The 65000 Roth Ira Mistake To Avoid

The 65 000 Roth Ira Mistake To Avoid Youtube One of my favorite retirement accounts is a roth ira for many different reasons. a roth ira is a type of individual retirement account that allows individual. Below are the mistakes to avoid. 1. not earning enough to contribute. you cannot contribute more to a roth ira than you received in earned income for the year. this income can come from wages.

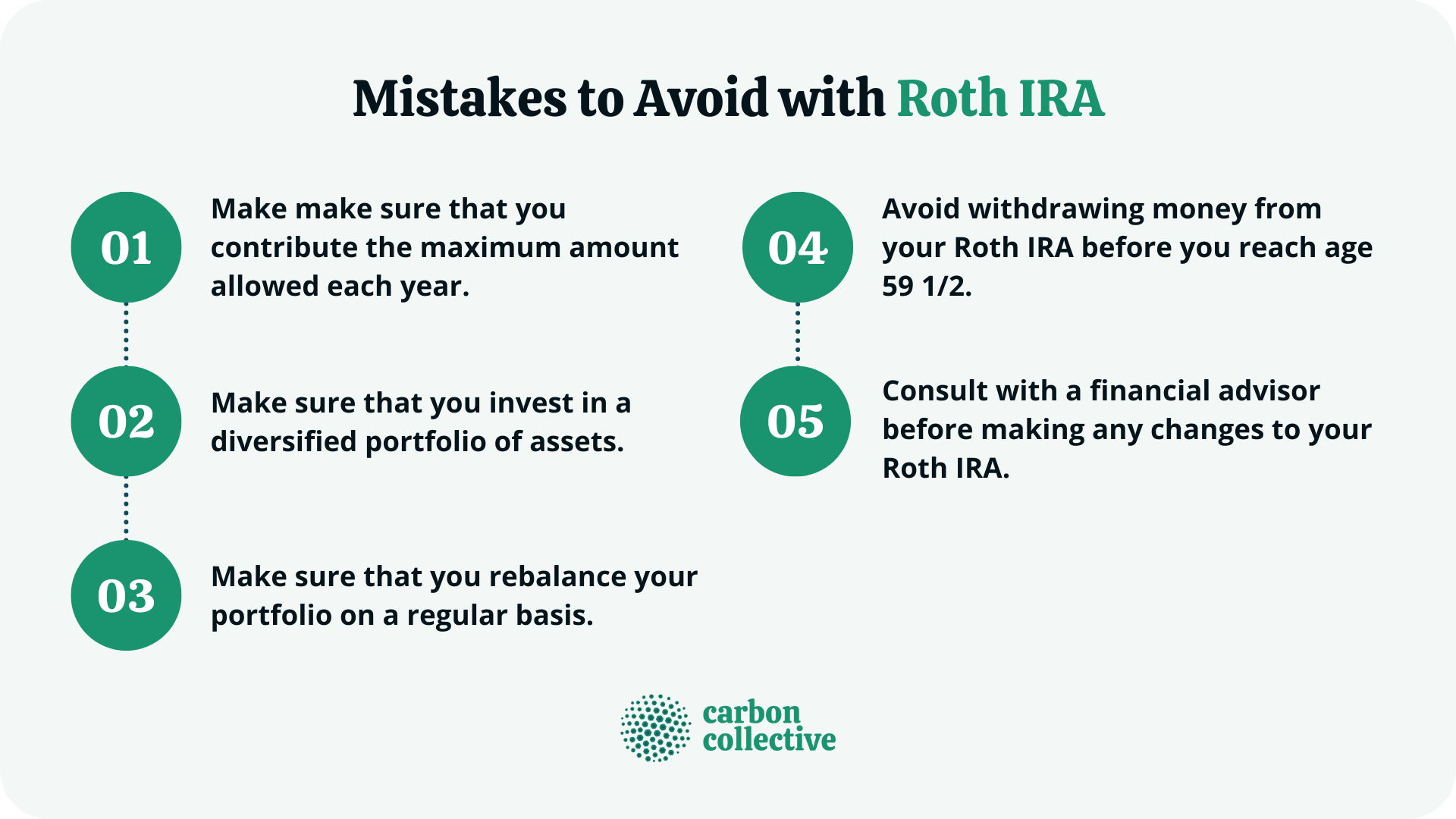

Roth Ira Mistakes To Avoid Youtube 8 common roth ira mistakes to avoid. these roth ira mistakes can have costly tax consequences. why invest in a roth ira? the balance is part of the dotdash meredith publishing family. a roth ira can help you save for retirement. but if you aren’t careful, you can miss out on its benefits. try to avoid these common roth ira mistakes. For 2021, individuals under 50 can contribute a maximum of $6,000 as long as earned income for the year is at least $6,000. savers 50 and over receive an annual $1,000 catch up incentive, which. Roths can be fantastic, but are not always for everyone and significant mistakes can be made. below are 15 mistakes to avoid with roth accounts. 1. not opening a roth because you already have a 401 (k) there are two main types of retirement savings accounts: iras (traditional and roth) and employer sponsored retirement accounts like 401ks. 3. withdrawing all your money before retirement. the roth ira is a unique retirement account because you can bypass penalties and taxes if you need to withdraw any money you've contributed. let's.

7 Mistakes To Avoid With Your Roth Ira Roths can be fantastic, but are not always for everyone and significant mistakes can be made. below are 15 mistakes to avoid with roth accounts. 1. not opening a roth because you already have a 401 (k) there are two main types of retirement savings accounts: iras (traditional and roth) and employer sponsored retirement accounts like 401ks. 3. withdrawing all your money before retirement. the roth ira is a unique retirement account because you can bypass penalties and taxes if you need to withdraw any money you've contributed. let's. However, for roth iras only, there are also income limits. if you're single, the amount you can contribute to a roth ira in 2022 is gradually reduced to zero if your modified adjusted gross income. There are income limits to eligibility for contributing to a roth ira. in 2023, the phase out range for singles is $138,000 to $153,000. for married couples filing jointly, it’s $218,000 to.

Can I Stop Contributing To My Roth Ira Rules And Mistakes To Avoid However, for roth iras only, there are also income limits. if you're single, the amount you can contribute to a roth ira in 2022 is gradually reduced to zero if your modified adjusted gross income. There are income limits to eligibility for contributing to a roth ira. in 2023, the phase out range for singles is $138,000 to $153,000. for married couples filing jointly, it’s $218,000 to.

7 Roth Ira Mistakes To Avoid

Comments are closed.