The Psychology Of Money By Morga Housel Book Summary Key Less

The Psychology Of Money вђ Morgan Housel A Quick Summary Overview. the psychology of money is a bestselling 2020 book by american finance expert morgan housel. housel’s book examines people’s financial decisions through the lenses of history and psychology. housel argues that financial management is a relatively new phenomenon that everyone approaches differently depending on their personal. This is a book summary of the psychology of money: timeless lessons on wealth, greed, and happiness by morgan housel. i couldn’t ignore the psychology of money any longer. it seems like everyone is talking about it in my little corner of twitter. many are calling it their top book of the year. and, amazon supports the hype. the book launched.

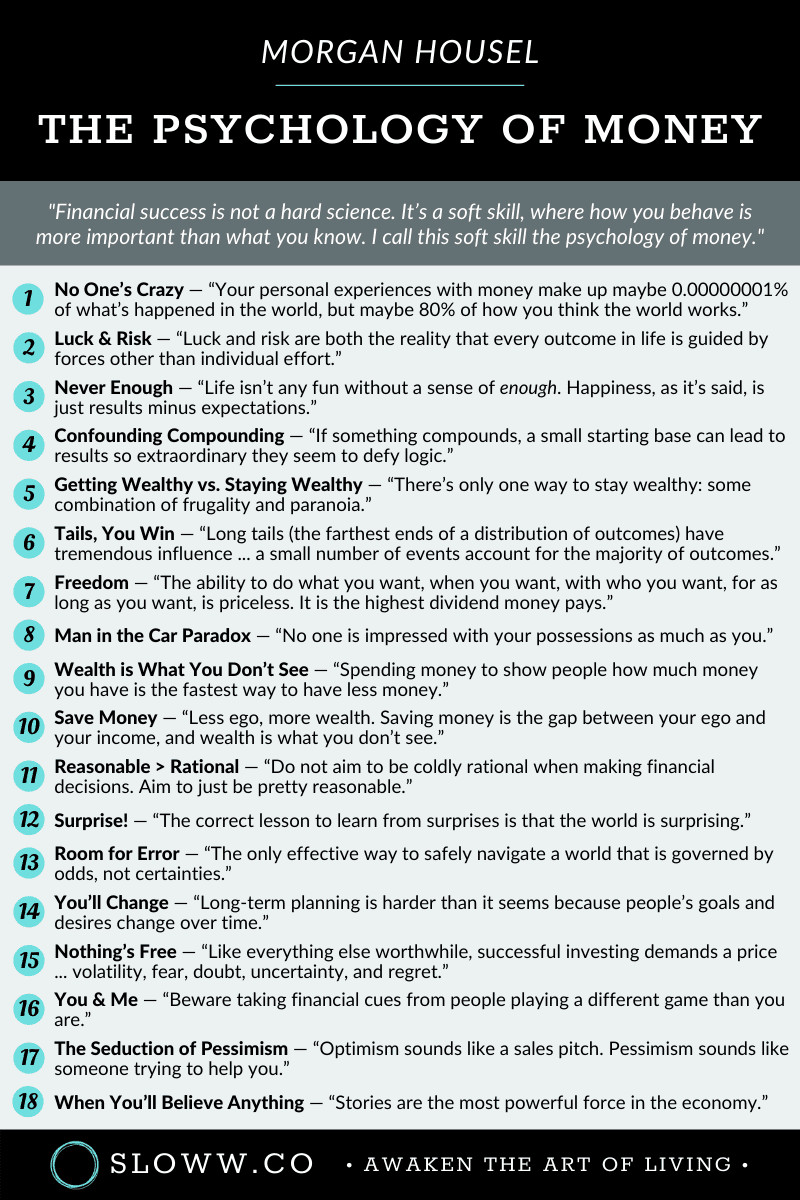

The Psychology Of Money By Morga Housel Book Summary Key L Morgan housel’s book, the psychology of money, challenges conventional wisdom by asserting that successful financial management is less about intelligence and more about behavior. housel argues that to comprehend why individuals make certain financial choices, it is imperative to examine the underlying human behaviors and attitudes towards. Key takeaways from the psychology of money by morgan housel. housel’s book is a short 20 chapter read that imparts enough wisdom for you to adopt a productive financial mindset. some of its key takeaways include: 1. you’re not crazy when it comes to money—no one is. housel believes that no matter how irrational your financial decisions. "the psychology of money" by morgan housel is about how our money and financial decisions are often determined by psychological factors such as ego, emotions, and biases. he argues that making good financial decisions and building wealth is less about gaining financial expertise, and more about cultivating qualities like patience, humility, and long term thinking. Summary. the most valuable part of this book is that it explicitly links personal finance with psychology. saving, investment strategies, decision making—these have all been known as key parts of personal finance, but the psychological side is rarely explored, and that's what this book is about. reading this plus another book on the.

18 Wealth Lessons From The Psychology Of Money By Morgan Housel Sloww "the psychology of money" by morgan housel is about how our money and financial decisions are often determined by psychological factors such as ego, emotions, and biases. he argues that making good financial decisions and building wealth is less about gaining financial expertise, and more about cultivating qualities like patience, humility, and long term thinking. Summary. the most valuable part of this book is that it explicitly links personal finance with psychology. saving, investment strategies, decision making—these have all been known as key parts of personal finance, but the psychological side is rarely explored, and that's what this book is about. reading this plus another book on the. In this free version of the psychology of money summary, we’ll outline the key highlights from the book. morgan housel has been writing about finance since 2008. through his research, he realized that luck and human behaviors play a much bigger role in determining one’s financial success than spreadsheets and analyses. Here are some key learnings and valuable insights from the psychology of money: the role of emotions and biases in financial decision making: one of the key insights of the book is the role that emotions and biases play in our financial decision making. for example, housel discusses how our emotions can lead us to make impulsive or irrational.

Book Summary The Psychology Of Money вђ Amorphous Pages In this free version of the psychology of money summary, we’ll outline the key highlights from the book. morgan housel has been writing about finance since 2008. through his research, he realized that luck and human behaviors play a much bigger role in determining one’s financial success than spreadsheets and analyses. Here are some key learnings and valuable insights from the psychology of money: the role of emotions and biases in financial decision making: one of the key insights of the book is the role that emotions and biases play in our financial decision making. for example, housel discusses how our emotions can lead us to make impulsive or irrational.

Comments are closed.