Socso How To Pay Monthly Contribution

Socso How To Pay Monthly Contribution Youtube This video is custom made for clients of tyng & co.connect with us: tyng ca .my facebook tyngcasocso: assist.perkeso. Socso contribution table. first category (is only applicable to employees who ages are below 60) employer contribute 1.75% of the employee’s total salary. employee contribute 0.5% of their monthly total salary. total of amount (contribute from employer and employee) will go towards socso fund. no. monthly salary.

How To Pay Socso Employees’ social security act 1969. socso operates based on the employees’ social security act 1969, which requires all private sector employees to have social security protection. the legislation establishes the parameters that contributions, benefits and claims must follow, creating a reliable and equal order for all. Socso and eis contribution guide for employers 2024. Socso & eis submission and payment methods. The complete guide to socso.

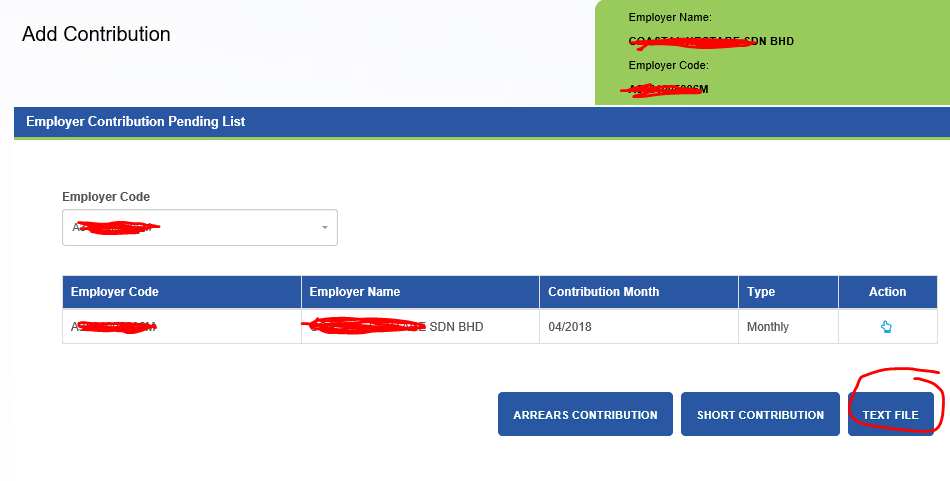

How To Pay Socso Online Socso & eis submission and payment methods. The complete guide to socso. The second category focuses on the employment injury scheme under socso, where a fixed contribution rate of 1.25% is calculated based on the total monthly salary. this contribution is the sole responsibility of the employer and applies to specific groups, including workers above the age of 60 and those hired after the age of 55 who contributed. The monthly payment of socso contribution comprising of both employees' and employer’s share should be paid by the 15th of the month for the salary issued for the previous month. a late payment interest rate of 6% per year will be charged for each day of contribution not paid.

Comments are closed.