These Charts Show How Traditional Iras And Roth Iras Stack Up Smartasset

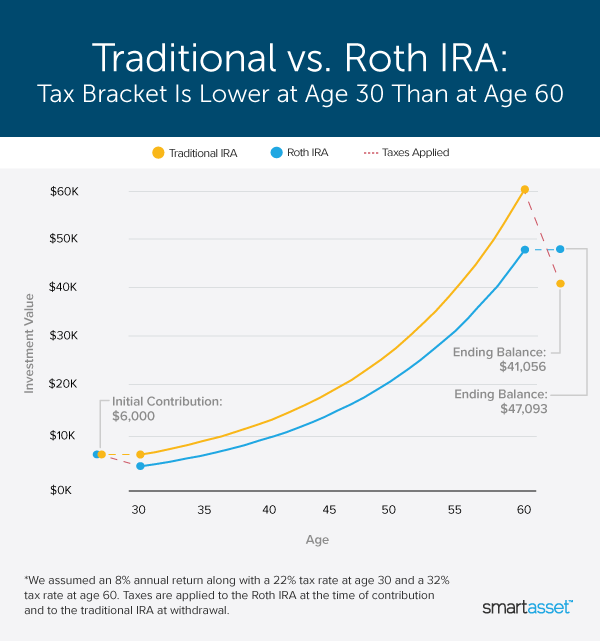

These Charts Show How Traditional Iras And Roth Iras St That’s because income tax would reduce the roth contribution to $4,680, while the full $6,000 could grow within the traditional account. as a result, the traditional ira would be worth $60,376 after 30 years, while the roth ira would be worth $47,093. Image is a chart by smartasset titled "traditional vs. roth ira: tax bracket is lower at age 30 than at age 60." scenario 3: lower tax bracket at age 60 not everyone ends up in a higher tax.

Roth Ira Vs Traditional Ira 2017 Which One Is Better Income taxes will take a substantial bite out of the person's traditional ira at age 60, whittling the account down to $41,056. however, had the same person used a roth account, her tax bill would. For example, if you opened a roth ira in 2020, you wouldn’t be able to withdraw earnings tax free until 2025, even if you are over age 59.5. the rule applies separately to each roth ira you own. as a result, if you open a new roth ira later in life that specific account will have its own five year waiting period. If they convert a traditional ira with a $115,000 balance to a roth, that would result in their taxable income rising from $125,000 to $240,000. this then puts their top rate in the 24% marginal tax bracket, raising their total income tax to $43,685. now, however, suppose they decide on a partial roth conversion. Despite the tax bill, a roth ira conversion can be worth it for a couple of reasons. first, it can get around the income caps that limit roth conversions for higher income taxpayers. most taxpayers can contribute up to $6,500 ($7,500 if you're age 50 or older), according to the irs. but contribution limits are lower for higher income taxpayers.

Comments are closed.