Trading Psychology And The 5 Rules To Follow

Trading Psychology 11 Lessons For Stock Market Traders Tmafx the most common problem with any day trader is having the proper trading psychology. trading psychology, meaning that a day trader can stay. Trading psychology is crucial, as it influences a trader’s ability to address emotional swings, adhere to a trading plan, and make rational decisions under pressure. key psychological traits for successful trading include discipline, patience, resilience, adaptability, confidence, continuous learning, emotional control, and analytical skills.

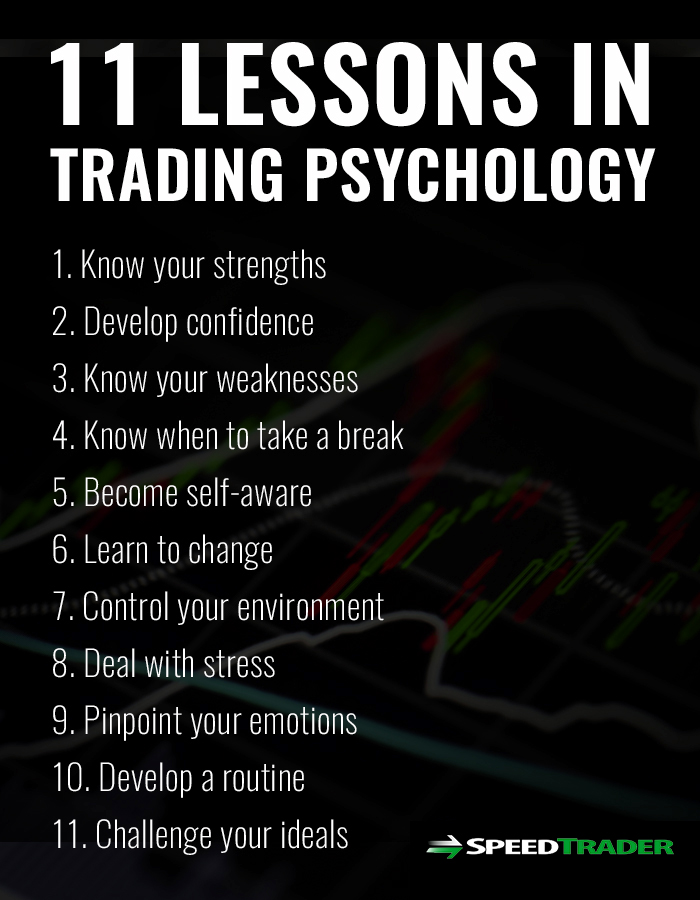

Trading Psychology Trading Charts Stock Trading Trading Strategies And this is why trading psychology is paramount. throughout this article, we’ll walk you through various aspects of trading psychology and how a winning attitude can lead to greater profits. while our list of 11 tips isn’t exhaustive, it reflects some of the more salient advice that separates winners from losers. 1. The role of trading psychology in successful trading. trading psychology plays a pivotal role in the success of traders by influencing how decisions are made under conditions of uncertainty and risk. it encompasses understanding one’s cognitive biases, exercising self control, and managing emotions to make informed and rational trading decisions. Here is how i have mastered the mental game of trading. 1. journal your activity. i can’t stress this enough: there is no successful trader who doesn’t keep a trading journal. you need to consistently document your trading activity, goals, market conditions, outcomes, plan, thoughts, and emotions. Vantage shares 5 tips that can help traders improve their overall trading psychology: #1 develop a trading plan: a well defined trading plan equipped with clear objectives, risk management strategies, and a set of rules to follow can provide the scaffolding needed for traders to remain disciplined and avoid impulsive behaviour.

Comments are closed.