Vat Reconciliation Spreadsheet Printable Spreadshee Vat

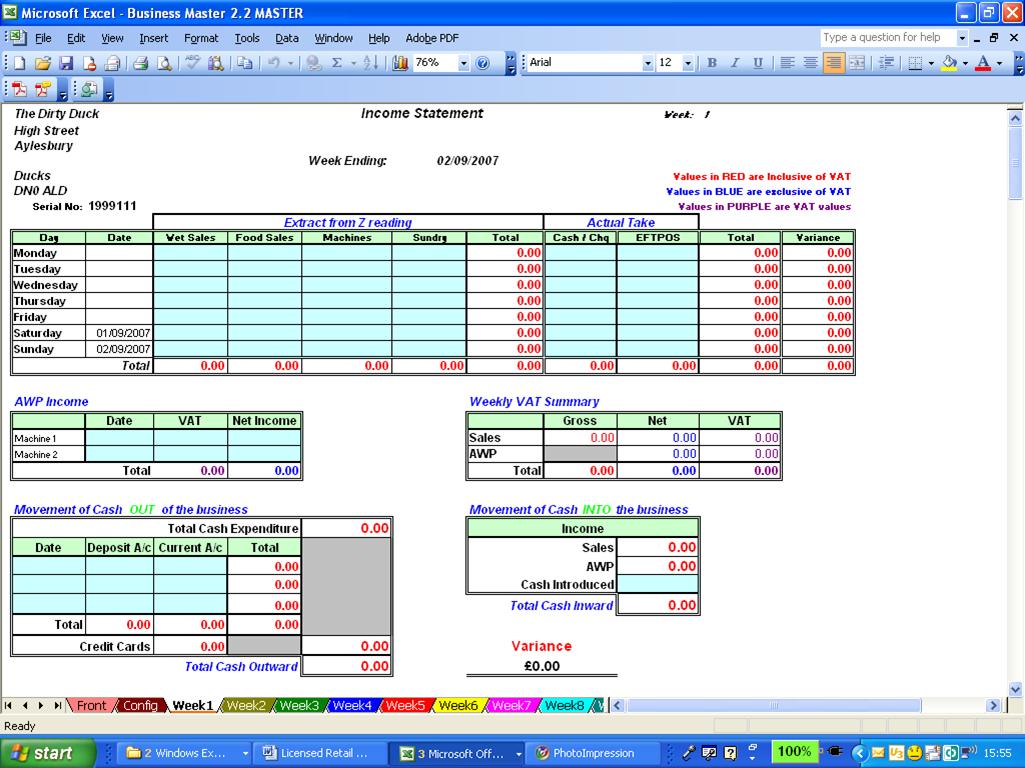

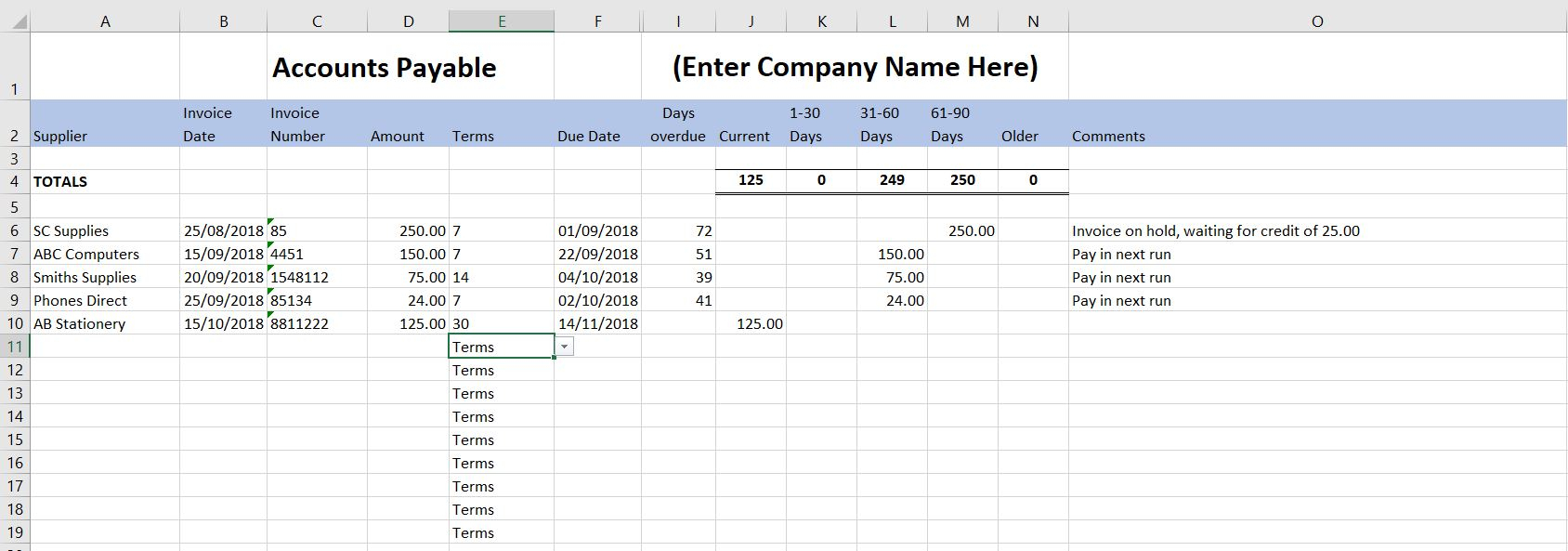

Vat Reconciliation Spreadsheet вђ Db Excel The monthly sales reconciliation table of the company's products. view our free and editable vat reconciliation templates for excel or google sheets. these vat reconciliation spreadsheet templates are easy to modify and you can customize the design, the header, table, formulas to suit your needs. download now to finish your work in minutes. Download this it vat reconciliation sheet template design in excel, google sheets format. easily editable, printable, downloadable. simplify vat management with our it vat reconciliation sheet template. effortlessly track sales, collected vat, and input vat for every month. gain a clear view of your vat liabilities and potential refunds.

Vat Reconciliation Spreadsheet Printable Spreadshee Vat Reconciliation This comprehensive guide is here to help you navigate the complexities of vat reconciliation with ease. by the end of this guide, you'll have the knowledge and tools to ensure compliance, minimize errors, and optimize your vat reconciliation process for maximum efficiency. setp bystep vat reconciliation process: finalize your accounts. 1) review any manual journals or adjustments that affect sales or vat. 2) check that your accounts all reconcile, e.g. the balance sheet balances, your bank reconciles, your sales ledger balance matches your closing debtors list. 3) re check your vat return and sales figures. output vat reconciliation. this reconciliation compares the expected. Season 1 looks at finding and keeping great people, while season 2 focuses on unlocking productivity. each season includes a keynote talk, plus new talks published each week alongside short articles providing a range of insights, advice and inspiration. talks are around 15 minutes long and bitesize articles are only a 5 minute read. We created a collection of making tax digital (mtd) spreadsheet templates to make calculating and submitting via our vat bridging tool easy. sign up below to get all three vat templates: standard (accrual) vat. cash basis. flat rate. i agree to anna’s privacy policy.

Vat Reconciliation Spreadsheet Printable Spreadshee Vat Reconciliation Season 1 looks at finding and keeping great people, while season 2 focuses on unlocking productivity. each season includes a keynote talk, plus new talks published each week alongside short articles providing a range of insights, advice and inspiration. talks are around 15 minutes long and bitesize articles are only a 5 minute read. We created a collection of making tax digital (mtd) spreadsheet templates to make calculating and submitting via our vat bridging tool easy. sign up below to get all three vat templates: standard (accrual) vat. cash basis. flat rate. i agree to anna’s privacy policy. Select an empty cell in the vat return template that you need to complete and enter the equal sign. select the worksheet containing your client data, then the cell with the value that you want to enter in the template, and press enter to confirm. repeat steps 2 and 3 for each cell that needs to be completed. make sure that the vat registration. About the vat reconciliation report. you can use the vat reconciliation report to compare the vat amounts from your vat returns with the vat you’ve collected and paid for the period. it also shows a summary of your vat information to help you to reconcile your vat account. if you use the standard vat scheme, the amounts from your vat returns.

Vat Reconciliation Spreadsheet Printable Spreadshee Vat Reconciliation Select an empty cell in the vat return template that you need to complete and enter the equal sign. select the worksheet containing your client data, then the cell with the value that you want to enter in the template, and press enter to confirm. repeat steps 2 and 3 for each cell that needs to be completed. make sure that the vat registration. About the vat reconciliation report. you can use the vat reconciliation report to compare the vat amounts from your vat returns with the vat you’ve collected and paid for the period. it also shows a summary of your vat information to help you to reconcile your vat account. if you use the standard vat scheme, the amounts from your vat returns.

Comments are closed.