Simplified Employee Pension Vs Simple Ira How Do They Differ

Simplified Employee Pension Vs Simple Ira How Do They Differ A simplified employee pension (sep or sep ira) and a simple ira are similar in several ways but these plans also have differences that set them apart. they include who can contribute and how large. A simple ira allows employers to make contributions on behalf of their employees. on the other hand, a sep ira only allows employers to make contributions themselves. additionally, a simple ira has an annual contribution limit of $15,500 per employee (as of 2023), while a sep ira has a yearly contribution limit of 25% of each employee's salary.

Simple Ira Vs Sep Ira Overview Differences Pros Cons A simplified employee pension (sep) is an individual retirement account (ira) that an employer or a self employed person can establish. the employer is allowed a tax deduction for contributions. A simple ira allows both the employee and the small business owner or sole proprietor to make contributions. a sep ira, meanwhile, only allows business owners to make contributions for both themselves and their employees. the contribution limits of a simple ira vs. sep ira are different too. the sep ira limit in 2023 is 25% of an employee’s. With a sep ira, employers may contribute to the plan, but they are not obligated. a sep ira allows employers to contribute up to $66,000 (in 2023), or up to 25 percent of an employee’s salary. Another core difference is that the simple ira employee contribution limit is $16,00 in 2024, with a $3,500 catch up for those 50 and older. the sep ira contribution limit is up to $69,000 in 2024.

Pin On Investing With a sep ira, employers may contribute to the plan, but they are not obligated. a sep ira allows employers to contribute up to $66,000 (in 2023), or up to 25 percent of an employee’s salary. Another core difference is that the simple ira employee contribution limit is $16,00 in 2024, with a $3,500 catch up for those 50 and older. the sep ira contribution limit is up to $69,000 in 2024. The maximum compensation that counts for the sep ira is $330,000. and contributions to the sep are limited to the lesser of 25% of compensation or $66,000 (2023 limit). hence, while 25% of. Learn about the main difference between a sep ira and a simple ira to better understand the annual investing requirements that small businesses must make. investopedia uses cookies to provide you with a great user experience.

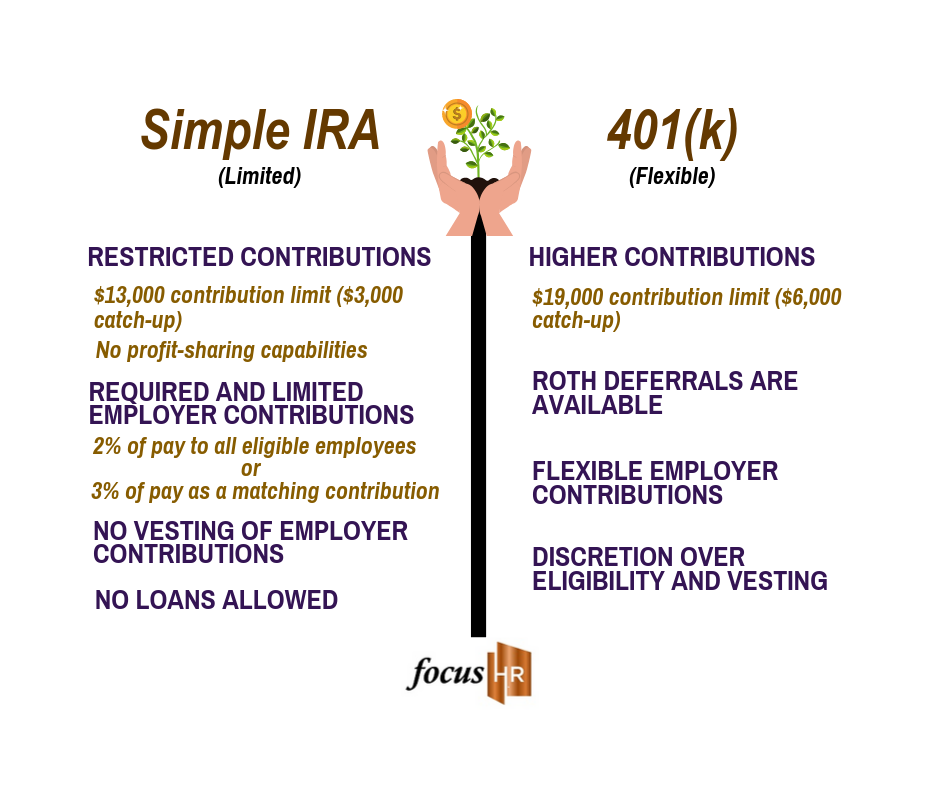

Retirement Plan Comparison Simple Ira Vs 401 K Focus Hr Inc The maximum compensation that counts for the sep ira is $330,000. and contributions to the sep are limited to the lesser of 25% of compensation or $66,000 (2023 limit). hence, while 25% of. Learn about the main difference between a sep ira and a simple ira to better understand the annual investing requirements that small businesses must make. investopedia uses cookies to provide you with a great user experience.

Simplified Employee Pension Sep Ira Definition How It Works

Comments are closed.