Transunion Vs Equifax Major Differences Explained Self Credit Builder

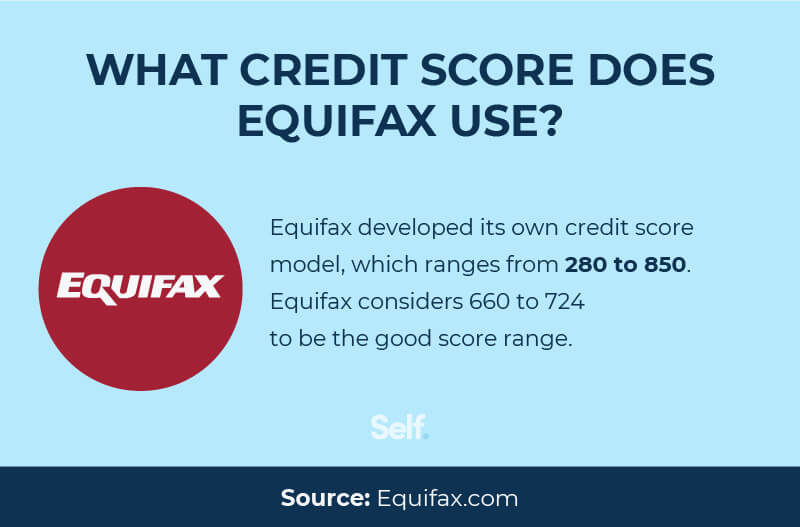

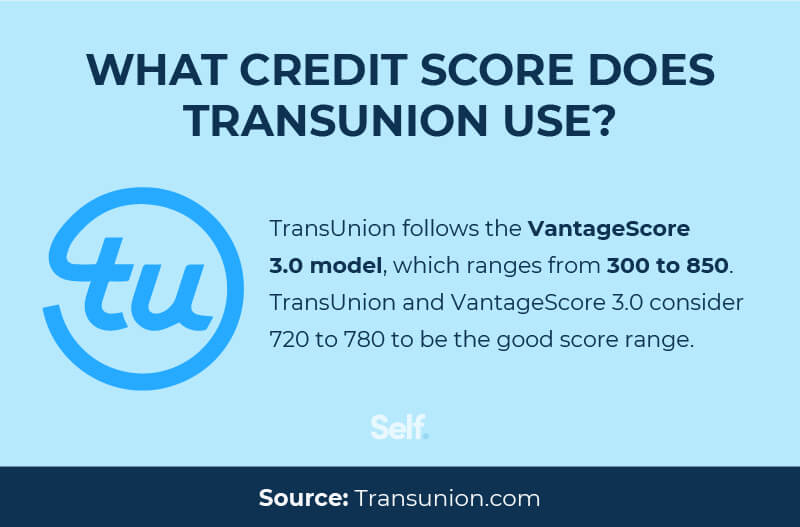

Transunion Vs Equifax Major Differences Explained Self Credit Builder Transunion is a chicago based company founded in 1968. it has information on more than a billion customers in 30 plus countries, including 200 million in the u.s. [2] transunion uses the vantagescore 3.0 model in compiling its credit score, which ranges from 300 to 850. a good credit score under the transunion model ranges from 720 to 780. You may already be familiar with the three big consumer credit bureaus — equifax, experian and transunion. but more than 50 companies appear on the consumer financial protection bureau’s 2023 list of consumer reporting companies. let’s narrow things down and focus on two major national credit bureaus: transunion vs. equifax.

Transunion Vs Equifax Major Differences Explained Self Credit Builder Transunion credit monitoring. the transunion credit agency offers a one size fits all approach to credit monitoring that will cost you $29.95 a month. this service offers multiple benefits to keep your credit score intact: unlimited credit score updates. email updates of important changes to your credit history. Self offers two year terms for four different monthly payment options. the lowest payment is $25 a month; you can also choose payments of $35, $48 or $150 per month. there’s a nonrefundable. Equifax, experian, and transunion are the 3 main credit bureaus in the us. they each collect and maintain a record of your credit history, with details like your borrowing habits, payment history, and overall credit utilization. they all gather similar types of information, but there can be big differences in the data they have on you and how. When it comes to equifax vs. transunion, both bureaus are accurate and just as important as the other. a slight difference in these scores is not usually a cause for concern. if you see a major difference when checking your credit scores, check your credit reports and decide if you need credit help. the credit agents are professionals that can.

Comments are closed.