a traditional 401 (k) or ira to a roth 401 (k) or ira, think about your future: where you will live in retirement, leaving money to others, and required minimum distributions (rmds). consider the costs of a conversion: how you would pay for it, the 3.8% net investment income tax, and gains on company stock in a 401 (k).

Comments are closed.