Top Factors That Affect Your Credit Scores Equifax Canada

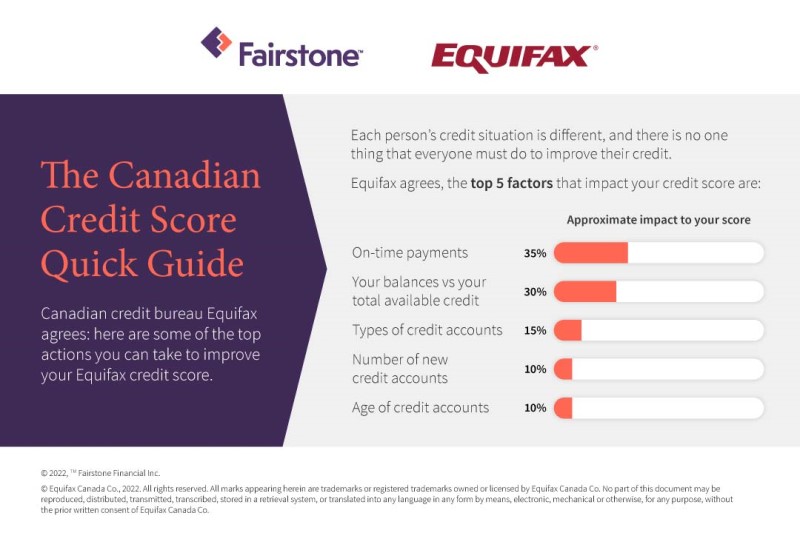

Top Factors That Affect Your Credit Scores Equifax Canada Top factors that affect your credit scores. whether you’re interested in building, maintaining or improving your credit, knowing how your scores are calculated and what may have the biggest impact can help you on your journey to financial well being. we worked with fairstone, which offers personal loans and mortgage refinancing to customers. Creditors and lenders prefer to see a lower debt to credit ratio – that’s the amount of credit you’re using compared to the total amount available to you. if all your credit cards are near the credit limit, for example, this may negatively impact credit scores and may indicate to lenders or creditors that you may have too much debt.

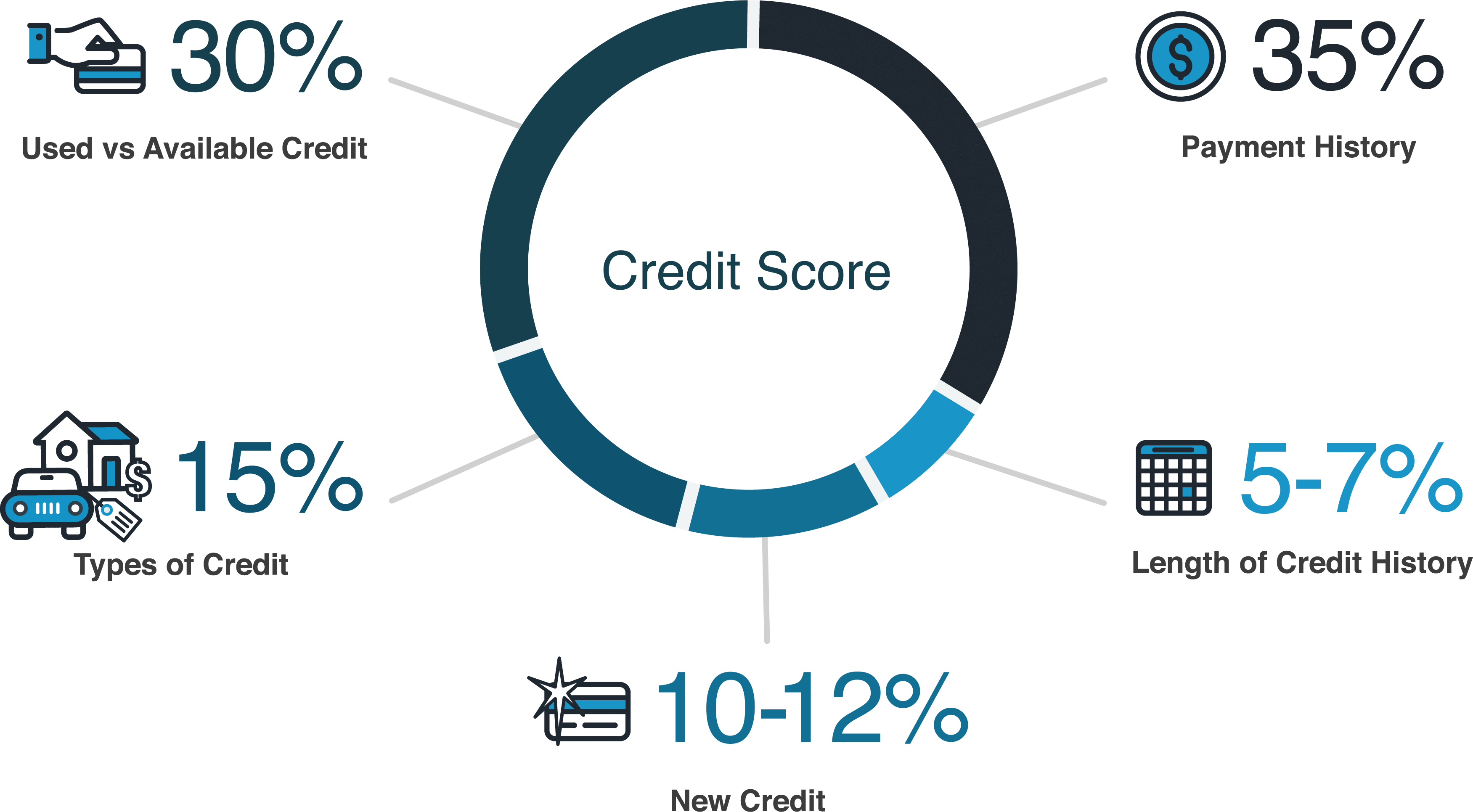

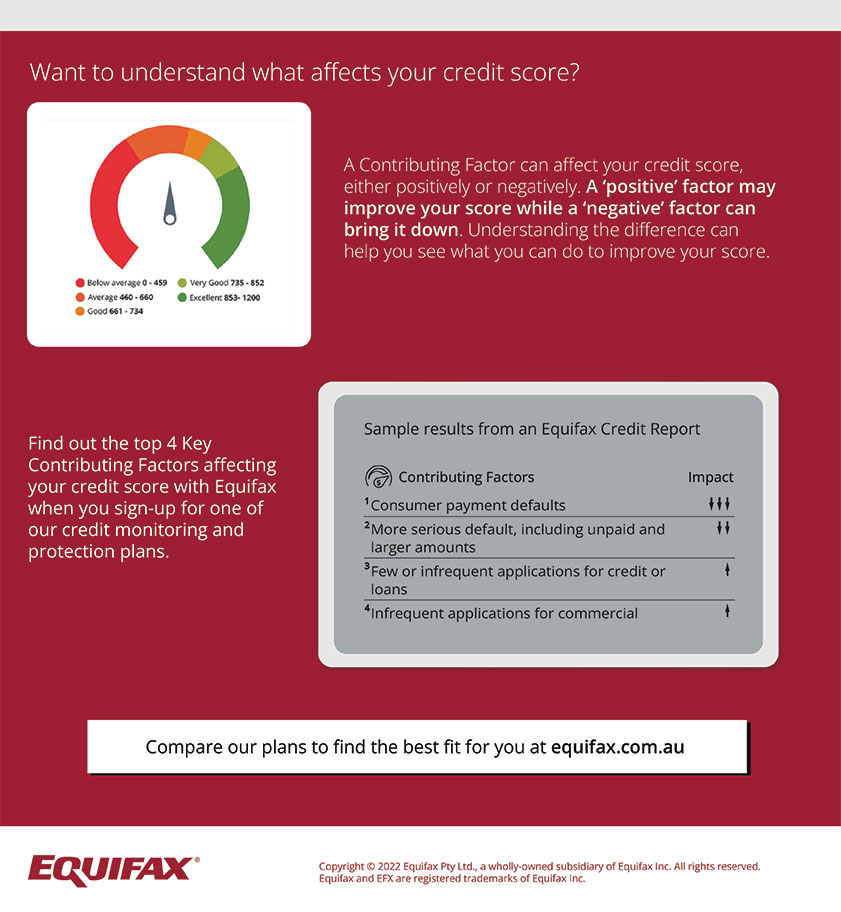

What Affects Credit Scores Infographic Equifaxв Changes to these and other factors on your credit report are what result in adjustments to your credit scores. that data could also include balance changes, the opening of new accounts, payments on existing accounts or closed accounts falling off your credit report after a period of time. A credit score is a 3 digit number that allows lenders to determine a potential borrower’s credit risk—the risk they run of not paying back their credit cards or loans. canadians typically. Why credit scores matter. a credit score is a snapshot in time that represents the health of your credit report. it's designed to predict your repayment behavior, but is not the only factor lenders use when deciding if they will extend credit and at what terms. the information in the above chart is for general educational purposes only and does. Myth #1: you can only check your credit score for free once a year. you can actually pull your credit report from each credit bureau (equifax and transunion) once per year for free by mail or phone. this only gives you access to the debts that are listed on your report and their ratings. getting your credit score requires paying an additional fee.

What Affects Your Credit Score Equifax Personal Why credit scores matter. a credit score is a snapshot in time that represents the health of your credit report. it's designed to predict your repayment behavior, but is not the only factor lenders use when deciding if they will extend credit and at what terms. the information in the above chart is for general educational purposes only and does. Myth #1: you can only check your credit score for free once a year. you can actually pull your credit report from each credit bureau (equifax and transunion) once per year for free by mail or phone. this only gives you access to the debts that are listed on your report and their ratings. getting your credit score requires paying an additional fee. Your equifax credit score is a three digit number from 300 to 900 that lenders and other creditors use to evaluate your credit risk. equifax is a credit bureau — a private company that collects. Top factors that affect your credit scores whether you’re interested in building, maintaining or improving your credit, knowing how your scores are calculated and what may have the biggest impact can help you on your journey to financial well being.

What Affects Your Credit Score Equifax Personal Your equifax credit score is a three digit number from 300 to 900 that lenders and other creditors use to evaluate your credit risk. equifax is a credit bureau — a private company that collects. Top factors that affect your credit scores whether you’re interested in building, maintaining or improving your credit, knowing how your scores are calculated and what may have the biggest impact can help you on your journey to financial well being.

Comments are closed.