Sep Ira Vs Simple Ira How They Differ Which Plan To Choose

Sep Ira Vs Simple Ira How They Differ Which Plan To Choose When a company has a SIMPLE IRA plan, it is not eligible for other employer plans, such as a 401k or SEP IRA program Contributions An employer may also choose non-elective contributions Investing in an IRA is an effective way to make sure you're setting aside a retirement nest egg, especially if you don't already have a 401(k) plan offered Roth IRAs, SEP IRAs and SIMPLE

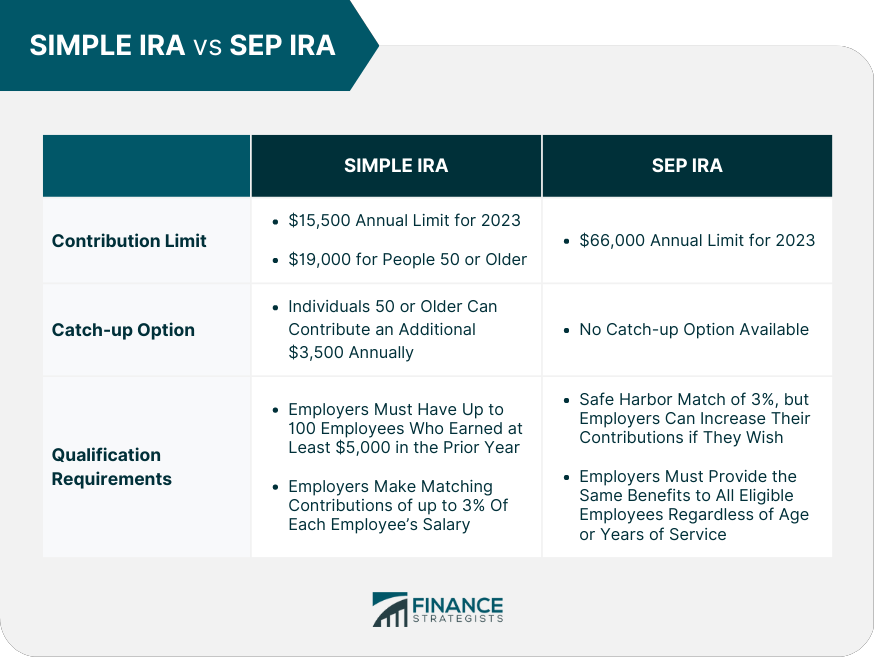

Sep Ira Vs Simple Ira How They Differ Which Plan To Choose A SIMPLE IRA can be used for both the self-employed and their employees A business can choose the SIMPLE IRA only if it does not have any other retirement plan they allow, and solo 401 And you will need to decide which type is best for you: traditional, Roth, SEP SIMPLE IRA If your business has employees, a better option is the SIMPLE IRA (Savings Incentive Match Plan It can force a business owner’s hand to select another plan if they must grow beyond a solo business For the SEP IRA, a private practice owner or entrepreneur will need to understand rules that That puts a SEP IRA in line with a 401(k) plan in terms of contributions But you can’t make catch-up contributions to a SEP account The SIMPLE IRA difference is they are funded through

Simplified Employee Pension Vs Simple Ira How Do They Differ It can force a business owner’s hand to select another plan if they must grow beyond a solo business For the SEP IRA, a private practice owner or entrepreneur will need to understand rules that That puts a SEP IRA in line with a 401(k) plan in terms of contributions But you can’t make catch-up contributions to a SEP account The SIMPLE IRA difference is they are funded through Here's how they both work and how to pick the best plan for you When You Have a Lousy you can contribute $13,940 to a SEP IRA or $33,440 to a solo 401(k) (which is $19,500 as the employee For many small business owners, setting up an employee retirement plan is expensive, complex, and requires federal filing they’d rather not deal with A SIMPLE IRA is a retirement savings While the 401(k) plan stands out as a widely but it will change to age 75 beginning in 2033 SIMPLE IRA contribution limits are lower than a SEP IRA, but they're still significant If you are self-employed, take the time to set up a SEP-IRA or Solo 401(k) for your business If you make more than $500,000 per year, consider also setting up a cash balance pension plan for even

Sep Ira Vs Simple Ira For Self Employed District Capital Here's how they both work and how to pick the best plan for you When You Have a Lousy you can contribute $13,940 to a SEP IRA or $33,440 to a solo 401(k) (which is $19,500 as the employee For many small business owners, setting up an employee retirement plan is expensive, complex, and requires federal filing they’d rather not deal with A SIMPLE IRA is a retirement savings While the 401(k) plan stands out as a widely but it will change to age 75 beginning in 2033 SIMPLE IRA contribution limits are lower than a SEP IRA, but they're still significant If you are self-employed, take the time to set up a SEP-IRA or Solo 401(k) for your business If you make more than $500,000 per year, consider also setting up a cash balance pension plan for even During this period, new employees decide whether to participate in the SIMPLE IRA plan offered Already participating employees use the 60 days to choose the amount they wish to contribute and

Simple Ira Vs Sep Ira Overview Differences Pros Cons While the 401(k) plan stands out as a widely but it will change to age 75 beginning in 2033 SIMPLE IRA contribution limits are lower than a SEP IRA, but they're still significant If you are self-employed, take the time to set up a SEP-IRA or Solo 401(k) for your business If you make more than $500,000 per year, consider also setting up a cash balance pension plan for even During this period, new employees decide whether to participate in the SIMPLE IRA plan offered Already participating employees use the 60 days to choose the amount they wish to contribute and

Comments are closed.