Roth Ira Rules Contribution Limits And How To Get Started The

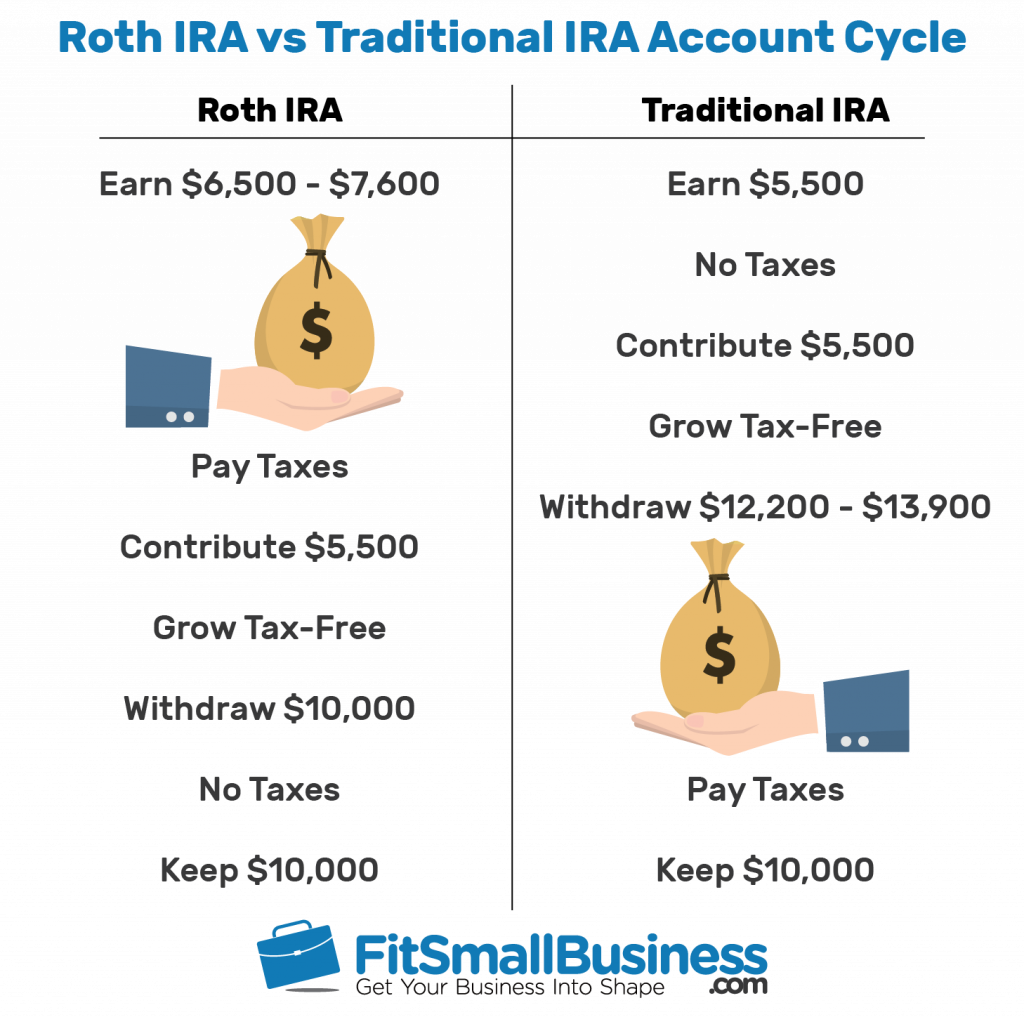

Roth Ira Rules Contribution Limits Deadlines Best Practice In Hr A roth ira is an ira that, except as explained below, is subject to the rules that apply to a traditional ira. you cannot deduct contributions to a roth ira. if you satisfy the requirements, qualified distributions are tax free. you can make contributions to your roth ira after you reach age 70 ½. you can leave amounts in your roth ira as long. The roth ira contribution limit is $6,500 for 2023, and $7,000 in 2024, if you are younger than age 50. if you are 50 or older, then the contribution limit increases to $7,500 in 2023, and $8,000.

Roth Ira Rules Contribution Limits And How To Get Started The The contribution limit for a roth ira is $7,000 (or $8,000 if you are over 50) in 2024. those are the caps even if you make more, up to the phaseout level. earned income is the basis for. Steps to open a roth ira. to open a roth ira, follow these steps: 1. determine your eligibility. the first step to opening a roth ira is finding out if you're eligible. the criteria for roth ira. The 2024 roth ira income limits are $161,000 for single tax filers and $240,000 for those married filing jointly. the roth ira contribution limits are $7,000, or $8,000 if you're 50 plus. The roth ira contribution limit for 2024 is $7,000 for those under 50, and $8,000 for those 50 and older. your personal roth ira contribution limit, or eligibility to contribute at all, is dictated by your income level. a roth ira is a tax advantaged way to save and invest for retirement.

Comments are closed.