Top 10 Money Saving Strategies For 2024 Build Wealth With Smart Financial Habits

How To Save Money 23 Tips That Work 2024 Now that you know how to set effective money goals, here are 10 examples of smart financial goals you can consider setting for 2024. 1. build an emergency fund. building an emergency fund is a. By kathryn pomroy. published 19 january 2024. in news. after two years of rising inflation, bank closures and an uncertain market, the economy may be showing some signs of stability. but we’re.

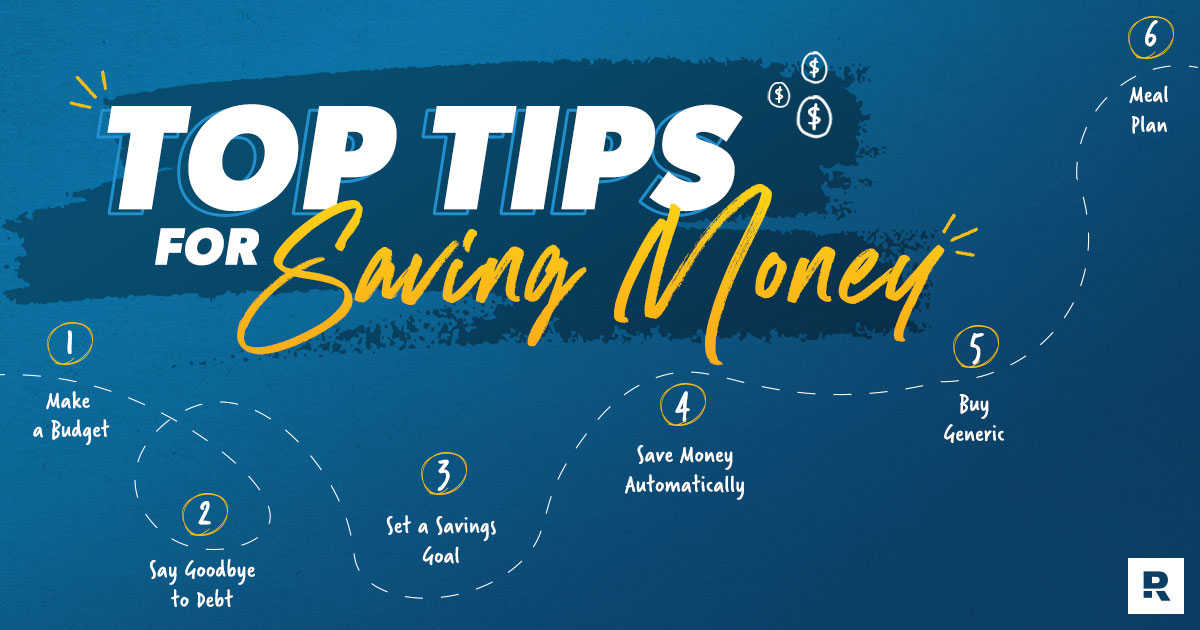

8 Smart Money Saving Strategies For 2024 Get Financially Prepared This way, you can build wealth instead of getting stuck in debt. let’s review our list and see what we can find to help us set up good money habits for 2024! read more about the key components of financial literacy. track your spending: set up a budget and record all your expenses to help you stay on top of your money goals. Set your goal for how much to save per month based on your age, risk tolerance and desired retirement income. 3. pay down debts. carrying debt, especially credit card debt, is expensive. paying it. 1. automate your investment account contributions. make 2022 the year you start investing for your future. your first move: opening a low cost taxable brokerage account that makes it easy to invest small chunks of change — literally, pennies on the dollar — every time you swipe your debit card. Taking inspiration from financial expert suze orman, a crucial step in building wealth is maximizing your retirement savings. suze advises, "at a minimum, you want to save 10% of your salary in.

10 Smart Money Saving Tips To Achieve Your Financial Goals 1. automate your investment account contributions. make 2022 the year you start investing for your future. your first move: opening a low cost taxable brokerage account that makes it easy to invest small chunks of change — literally, pennies on the dollar — every time you swipe your debit card. Taking inspiration from financial expert suze orman, a crucial step in building wealth is maximizing your retirement savings. suze advises, "at a minimum, you want to save 10% of your salary in. If you’re wondering what your financial goals for 2024 should be, here are some smart ideas for inspiration. 1. pay off your debts. owing money to anyone is stressful but some types of debt needs to be prioritised over others because the consequences of not paying are more serious. put your debts in order of priority. 1. invest regularly. consistency is key with investing. the best habit you can get into is investing regularly. two popular options are investing every month or after every paycheck. for example.

Comments are closed.