Vantagescore Vs Fico Credit Score Ranges Explained

Credit Score Ranges What They Mean And Why They Matter Fico scores range from 300 to 850. at first, vantagescore credit scores featured a different numerical scale (501 to 990). however, vantagescore 3.0 and 4.0 adopted the same 300 to 850 scale that. Otherwise, fico won’t generate your scores. on the other hand, the vantagescore® model may be able to score consumers who are new to credit or use credit infrequently. vantagescore can use data of just one month’s history and one account reported within the previous 24 months.

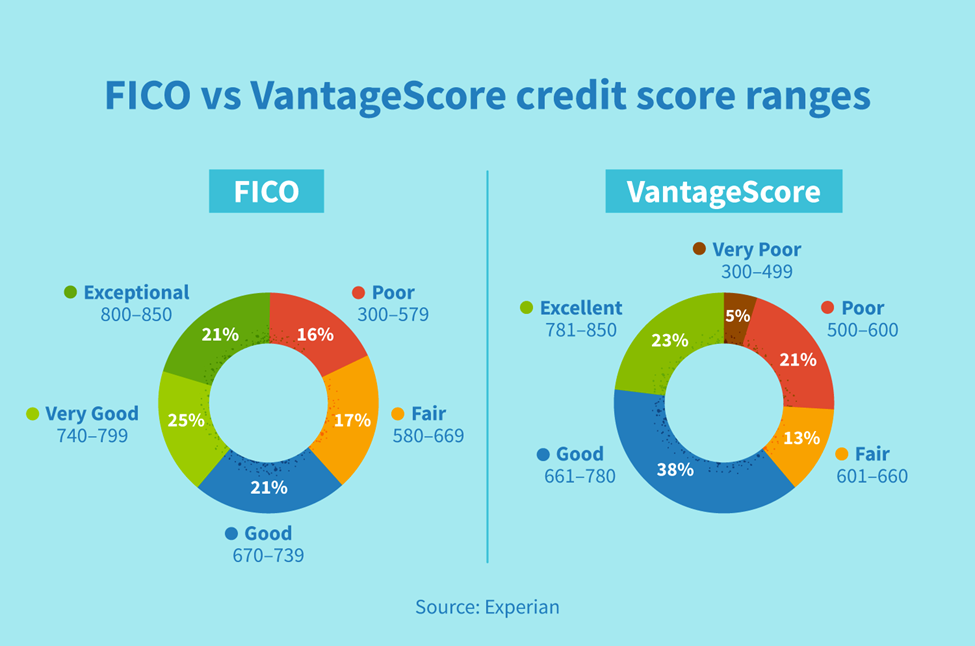

What Credit Score Do You Start With How To Improve It Creditrepair Vantagescore is a newer credit scoring model created by the three major credit bureaus as an alternative to fico. like fico, vantagescore has been updated several times. while vantagescore. All the latest generic scoring models range from 300 to 850, with a higher credit score being better. however, fico’s industry specific models and vantagescore 1.0 and 2.0 have different score. The credit score range for both fico® and vantagescore is 300 to 850; however, the way the scores classify consumers are slightly different. for example, in the fico® system, a very poor score range is anything 579 and below, while vantagescore’s very poor credit score range is up to 549. A vantagescore is a consumer credit score developed jointly by the three major credit bureaus. like fico, it's on a 300 850 scale and uses similar data. which is the same range as a typical.

Vantagescore 3 Vs Fico 8 Credit Score One Person S Experience The credit score range for both fico® and vantagescore is 300 to 850; however, the way the scores classify consumers are slightly different. for example, in the fico® system, a very poor score range is anything 579 and below, while vantagescore’s very poor credit score range is up to 549. A vantagescore is a consumer credit score developed jointly by the three major credit bureaus. like fico, it's on a 300 850 scale and uses similar data. which is the same range as a typical. With all these credit scoring models, a higher score indicates you're less likely to miss a payment, which is why creditors are willing to offer people with high scores the best rates and terms. the base fico ® scores range from 300 to 850, while fico's industry specific scores range from 250 to 900. the first two versions of the vantagescore. If you have checked your credit score, and you're wondering where it falls on the spectrum, the scoring ranges below can help: fico credit scores: poor: 579 and below. fair: 580 to 669. good: 670.

Comments are closed.