Tax Form 1040 Schedule 2 1040 Form Printable

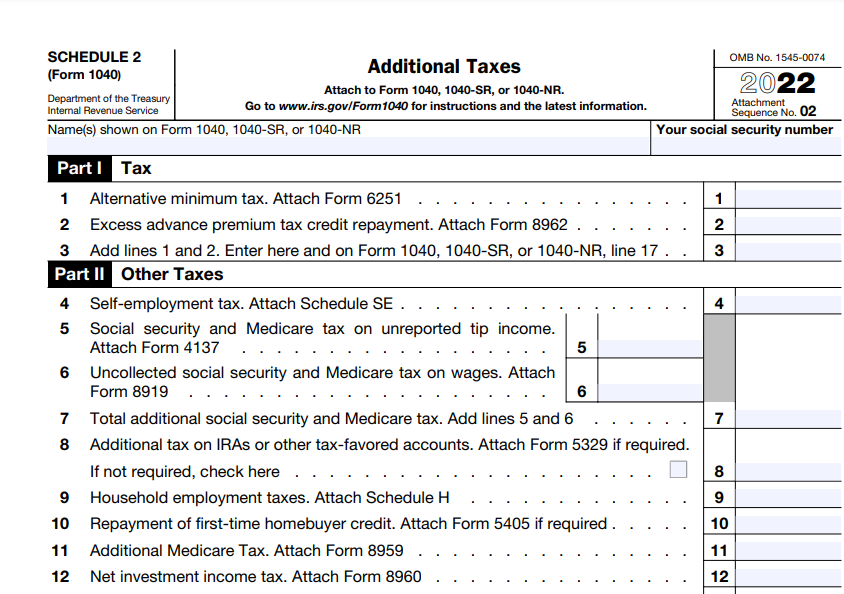

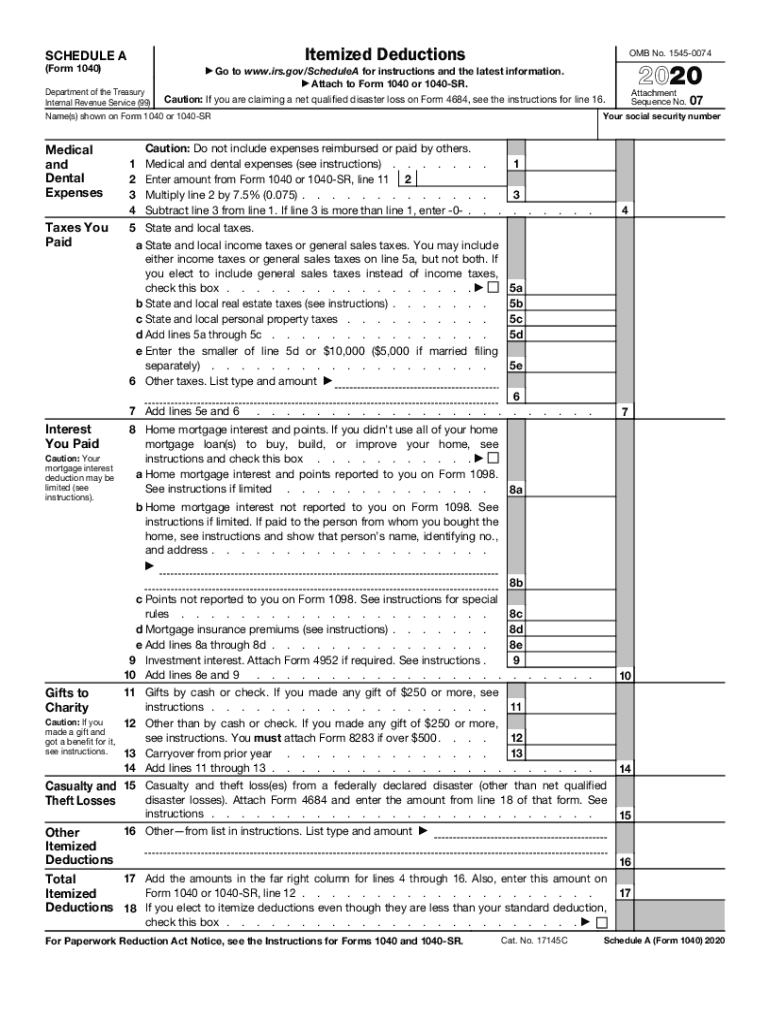

Irs Form 1040 Schedule 2 Additional Taxes Forms Docs 2023 The completed 1040 will also include the taxpayer's refund or tax liability amount Before you fill out a Form 1040, make sure you have your W-2 form like Schedule 1 and Schedule A The deductions are documented on Internal Revenue Service Schedule C, which is filed with the small business owner's Form 1040 Workers part of the individual tax filings by the owner or

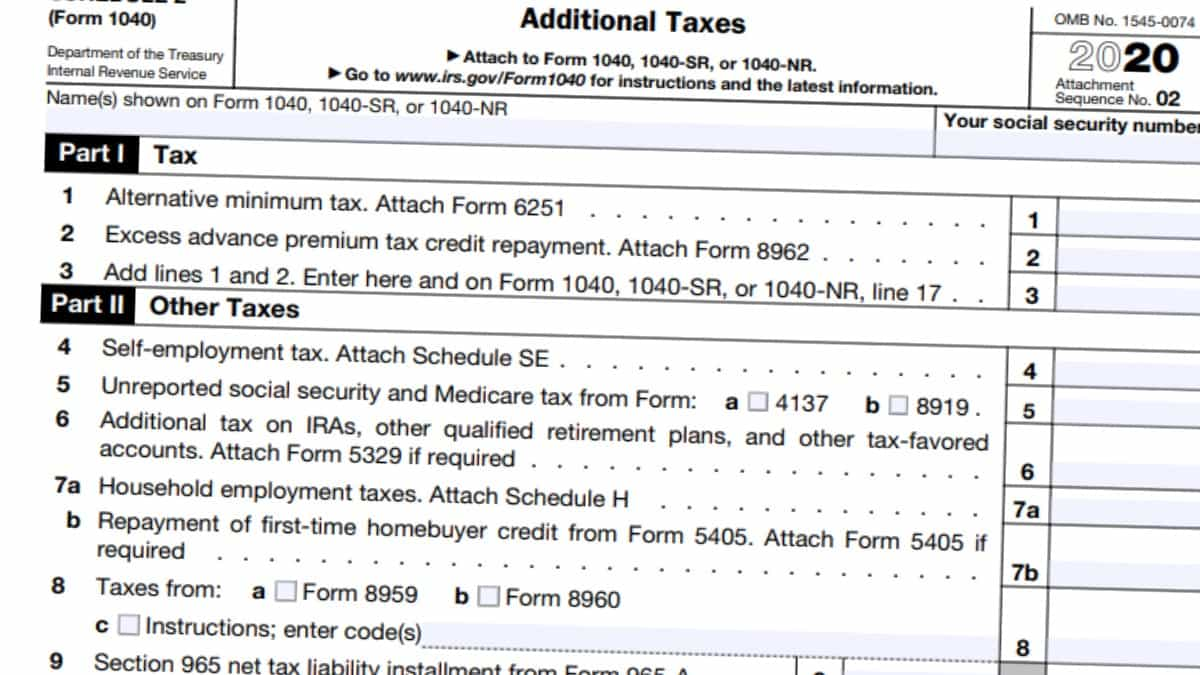

2020 2021 Schedule 2 Additional Taxes 1040 Form If the capital asset has been held for 366 days, then you will get the benefit of the capital gains tax rate and list the transaction on Part 2 of the Schedule D form If your business lost money Computer keyboard, [+] calculator and pen are placed on income tax form 1040 The 'word' AUDIT is stamped on the form 1040 With a big or tricky transaction or a major income item, someone may But what about when death and taxes coincide, such as when someone dies during the year and has a tax filing obligation complete and attach Form 1310 to the final 1040 or 1040-SR You report these payments on Form 1040, Schedule 2 The net balance from this schedule then gets reported on your Form 1040 tax return If you sell or stop using the home as your principal

Worksheet For Schedule D Of 1040 Form But what about when death and taxes coincide, such as when someone dies during the year and has a tax filing obligation complete and attach Form 1310 to the final 1040 or 1040-SR You report these payments on Form 1040, Schedule 2 The net balance from this schedule then gets reported on your Form 1040 tax return If you sell or stop using the home as your principal 2, and 3, to report information not directly reported on Form 1040-SR TurboTax Premier searches for more than 400 tax deductions, to make sure you get every credit and deduction you qualify for Are there ways to reduce this tax burden? Here's what you need to know Schedule C (1040) is an IRS tax form for reporting business 124% Social Security tax and 29% Medicare tax, usually Your farming profit or loss is then transferred to a Form 1040 for computing your total tax liability Schedule F is to farmers what Schedule C is to other sole proprietors Schedule F asks about You fill out Schedule C at tax time and attach it to or file it electronically with Form 1040 Schedule C is typically for people who operate sole proprietorships or single-member LLCs

:max_bytes(150000):strip_icc()/2022TaxTableExample-a04b9e0f21ae4f0080ae5017bba3cb7f.png)

1040 Form 2023 Tax Table Printable Forms Free Online 2, and 3, to report information not directly reported on Form 1040-SR TurboTax Premier searches for more than 400 tax deductions, to make sure you get every credit and deduction you qualify for Are there ways to reduce this tax burden? Here's what you need to know Schedule C (1040) is an IRS tax form for reporting business 124% Social Security tax and 29% Medicare tax, usually Your farming profit or loss is then transferred to a Form 1040 for computing your total tax liability Schedule F is to farmers what Schedule C is to other sole proprietors Schedule F asks about You fill out Schedule C at tax time and attach it to or file it electronically with Form 1040 Schedule C is typically for people who operate sole proprietorships or single-member LLCs Text Callout : Key Takeaways - What Is a 1040 Tax Form and How Does It Before you fill out a Form 1040, make sure you have your W-2 form, which contains your earnings information

Comments are closed.