Trading Psychology Master Your Trading Mind With Free Pdf

Trading Psychology Master Your Trading Mind With Free Pdf Trading psychology is a broad term that takes into account everything that involves your emotions when trading. when traders refer to trading psychology they are normally referring to the mistakes and mental errors that they continually repeat that cost them money. these errors normally fall into two categories; errors from being greedy and. Uch like professional sports, trading is a high perfor mance activity. traders need to be in their best possible state of mind both emotionally and psychologically, and their cognitive thinking must be free of bias or prejudgment. there is a fine line between calculated risk taking and gambling.

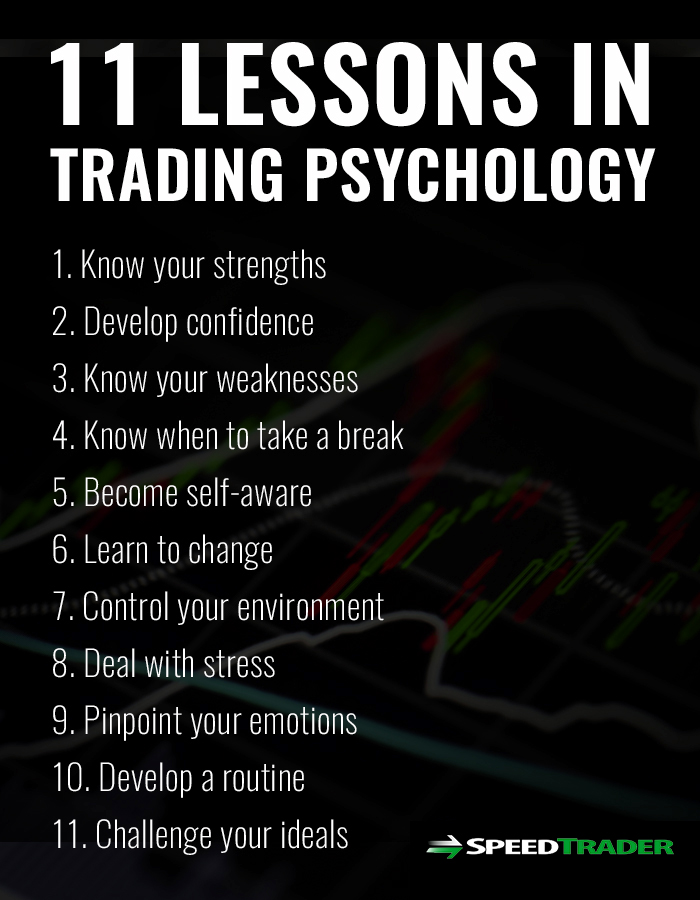

Trading Psychology 11 Lessons For Stock Market Traders The role of trading psychology in successful trading. trading psychology plays a pivotal role in the success of traders by influencing how decisions are made under conditions of uncertainty and risk. it encompasses understanding one’s cognitive biases, exercising self control, and managing emotions to make informed and rational trading decisions. Mastering trading psychology andrew aziz.pdf free ebook download as pdf file (.pdf), text file (.txt) or read book online for free. Denise shull's 'market mind games' delves into the psychological complexities of trading. it offers a neuropsychological perspective, helping traders understand the emotional and cognitive processes influencing their trading decisions. readers gain insights into managing emotions, understanding market psychology, and making more informed. The basics of trading psychology. managing emotions. fear, greed, excitement, overconfidence and nervousness are all typical emotions experienced by traders at some point or another. managing the.

Understanding The Importance Of Trading Psychology вђў Mexc Blog Denise shull's 'market mind games' delves into the psychological complexities of trading. it offers a neuropsychological perspective, helping traders understand the emotional and cognitive processes influencing their trading decisions. readers gain insights into managing emotions, understanding market psychology, and making more informed. The basics of trading psychology. managing emotions. fear, greed, excitement, overconfidence and nervousness are all typical emotions experienced by traders at some point or another. managing the. This document discusses the importance of trading psychology and provides tips to improve one's trading mindset. it explains that psychological mistakes are commonly overlooked but can undermine even a good trading strategy. specific tips include not overtrading, cutting losses short, taking profits, and acknowledging emotions without pretending they don't exist. it recommends reading several. At its core, trading psychology revolves around understanding the influence of emotional and mental states on trading. emotions like fear, greed, and overconfidence can cloud judgment, leading to impulsive decisions and potentially detrimental outcomes. 1. greed: the double edged sword.

Why Is Trading Psychology So Important This document discusses the importance of trading psychology and provides tips to improve one's trading mindset. it explains that psychological mistakes are commonly overlooked but can undermine even a good trading strategy. specific tips include not overtrading, cutting losses short, taking profits, and acknowledging emotions without pretending they don't exist. it recommends reading several. At its core, trading psychology revolves around understanding the influence of emotional and mental states on trading. emotions like fear, greed, and overconfidence can cloud judgment, leading to impulsive decisions and potentially detrimental outcomes. 1. greed: the double edged sword.

Trading Psychology

Comments are closed.