Sip Vs Lump Sum Which Is Better In Mutual Funds Investing Stable

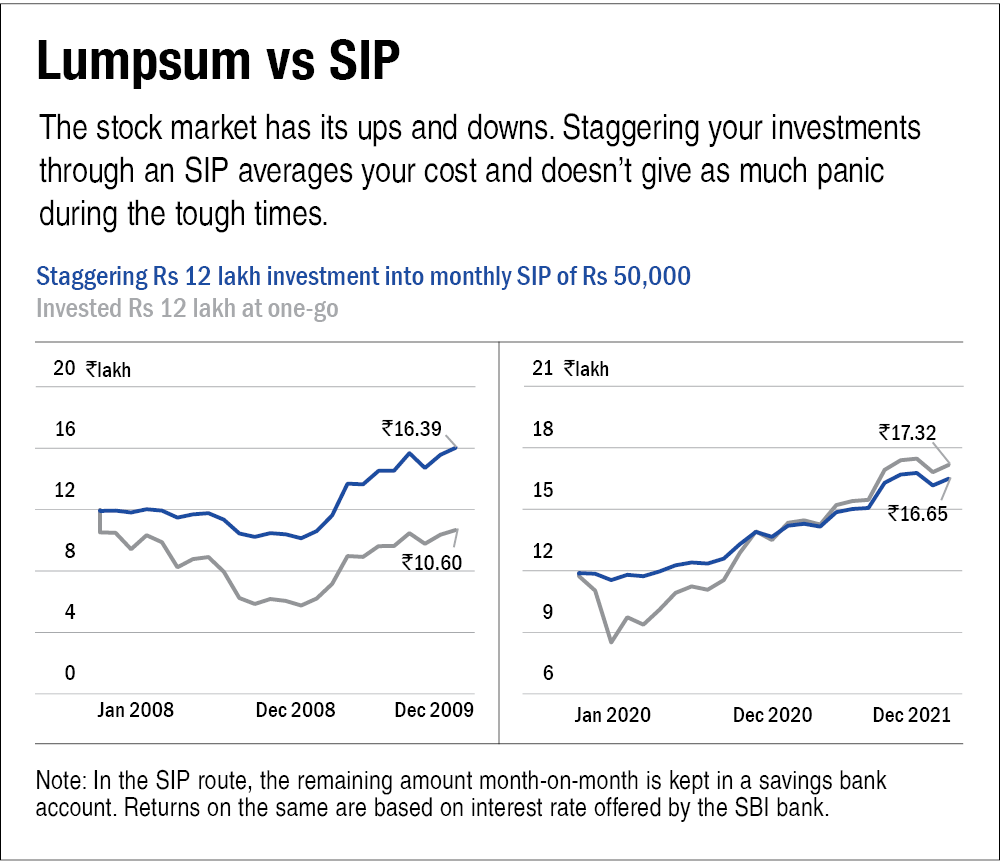

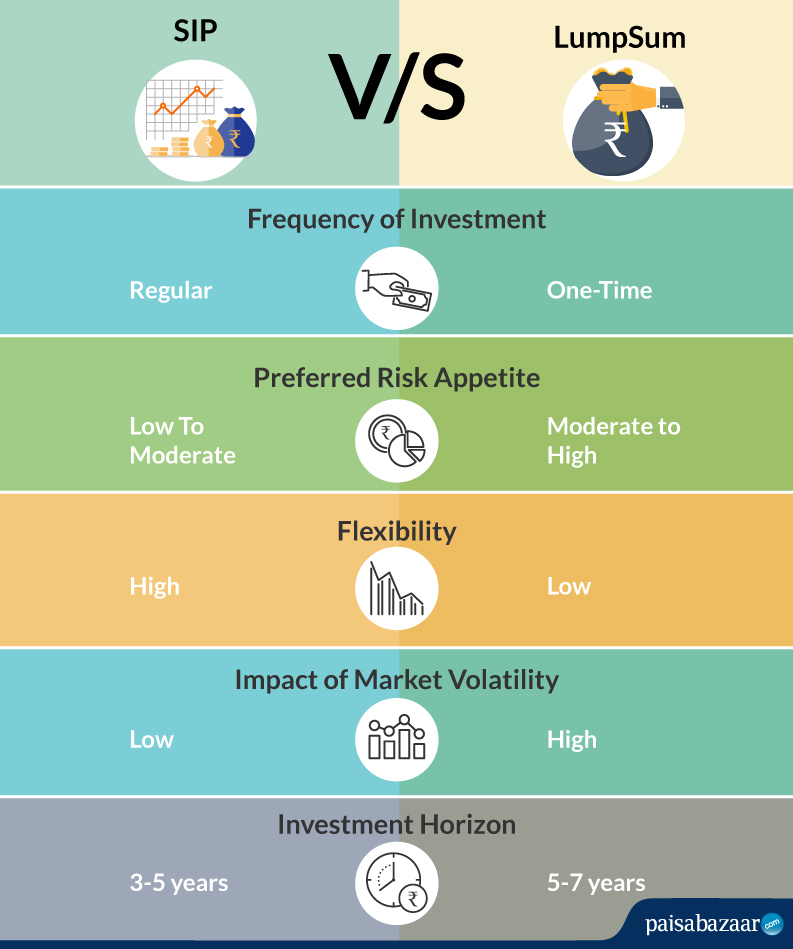

Sip Vs Lump Sum Which Is Better In Mutual Funds Investing Stable What would have been a better so the SIP would work a lot better for them Let us look at lump-sum investing and SIPs in greater detail How Does Lump-sum Investing In Mutual Funds Work? Mutual Fund SIP through mutual funds Not all investors have a lump sum amount to start with, which makes SIPs a more practical choice If you have lump sum available, investing it immediately

Sip Vs Lump Sum Difference Between Sip And Lumpsum Value Research For most investors, this may not really be a choice Typically, a lump-sum investment makes sense only if you have a substantial sum of money available in your hand to invest in one go Otherwise SIP vs Lump Sum: Investors often face the STPs allow for transferring funds between mutual funds, which can potentially yield better results than keeping funds in a traditional savings account Shuffling of portfolio gets easier by investing directly into stocks If a particular stock is not doing well, one can exit easily and immediately opt for a better funds Monthly or lump sum Leaving money in a stagnant bank account guarantees that inflation will gradually reduce your purchasing power Most bank savings rates don't keep up with inflation, and even if they do, the

Sip Vs Lump Sum Which Is Better In Mutual Funds Investing Stable Shuffling of portfolio gets easier by investing directly into stocks If a particular stock is not doing well, one can exit easily and immediately opt for a better funds Monthly or lump sum Leaving money in a stagnant bank account guarantees that inflation will gradually reduce your purchasing power Most bank savings rates don't keep up with inflation, and even if they do, the But those who want to go this route should know that lump sum investing has proved to provide better long-term returns more times than not A 2012 Vanguard study found that, on average Many people see mutual funds as a great investment vehicle Profit and prosper with the best of expert advice on investing, taxes, retirement, personal finance and more - straight to your Investing in mutual funds is a straightforward way to build a diversified portfolio, even if you’re new to investing By pooling your money with other investors, mutual funds allow you to buy

Which Is Better To Invest Sip Or Mutual Funds Lumpsum Know The But those who want to go this route should know that lump sum investing has proved to provide better long-term returns more times than not A 2012 Vanguard study found that, on average Many people see mutual funds as a great investment vehicle Profit and prosper with the best of expert advice on investing, taxes, retirement, personal finance and more - straight to your Investing in mutual funds is a straightforward way to build a diversified portfolio, even if you’re new to investing By pooling your money with other investors, mutual funds allow you to buy

Comments are closed.