Taxes On Stocks

How Do Taxes On Stocks And Bonds Work National Tax Network Learn how capital gains and dividends on stock sales are taxed, and how to reduce your tax bill. find out the difference between short term and long term gains, qualified and nonqualified dividends, and net investment income tax. Learn what capital gains taxes are, how they work and how to report them on your tax return. find out how to reduce your tax bill with retirement accounts, tax loss harvesting and tax exempt investments.

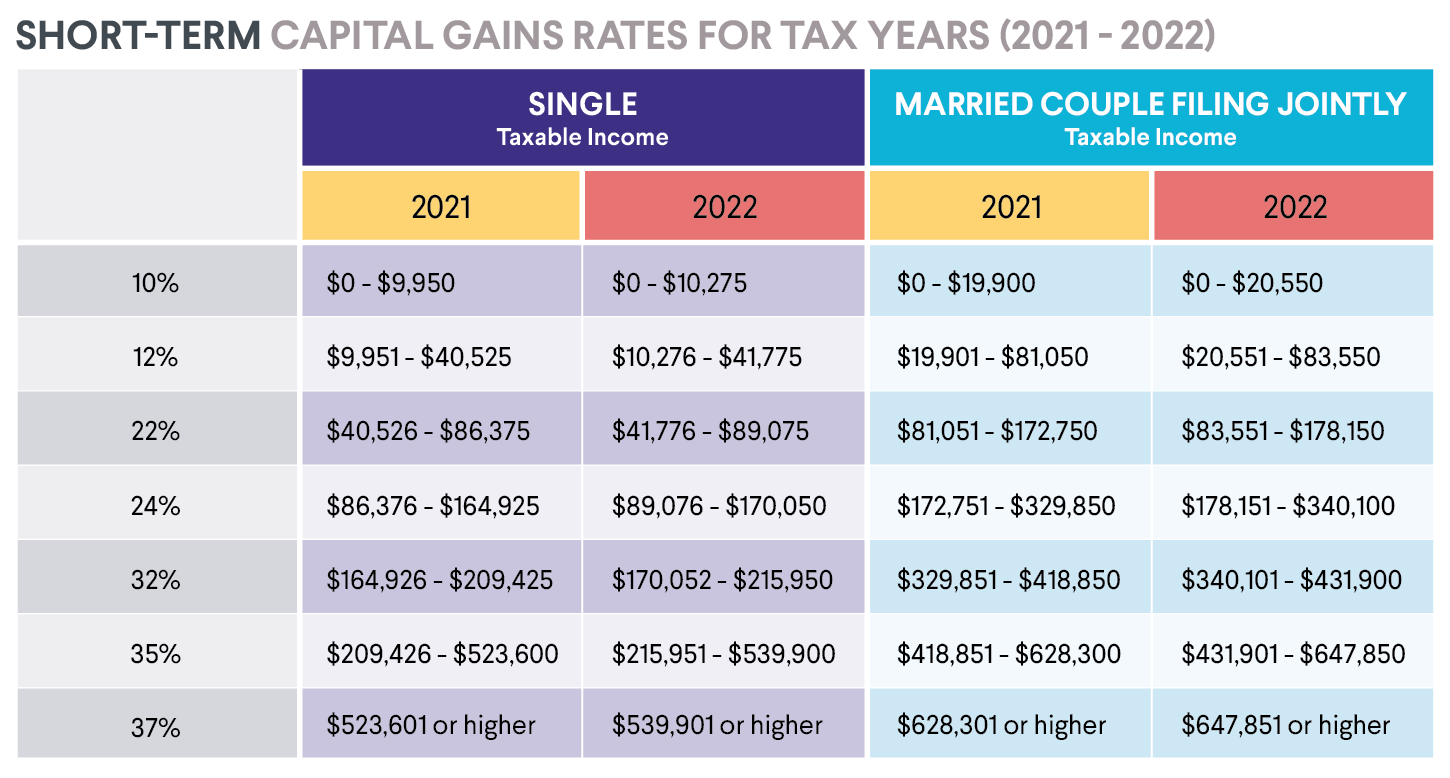

What To Know About Paying Taxes On Stocks Sofi Learn about the different types of capital gains taxes, rates, and scenarios for investors who sell stocks. find out how to reduce your tax liability with tax loss harvesting and other strategies. Learn how taxes on stocks depend on the type of stock, the length of time you hold it, and your income level. find out the tax rates, tips, and exceptions for capital gains, dividends, and net investment income tax. Learn about the different types of taxes on investments, such as capital gains, dividends and 401 (k)s, and how to minimize them. find out how to use tax loss harvesting, qualified dividends, retirement accounts and more to save money on taxes. Learn how capital gains taxes work for short term and long term stock sales, and how to reduce your tax bill with tax loss harvesting and other strategies. find out the 2021 tax rates, thresholds and exceptions for different income levels and filing statuses.

Taxes On Selling Stock What You Pay How To Pay Less The Motley Fool Learn about the different types of taxes on investments, such as capital gains, dividends and 401 (k)s, and how to minimize them. find out how to use tax loss harvesting, qualified dividends, retirement accounts and more to save money on taxes. Learn how capital gains taxes work for short term and long term stock sales, and how to reduce your tax bill with tax loss harvesting and other strategies. find out the 2021 tax rates, thresholds and exceptions for different income levels and filing statuses. Learn how capital gains taxes work and how to minimize them on your investments. find out the difference between short term and long term gains, the tax rates for 2024, and the exceptions and exclusions. These gains are taxed at your ordinary income tax rate, which can be as high as 37%. long term capital gains: if you sell a stock that you have held for more than one year, the gain is considered long term. these gains are taxed at a lower rate, ranging from 0% to 20%, depending on your income level. example: if you bought shares of a company.

Taxation Rules On Stocks And Shares Sharesexplainedshares Explained Learn how capital gains taxes work and how to minimize them on your investments. find out the difference between short term and long term gains, the tax rates for 2024, and the exceptions and exclusions. These gains are taxed at your ordinary income tax rate, which can be as high as 37%. long term capital gains: if you sell a stock that you have held for more than one year, the gain is considered long term. these gains are taxed at a lower rate, ranging from 0% to 20%, depending on your income level. example: if you bought shares of a company.

Comments are closed.