Sep Ira Vs Simple Ira Small Business Retirement Plans

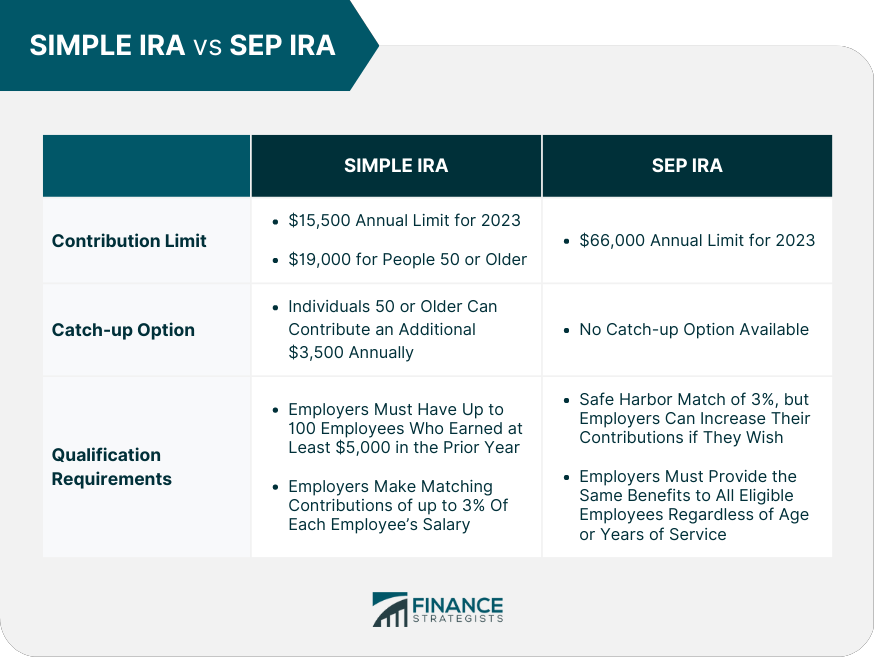

Simplified Employee Pension Vs Simple Ira How Do They Differ A simple ira allows both the employee and the small business owner or sole proprietor to make contributions. a sep ira, meanwhile, only allows business owners to make contributions for both themselves and their employees. the contribution limits of a simple ira vs. sep ira are different too. the sep ira limit in 2023 is 25% of an employee’s. The maximum compensation that counts for the sep ira is $330,000. and contributions to the sep are limited to the lesser of 25% of compensation or $66,000 (2023 limit). hence, while 25% of.

Simple Ira Vs Sep Ira Overview Differences Pros Cons Businesses with fewer than 100 employees can set up a simple ira. any size business can set up a sep ira. both simple ira and sep ira retirement plans are suited for small businesses but a. With a sep ira, employers may contribute to the plan, but they are not obligated. a sep ira allows employers to contribute up to $66,000 (in 2023), or up to 25 percent of an employee’s salary. A simple ira allows employers to make contributions on behalf of their employees. on the other hand, a sep ira only allows employers to make contributions themselves. additionally, a simple ira has an annual contribution limit of $15,500 per employee (as of 2023), while a sep ira has a yearly contribution limit of 25% of each employee's salary. Retirement plan startup costs tax credit. establishing a sep or a simple ira for your business may allow you to claim the retirement plan startup costs tax credit. this credit is designed to help offset startup costs for small businesses that set up retirement plans for their employees, and it's worth up to $5,000 per year for three years.

Comments are closed.