Transunion Vs Equifax Credit Scores Why The Difference Between о

Transunion Vs Equifax Major Differences Explained Self Credit Builder When you log into your credit karma account, you can access your free credit reports and scores from both transunion and equifax. they’ll likely be slightly different, and it’s possible they could be very different. multiple factors could account for why your scores are different. credit scoring models can differ and produce different scores. Transunion credit monitoring. the transunion credit agency offers a one size fits all approach to credit monitoring that will cost you $29.95 a month. this service offers multiple benefits to keep your credit score intact: unlimited credit score updates. email updates of important changes to your credit history.

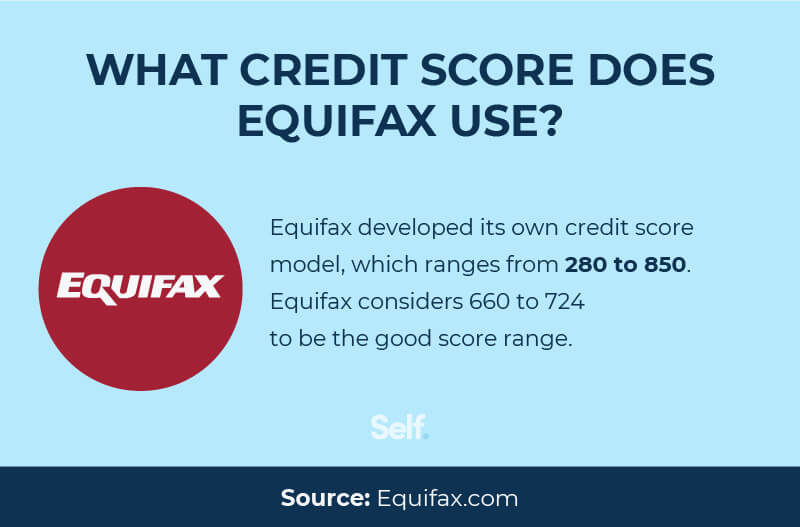

Transunion Vs Equifax Which Credit Score Matters More What S The Transunion is a chicago based company founded in 1968. it has information on more than a billion customers in 30 plus countries, including 200 million in the u.s. [2] transunion uses the vantagescore 3.0 model in compiling its credit score, which ranges from 300 to 850. a good credit score under the transunion model ranges from 720 to 780. Credit scores can easily get confusing, especially if you are new to monitoring your credit. in reality, the concepts are pretty simple. equifax and transunion are just two different credit bureaus that compile and distribute credit reports and scores. while these scores may differ slightly, they use the same information and should be similar. 1. in canada, there are two credit bureaus that financial institutions use in the credit scoring process: equifax and transunion. but while the two companies serve a similar purpose, each one will give you a different credit score. in this article, i’ll explain why that is, and show you how you can get an updated credit score every month for. Equifax recommends aiming for a score of 739 or higher if a “good” score is desired. the equifax credit score model falls on a credit rating scale that starts at 280 and ends at 850. the higher a score is on this scale, the better indication that the consumer poses a lower risk to creditors. transunion and equifax calculate credit scores.

Transunion Vs Equifax Credit Scores Why The Difference 1. in canada, there are two credit bureaus that financial institutions use in the credit scoring process: equifax and transunion. but while the two companies serve a similar purpose, each one will give you a different credit score. in this article, i’ll explain why that is, and show you how you can get an updated credit score every month for. Equifax recommends aiming for a score of 739 or higher if a “good” score is desired. the equifax credit score model falls on a credit rating scale that starts at 280 and ends at 850. the higher a score is on this scale, the better indication that the consumer poses a lower risk to creditors. transunion and equifax calculate credit scores. Transunion typically utilizes the vantagescore model, ranging from 300 850. this system places a greater emphasis on recent credit activities, offering a distinct perspective. equifax, in contrast, uses its educational credit score model. this model, with a similar 280 850 range, gives more weight to your overall credit history. It’s impossible to say which credit reporting agency, transunion, experian, or equifax, is more accurate since all three agencies use similar methods to collect and report credit information, but may differ in their scoring models and data sources. it’s also important to note that credit scores are only sometimes 100% accurate and can vary.

Comments are closed.