Traditional Ira Explained In 5 Minutes Tax Deferred Retirement Account In 2024

Traditional Ira Explained In 5 Minutes Tax Deferred Ret Open a traditional ira here: optimizedportfolio go m1in this video i'll explain what a traditional ira is, who they're for, when to contribute, a. A traditional ira is a tax deferred retirement account you open outside of an employer’s retirement plan. the ira contribution limit is $6,500 for both a traditional and a roth ira. in 2024.

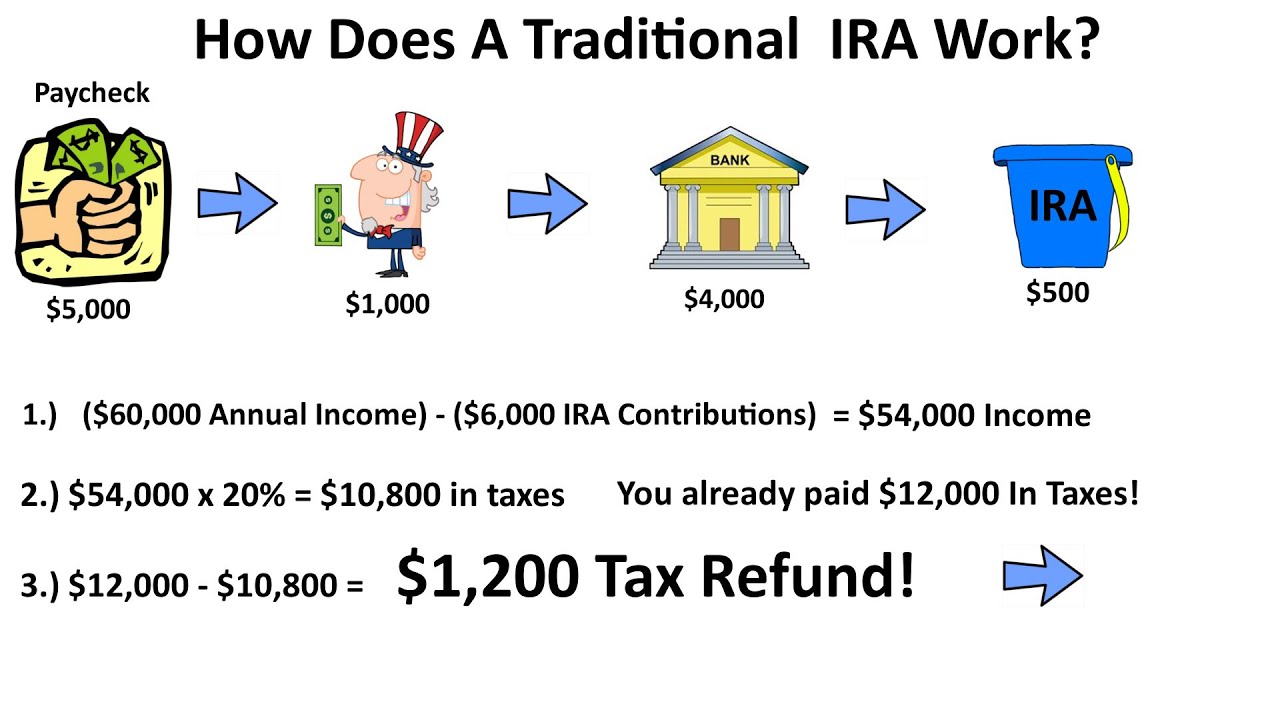

How Does An Ira Work Traditional Ira Explained In A Flow Chart Tax A traditional ira is an individual retirement account (ira) designed to help people save for retirement, with taxes deferred on any potential investment growth. contributions are generally made with after tax money, but may be tax deductible if you meet income eligibility. 1. benefits of a traditional ira. Traditional ira: tax rules, limits and more. with a traditional individual retirement account (ira), you contribute tax deductible dollars to an investment account, where they grow tax deferred. how much you can contribute per tax year is set by congress. for 2024, it’s $7,000, plus a catch up $1,000 for people 50 and older. A traditional ira allows any investment earnings to grow tax deferred until withdrawn, typically at retirement. generally, if you have earned income, you can establish as many iras as you want. you may also have an ira even if you participate in a qualified pension, profit sharing, or other retirement plan. your entire contribution may not be. A traditional ira is a type of individual retirement account that allows owners to make pre tax contributions. while annual contributions could result in a tax break for that year, withdrawals.

Comments are closed.