The Big List Of 401k Faqs For 2020 Workest

The Big List Of 401k Faqs For 2020 Workest A 401 (k) and an ira are both retirement plans that help you lower the amount of taxes you have to pay on the money you’re saving for retirement. you set up your own ira, and you can contribute up to $5,500 in 2018 (or a little more if you’re nearing retirement age). for your 401 (k), your employer does most of the heavy lifting, including. A 401 (k) is a tax advantaged retirement plan that is set up and managed by an employer. basically, you put money into the 401 (k) where it can be invested and potentially grow tax free over time. in most cases, you choose how much money you want to contribute to your 401 (k) based on a percentage of your income.

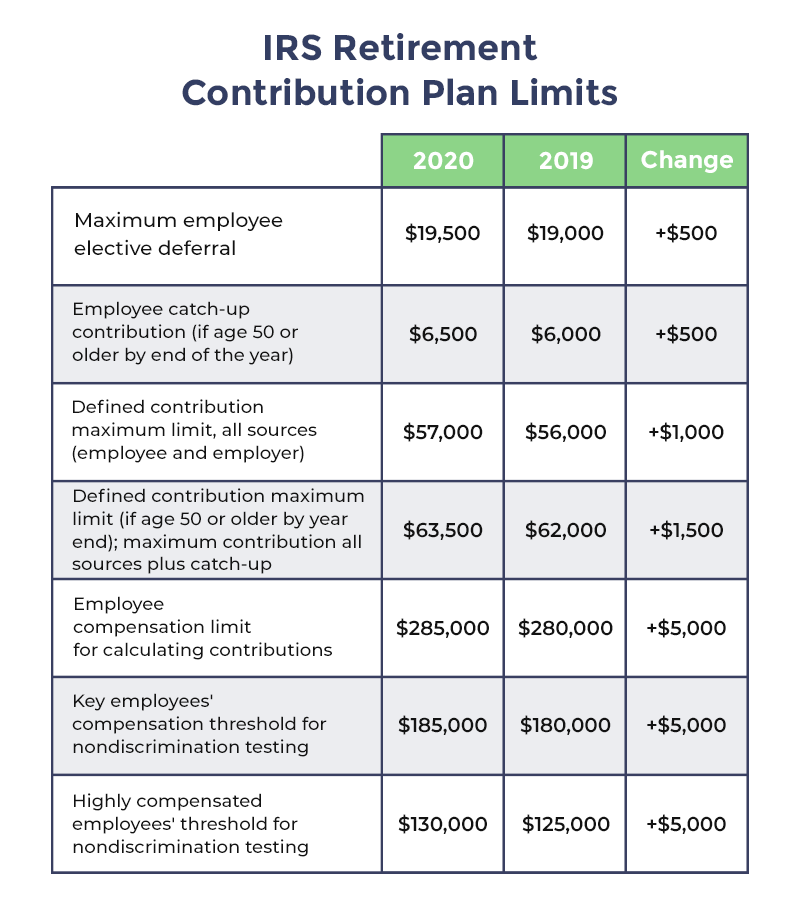

401 K Administration Checklist For The 2020 Plan Year By Eric Yes. as of 2021, an employee can defer up to $19,500 total to a 401 (k) plan per year as pretax or roth contributions. if an employee is 50 years or older, the employee can defer up to $26,000 as pretax or roth contributions by taking advantage of a $6,500 catch up contribution. The big list of 401k faqs for 2020 workest general distribution rules explains the different forms of plan distributions plan termination what to know and do when terminating your plan 401 (k) fix it guide tips on how to find, fix, and avoid common mistakes in 401 (k) plans. As a general rule, i suggest subtracting your age from 110 to determine how much of your 401 (k) should be in stocks (equities). the rest should be in bonds (fixed income). so, a 40 year old. October 1, 2021: safe harbor 401 (k) plan is effective and exempt from nondiscrimination testing for 2020. key dates for existing plans: by or before november 20, 2021: request the addition of a safe harbor provision to your 401 (k) plan for the following year. december 1, 2021: 30 day notice must be sent to employees.

Comments are closed.