The Truth About Credit Score In Canada How To Build Your Credit Score

Credit Score Range What Is The Credit Score Range In Canada In this video, i'll tell you everything about credit scores in canada. what is a credit score and how to start building your credit history? why should you c. Borrowing more than the authorized limit on a credit card may lower your credit score. try to use less than 30% of your available credit. it’s better to have a higher credit limit and use less of it each month. for example, suppose you have a credit card with a $5,000 limit and an average borrowing amount of $1,000.

Understanding Your Credit Score And Why It Matters Envision Financial These factors are then used to calculate your credit score, which is a three digit figure on your credit rating report that shows lenders how likely you are to repay a loan. generally speaking, credit scores tend to fall under these categories: low credit score: 300 660. good credit score: 660 750. high credit score: 750 900. Steps to start building credit in canada. 1. open a bank account. it may not be credit related, but opening a bank account should be the first step in starting your credit history. many banks. Here are some tips to help you improve your credit score as a newcomer: 1. get a social insurance number (sin) a social insurance number (sin) is a unique identifying number you need to work in canada or access government programs. it’s also required to open many types of bank accounts, especially credit accounts. A credit score is a number on a scale of 300 to 900. it tells potential lenders how well you manage debt and credit; money that doesn’t belong to you. you should aim for a credit score of at least 660 to come across well when applying for loans. the higher the score, the better you are at repaying your debts.

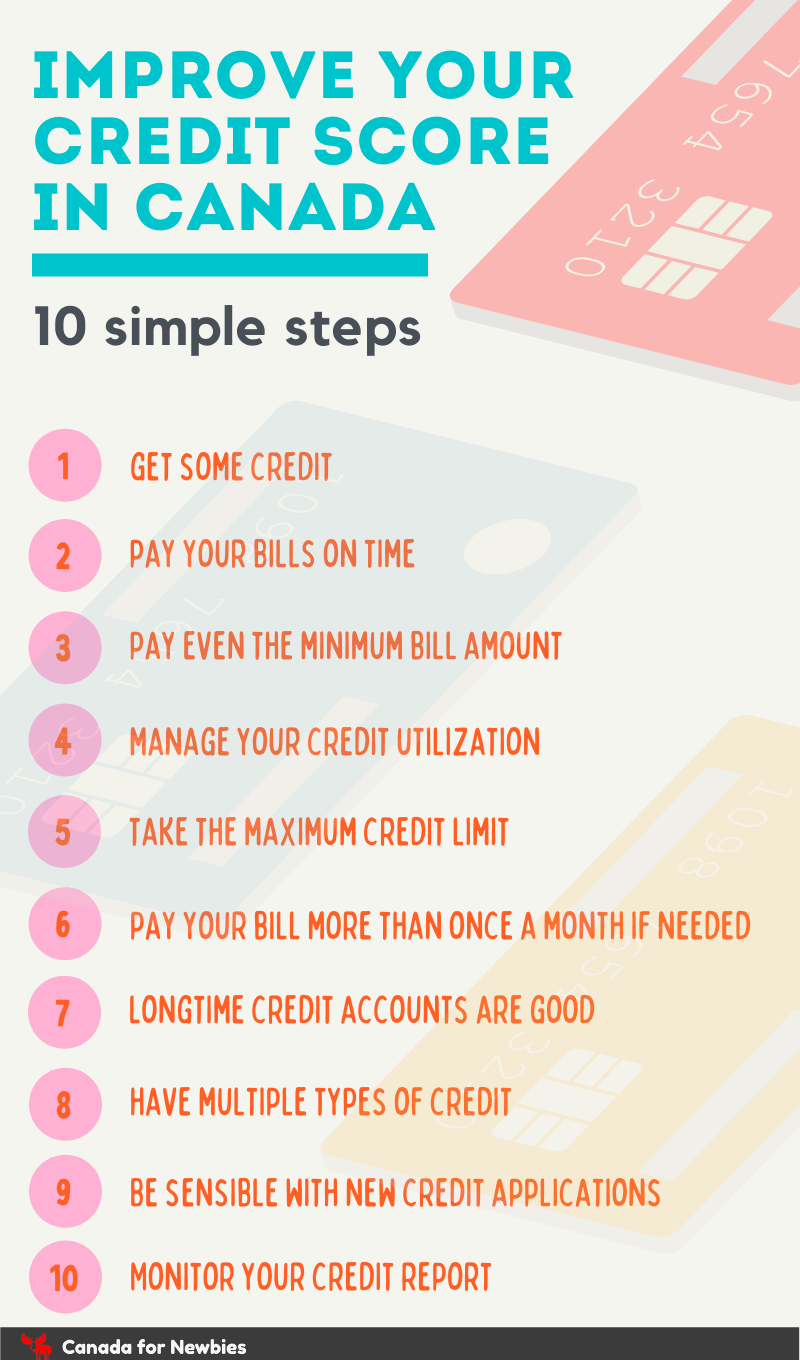

How To Improve Your Credit Score 10 Step Guide Canada For Newbies Here are some tips to help you improve your credit score as a newcomer: 1. get a social insurance number (sin) a social insurance number (sin) is a unique identifying number you need to work in canada or access government programs. it’s also required to open many types of bank accounts, especially credit accounts. A credit score is a number on a scale of 300 to 900. it tells potential lenders how well you manage debt and credit; money that doesn’t belong to you. you should aim for a credit score of at least 660 to come across well when applying for loans. the higher the score, the better you are at repaying your debts. 2. keep your credit utilization ratio low. the amount of available credit you’re using is known as your credit utilization ratio. for example, if you have a credit card with a limit of $1,000. Keep balances low. maxing out your credit cards can negatively affect your credit scores. light use of your cards is best. the less you charge, the better. the balance shown on your credit report — which is usually the balance of your last statement — affects your overall score, so maintaining a lower balance can help you build credit.

The Truth About Credit Score In Canada How To Build Your Credit Score 2. keep your credit utilization ratio low. the amount of available credit you’re using is known as your credit utilization ratio. for example, if you have a credit card with a limit of $1,000. Keep balances low. maxing out your credit cards can negatively affect your credit scores. light use of your cards is best. the less you charge, the better. the balance shown on your credit report — which is usually the balance of your last statement — affects your overall score, so maintaining a lower balance can help you build credit.

Comments are closed.