Understanding Your Credit Score

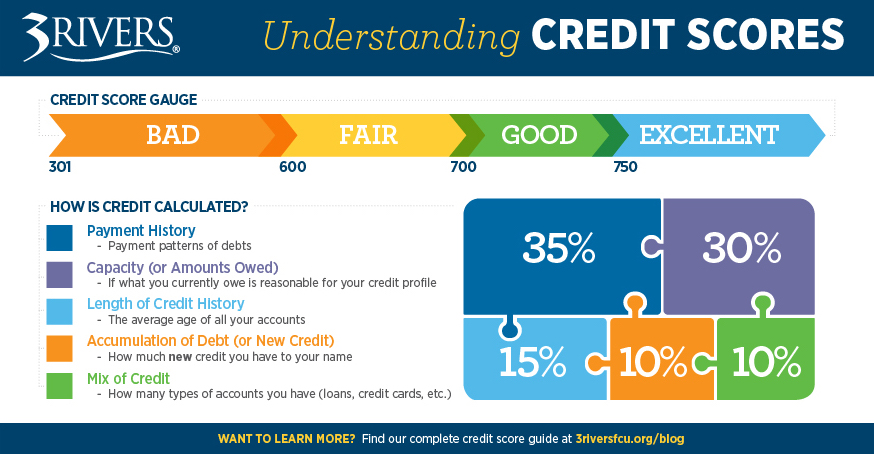

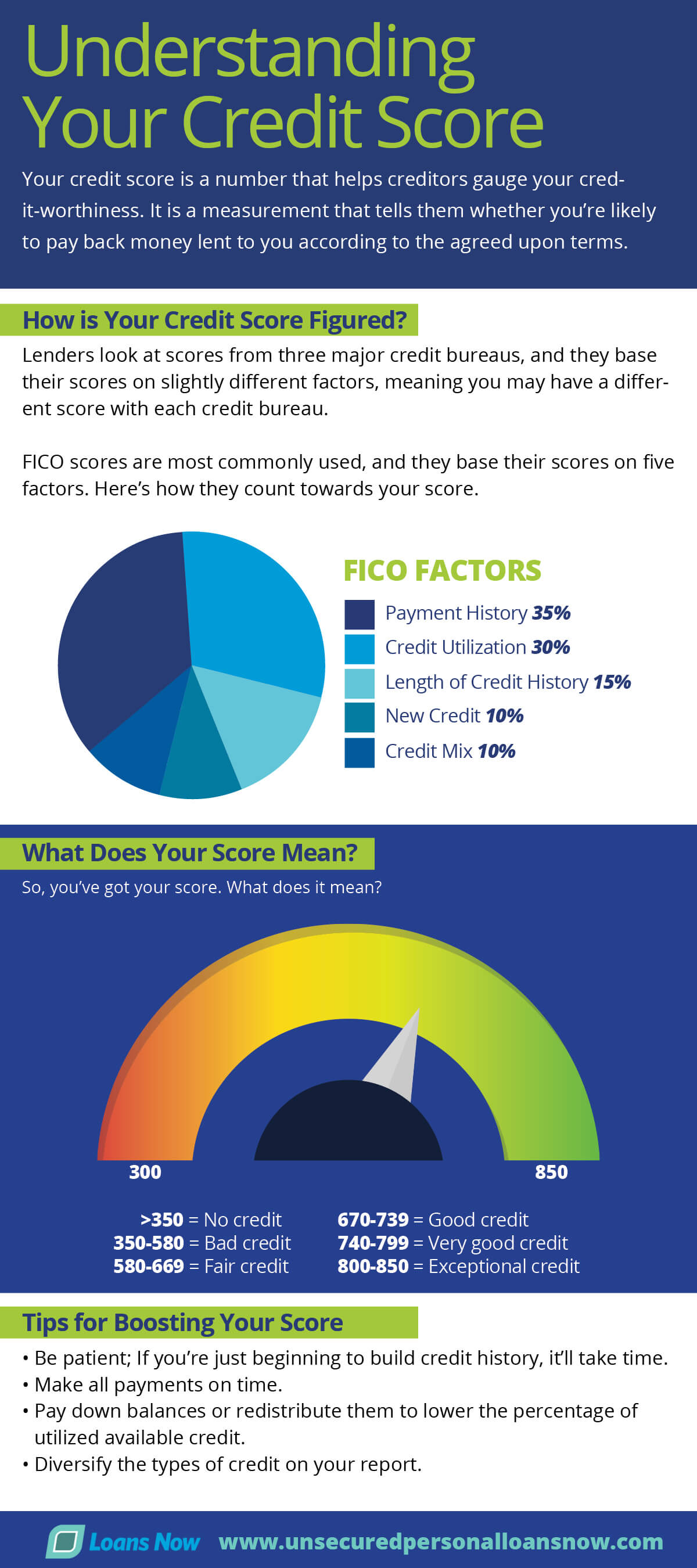

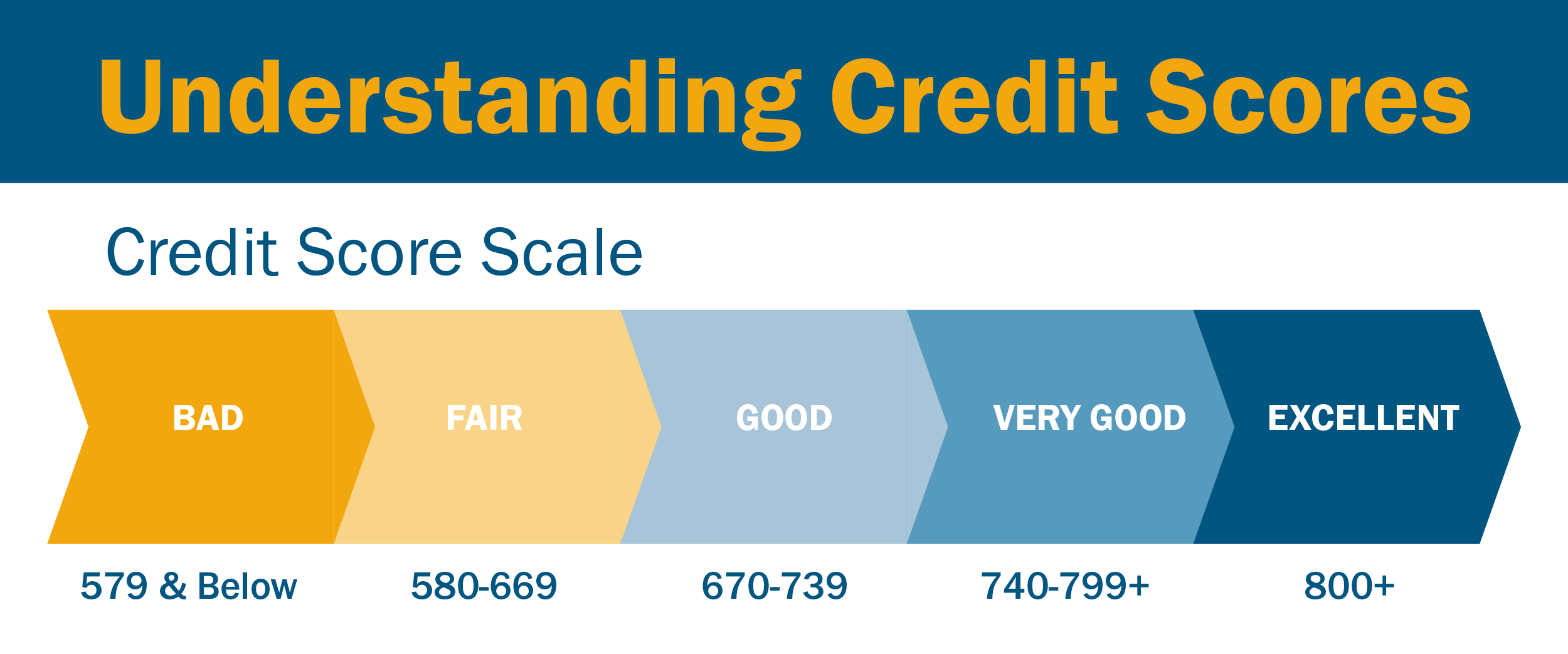

Understanding Credit Scores Score ranges: for the vantagescore and the base fico ® score, the range is 300 to 850. however, fico's bankcard and auto scoring models use a range of 250 to 900. weighting factors: when calculating your credit score, vantagescore and fico generally look at the same information. however, they weigh certain factors differently. Learn what a credit score is, how it is calculated, and how you can improve it. find out four ways to get your credit score and what factors affect it.

Understanding Your Credit Score Some financial advisors suggest staggering your requests over a 12 month period to help keep an eye on your reports and make sure they have accurate information. the best way to get your free credit report is to. go to annualcreditreport or. call annual credit report at 1 877 322 8228. Your credit scores play a critical role in your ability to access credit, so it's important to understand how your actions may or may not impact your credit scores. lenders and creditors often use credit scores to help determine the likelihood that someone will pay back what they owe on loans , credit cards and mortgages. It's safe and smart to check it often. heavy credit card use, a missed payment or a flurry of credit applications could account for a credit score drop. pay everything on time. use less than 30%. On credit karma, you can get your free vantagescore 3.0 credit scores from equifax and transunion. you can also get your credit scores from the three main consumer credit bureaus, though you may be charged a fee. (you’re entitled to a free copy of your credit reports from each of the three credit bureaus every year, but not your scores.).

Understanding Your Credit Score Nfm Lending It's safe and smart to check it often. heavy credit card use, a missed payment or a flurry of credit applications could account for a credit score drop. pay everything on time. use less than 30%. On credit karma, you can get your free vantagescore 3.0 credit scores from equifax and transunion. you can also get your credit scores from the three main consumer credit bureaus, though you may be charged a fee. (you’re entitled to a free copy of your credit reports from each of the three credit bureaus every year, but not your scores.). Here are three ways to check your credit score and stay on top of your finances. 1. free credit scoring website. one of the best ways to check your credit score for free is by visiting a free. If you have $1,000 in balances and $5,000 in available credit, then your credit utilization is 20%. a low credit utilization is better for your credit score. there's no specific amount separating.

Understanding Your Credit Score Here are three ways to check your credit score and stay on top of your finances. 1. free credit scoring website. one of the best ways to check your credit score for free is by visiting a free. If you have $1,000 in balances and $5,000 in available credit, then your credit utilization is 20%. a low credit utilization is better for your credit score. there's no specific amount separating.

Understanding Your Credit Score

Comments are closed.