Understanding The Differences Between Independent Contractors And

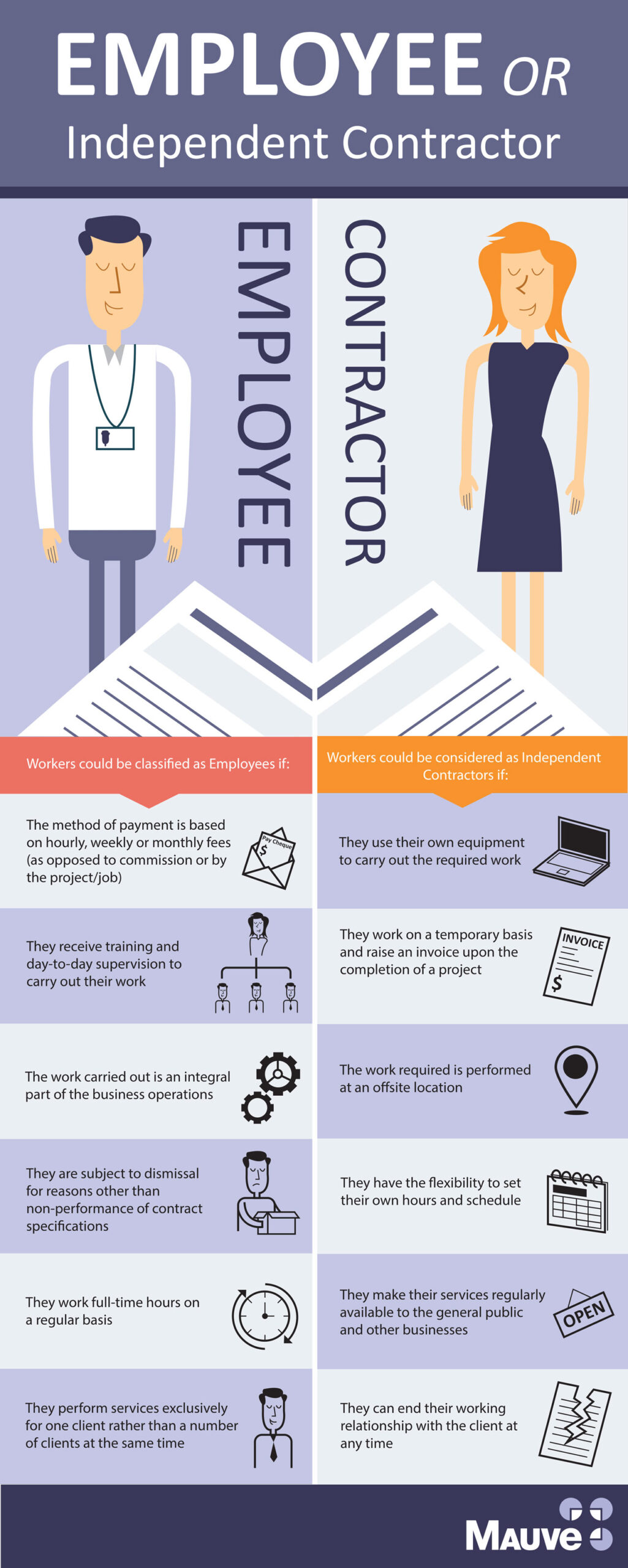

What Are The Differences Between Employees And Independent Contractors Employee or independent contractor? a guide to the new rule. To help you understand the crucial differences between independent contractors and employees, i’ve broken down each worker classification in more detail. independent contractors. an independent contractor is a self employed individual who provides services to clients while maintaining control over how these services are delivered.

What S The Difference Between An Employee Vs Contractor Independent Worker classification 101: employee or independent. Choosing between these paths depends on your career goals and desired work style. understanding the differences between freelancer vs independent contractor can help you determine which path aligns best with your professional aspirations and personal needs. For the 2024 tax year, independent contractors pay 12.4% in social security contributions on the first $168,600 of net income and 2.9% in medicare taxes on all net income. single filers must pay. When distinguishing between an independent contractor and an employee, it is important to understand the tax forms and responsibilities for each. employees receive a form w 2 from their employer, and the employer is responsible for withholding and depositing income taxes, social security taxes, and medicare taxes from the wages paid to the.

Comments are closed.