Types Of Candle Chart Patterns

Candlestick Types Doji. when a market’s open and close are almost at the same price point, the candlestick resembles a cross or plus sign – traders should look out for a short to non existent body, with wicks of varying length. this doji’s pattern conveys a struggle between buyers and sellers that results in no net gain for either side. Here’s how to identify the dark cloud cover candlestick pattern: the first candle is bullish. the second candle is bearish. the open level of the second candle must be above the first candle (there’s a gap there) the close of the second candle must be below the 50% level of the body of the first candle.

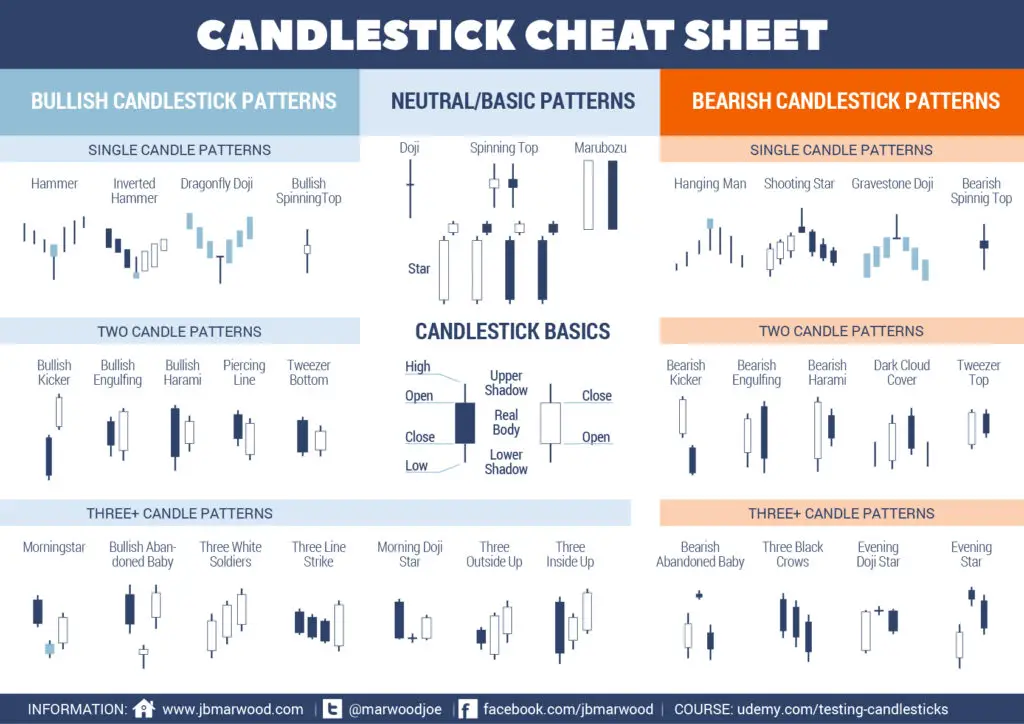

How To Read Candlestick Charts Candlestick Patterns Candlestick 48. three inside up. the three inside up candlestick pattern is a bullish reversal pattern that occurs at the end of a bearish trend. it consists of three candles, with the first two forming an inside bar followed by a bullish breakout. it might look like this on a chart: three inside up candlestick pattern. 49. Below are the different types of bearish reversal candlestick chart patterns: 14. hanging man: hanging man is a single candlestick pattern that is formed at the end of an uptrend and signals a bearish reversal. the real body of this candle is small and is located at the top with a lower shadow which should be more than twice the real body. Different types of candlestick patterns tell you a different story about the price chart. candlestick patterns have been accepted fairly by the traders worldwide to be the most effective technical tool for reading a price chart. candlestick patterns were first used in japan in the 17 th century. candlestick patterns have been able to showcase. 35 types of candlestick patterns list. now, let’s embark on an exploration of the 35 essential candlestick chart patterns, categorized into bullish reversal, bearish reversal, and continuation patterns. bullish reversal candlestick patterns 1. hammer. the hammer is a single candlestick pattern that typically appears at the end of a downtrend.

Candlestick Patterns Cheat Sheet New Trader U Different types of candlestick patterns tell you a different story about the price chart. candlestick patterns have been accepted fairly by the traders worldwide to be the most effective technical tool for reading a price chart. candlestick patterns were first used in japan in the 17 th century. candlestick patterns have been able to showcase. 35 types of candlestick patterns list. now, let’s embark on an exploration of the 35 essential candlestick chart patterns, categorized into bullish reversal, bearish reversal, and continuation patterns. bullish reversal candlestick patterns 1. hammer. the hammer is a single candlestick pattern that typically appears at the end of a downtrend. Candlestick pattern explained . candlestick charts are a technical tool that packs data for multiple time frames into single price bars. a candlestick is a type of price chart that displays. Steven holm. candlestick patterns are key indicators on financial charts, offering insights into market sentiment and price movements. these patterns emerge from the open, high, low, and close prices of a security within a given period and are crucial for making informed trading decisions. the aim is to identify potential market reversals or.

Comments are closed.