The 4 Types Of Profit Margins

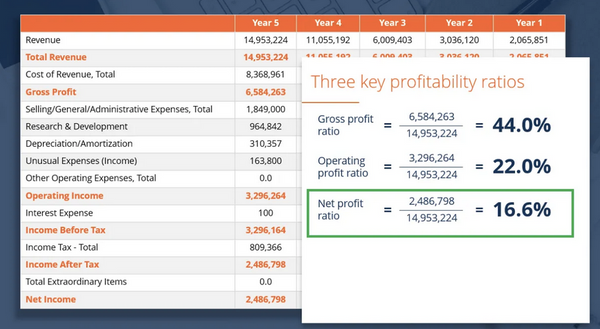

Profit Margin Defined Types Examples How To Calculate And Compare Ebb The operating profit margin formula is as follows: operating profit margin = ( [gross profit company operating expenses] total revenue) x 100. in this definition, “company operating expenses” includes all the costs incurred after creating the product to market and sell it. Profit margin is a common measure of the degree to which a company or a particular business activity makes money. expressed as a percentage, it represents the portion of a company’s sales.

The 4 Types Of Profit Margins Youtube There are four types of profit margin. of these, net profit margin is used and referred to the most. gross profit is different from gross profit margin. in our example above, the gross profit. The profit margin is a ratio of a company's profit (sales minus all expenses) divided by its revenue. the profit margin ratio compares profit to sales and tells you how well the company is handling its finances overall. it's always expressed as a percentage. there are three other types of profit margins that are helpful when evaluating a business. There are four types of profit margin that can be calculated: gross profit margin. operating profit margin. pre tax profit margin. net profit margin. these calculations should be used in conjunction with each other to assess the health of a business, or to benchmark it to next to other businesses. let’s get started!. Profit margin is a crucial measure of a company's profitability and performance, computed by comparing residual profit to sales. there are four main types of profit margins: gross profit margin, operating profit margin, pre tax profit margin, and net profit margin, each serving different purposes in assessing a company's financial health.

Guide To Profit Margin How To Calculate Profit Margins With Examples There are four types of profit margin that can be calculated: gross profit margin. operating profit margin. pre tax profit margin. net profit margin. these calculations should be used in conjunction with each other to assess the health of a business, or to benchmark it to next to other businesses. let’s get started!. Profit margin is a crucial measure of a company's profitability and performance, computed by comparing residual profit to sales. there are four main types of profit margins: gross profit margin, operating profit margin, pre tax profit margin, and net profit margin, each serving different purposes in assessing a company's financial health. There are three different types of profit margins: gross profit margins, operating profit margins, and net profit margins. net profit margin = ($4.2 billion ÷ $29.06 billion) × 100 = 14.45%;. Contributor, benzinga. september 13, 2023. profit margin is a key financial metric that reveals the percentage of profit a business earns from its total revenue. it showcases how much money is.

The 4 Types Of Profit Margins Youtube There are three different types of profit margins: gross profit margins, operating profit margins, and net profit margins. net profit margin = ($4.2 billion ÷ $29.06 billion) × 100 = 14.45%;. Contributor, benzinga. september 13, 2023. profit margin is a key financial metric that reveals the percentage of profit a business earns from its total revenue. it showcases how much money is.

How To Determine Profit Margin Guide For Business Owners

Comments are closed.