Understanding Auto Insurance Collision Coverage

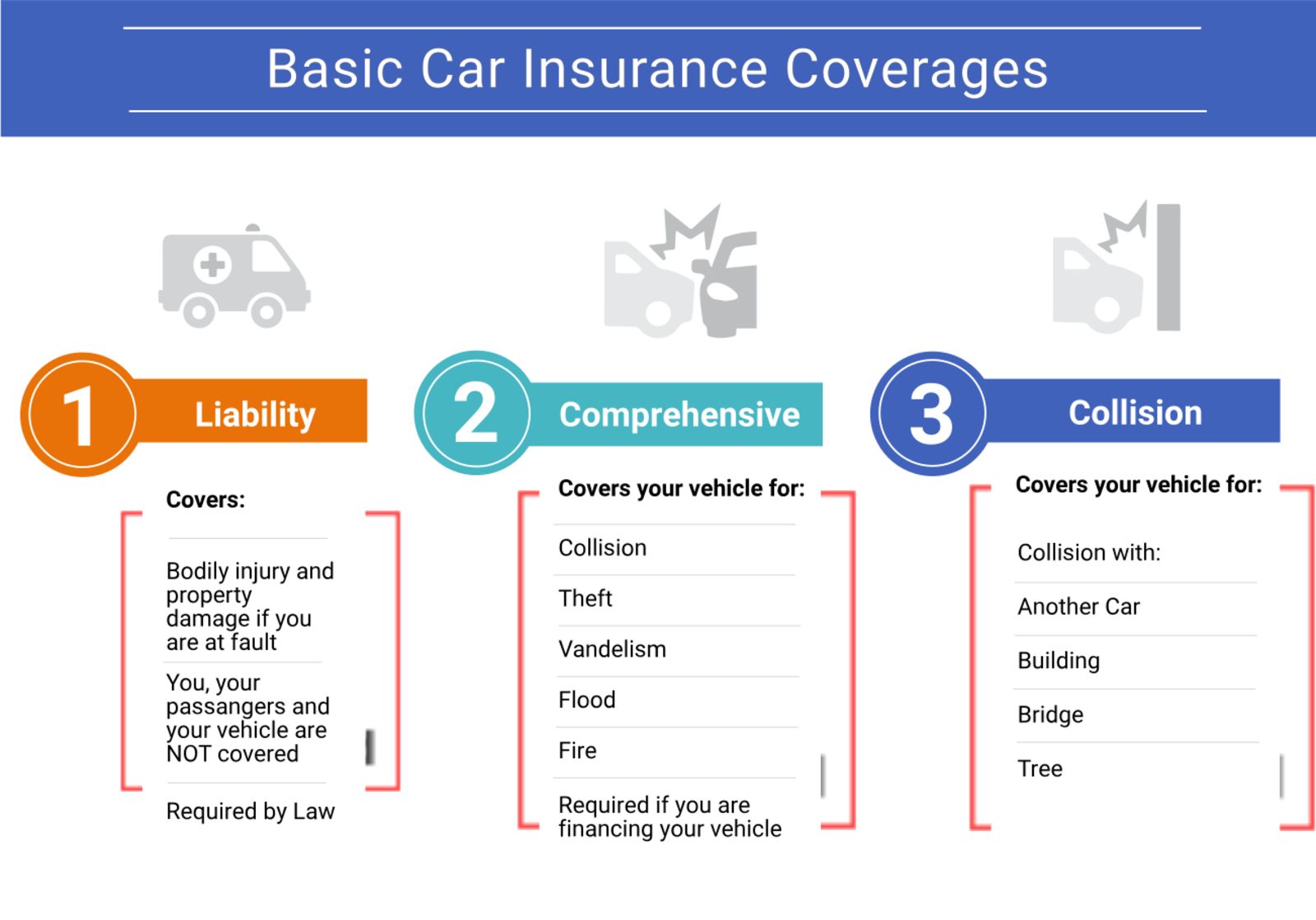

Basic Car Insurance Vs Full Coverage Car Insurance Collision insurance covers car repair bills if your car is damaged in an accident or pays to replace your car if it’s totaled in an accident, such as: a car crash with another vehicle. a car. As the saying goes: an ounce of prevention is worth a pound of cure. to read and understand your auto insurance policy, start with the declarations page because this defines your coverage, insured drivers, vehicles, and more. review the declarations page periodically to ensure accuracy.

What Is Collision Coverage Understanding Auto Insurance However, in many states, liability auto insurance minimum limits are low — just $5,000 or $10,000. given that the average cost of a new car is nearly $50,000, a driver with only state required. The maximum amount of coverage for any property damage in an accident you cause. to better understand the breakdown of limits, use the example of 15 30 5. what that means is that $15,000 is the. Collision insurance covers damage to your vehicle in the event of an accident, such as a fender bender or a collision with a fixed object. unlike liability insurance, collision coverage is not required by law. it is usually mandated if you’re financing or leasing a vehicle. collision insurance is subject to a deductible: the amount you're. Collision insurance can pay to repair or replace your car following collision related accidents, including: a collision with an object, such as a light post or tree. a collision with another vehicle. a collision while your car is parked, including hit and runs. a single car accident involving rolling or falling over.

Understanding Collision And Comprehensive Auto Coverage Vtc Insurance Collision insurance covers damage to your vehicle in the event of an accident, such as a fender bender or a collision with a fixed object. unlike liability insurance, collision coverage is not required by law. it is usually mandated if you’re financing or leasing a vehicle. collision insurance is subject to a deductible: the amount you're. Collision insurance can pay to repair or replace your car following collision related accidents, including: a collision with an object, such as a light post or tree. a collision with another vehicle. a collision while your car is parked, including hit and runs. a single car accident involving rolling or falling over. When you choose collision insurance, you can drive knowing your car is covered in the event of an accident. avoid paying out of pocket for repairs above the cost of your deductible. coverage for your loss when your damaged vehicle is deemed to be totaled. While basic, legally mandated auto insurance covers the cost of damages to other vehicles that you cause while driving, it does not cover damage to your own car. to cover this, you need to purchase the following optional auto insurance coverages: collision — this optional coverage reimburses you for damage to your car that occurs as a result.

Understanding Auto Insurance What Is Collision Coverage Car When you choose collision insurance, you can drive knowing your car is covered in the event of an accident. avoid paying out of pocket for repairs above the cost of your deductible. coverage for your loss when your damaged vehicle is deemed to be totaled. While basic, legally mandated auto insurance covers the cost of damages to other vehicles that you cause while driving, it does not cover damage to your own car. to cover this, you need to purchase the following optional auto insurance coverages: collision — this optional coverage reimburses you for damage to your car that occurs as a result.

Comments are closed.