The Best Trading Candlestick Patterns

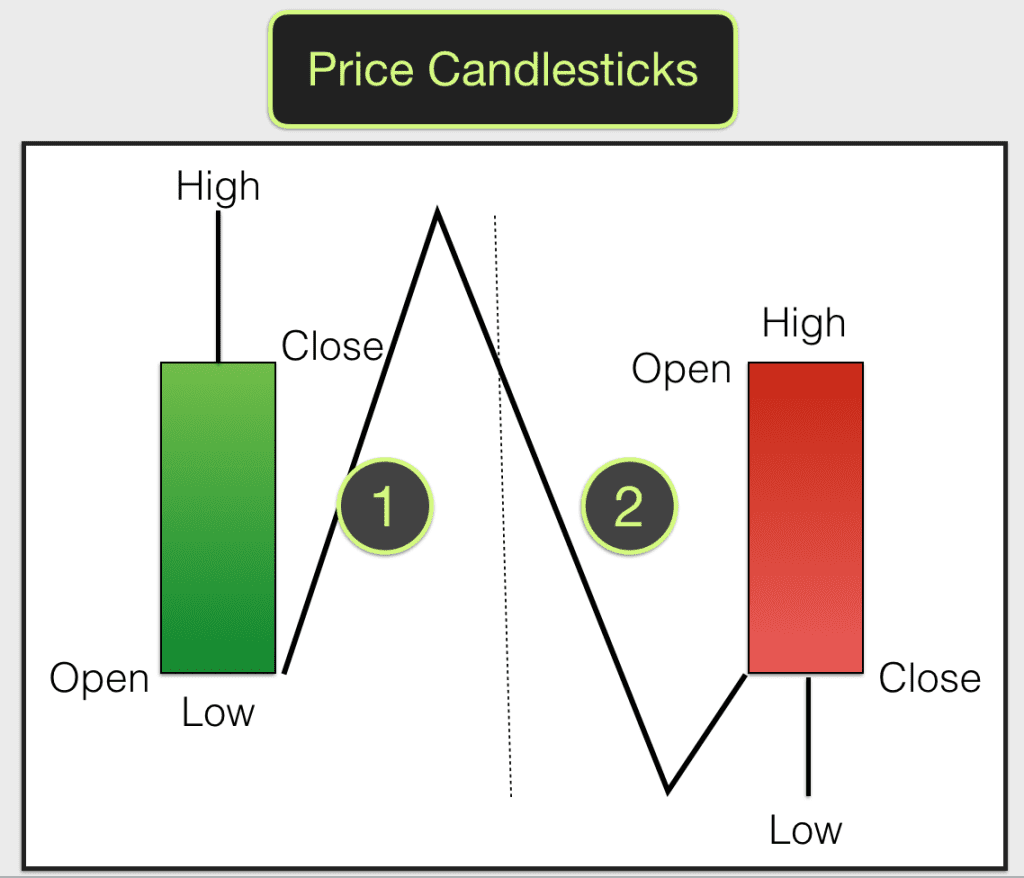

Candlestick Chart Patterns Explained Candle Stick Trading Pattern 41 candlestick patterns explained with examples. What are candlestick patterns? candlestick patterns are a technical trading tool used for centuries to help predict price moments. each candlestick pattern has a distinct name and a traditional trading strategy. a picture is worth a thousand words, so let’s use a few to shine a light on candlesticks.

.png)

4 Powerful Candlestick Patterns Every Trader Should Know Spinning top. the spinning top – a common candlestick that signals a tug of war between the bulls and the bears. this candle gets its name from its uncanny resemblance to a spinning top. the candle contains a small body sandwiched between upper and lower wicks of similar lengths – that’s the classic look. Based on our 58,680 test trades, the most accurate candle patterns are the inverted hammer (a 60% success rate), followed by the bearish marubozu (56.1%), gravestone doji (57%), and bearish engulfing (57%). the inverted hammer is the most profitable candle pattern, with a 1.12% profit per trade. thanks to this research, we have proof that. Candlestick patterns: the updated guide (2024). Candlestick patterns to know in 2024: the complete guide.

The Best Trading Candlestick Patterns Candlestick patterns: the updated guide (2024). Candlestick patterns to know in 2024: the complete guide. 16 candlestick patterns every trader should know ig. There is no single “best” candlestick pattern for trading, as different patterns provide various insights into market trends and potential reversals. the effectiveness of a candlestick pattern depends on the trader’s strategy, market context, and the combination of other technical analysis tools used.

Comments are closed.