Tdecu Your Texas Credit Union With Digital Banking

Tdecu Your Texas Credit Union With Digital Banking Must be at least 18 years of age to open a value plus checking (vpc) account with a limit of two accounts per member. the minimum opening deposit is $50.00. highest apy includes 4.00% on vpc balances <$50,000.00 and 0.25% on vpc balances >$50,000.00. account holders will receive a maximum monthly rebate of $30.00 on non tdecu atm fees. Once enrolled in digital banking, you will enjoy the following features from your computer, tablet, or mobile devices: check your account balance and history. transfer money between accounts. track spending and create budgets. access your account statements. deposit checks (mobile only) pay bills. manage your cards.

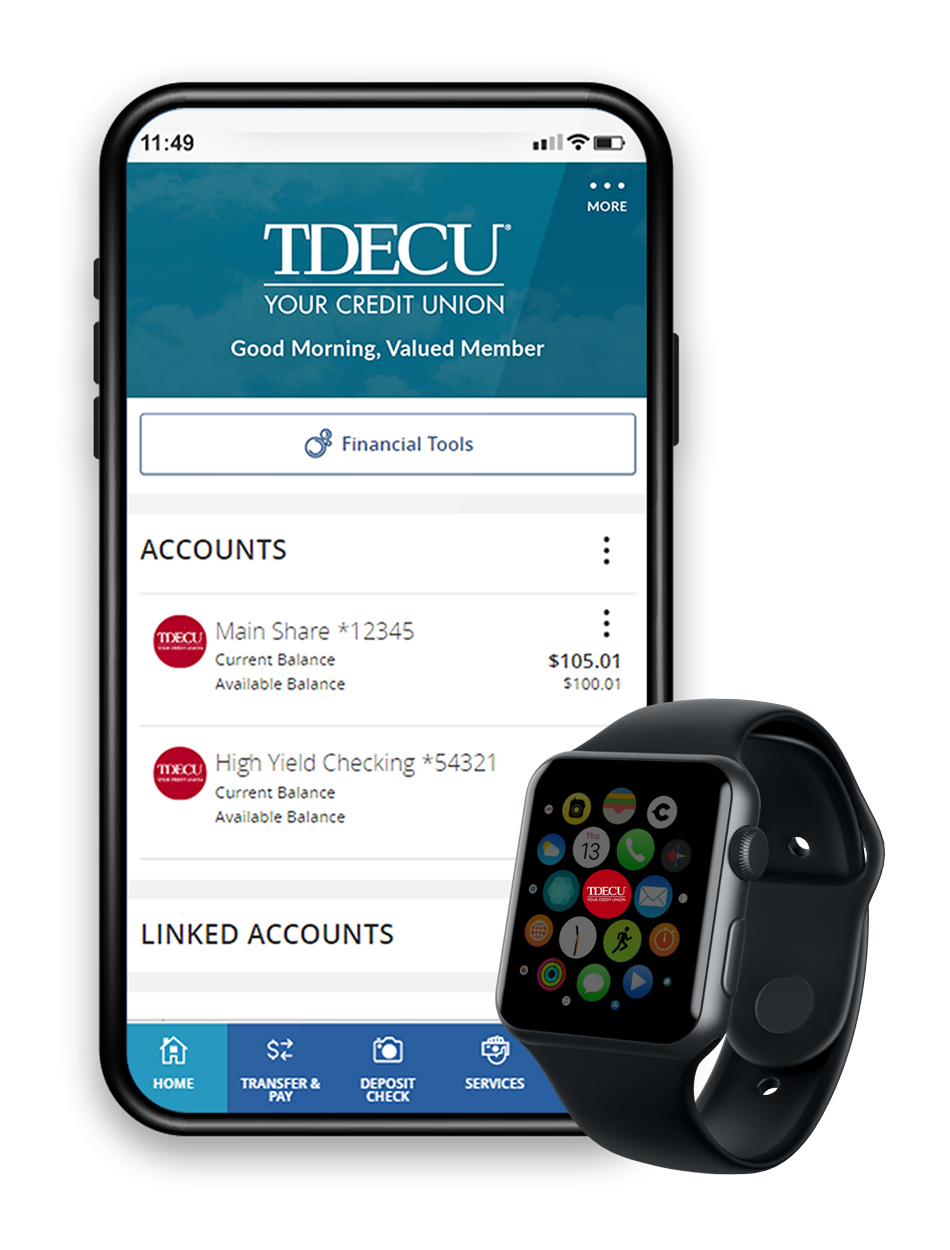

Tdecu Your Texas Credit Union With Digital Banking Should you have questions about upgrading or your existing account, please call us at (800) 839 1154. for our high yield checking accounts only, members qualify for identity theft recovery services; see the member handbook for additional information regarding this benefit. with rates as high as 4.00%, compare tdecu checking accounts, including. Once customer support moves your email address or u.s. mobile phone number, it will be connected to your bank account so you can start sending and receiving money with zelle ® through your tdecu digital banking account. please call member care at (800) 839 1154 for help. With our mobile application, you can: • enroll in tdecu digital banking. • check balances and account history. • pay bills. • deposit checks (restrictions apply) • transfer funds between accounts. • track spending and create budgets. • setup travel notifications and manage your tdecu credit card. • view your tdecu mortgage. Improving lives. it’s what we do.

Comments are closed.