What Are The Differences Between Employees And Independent Contractors

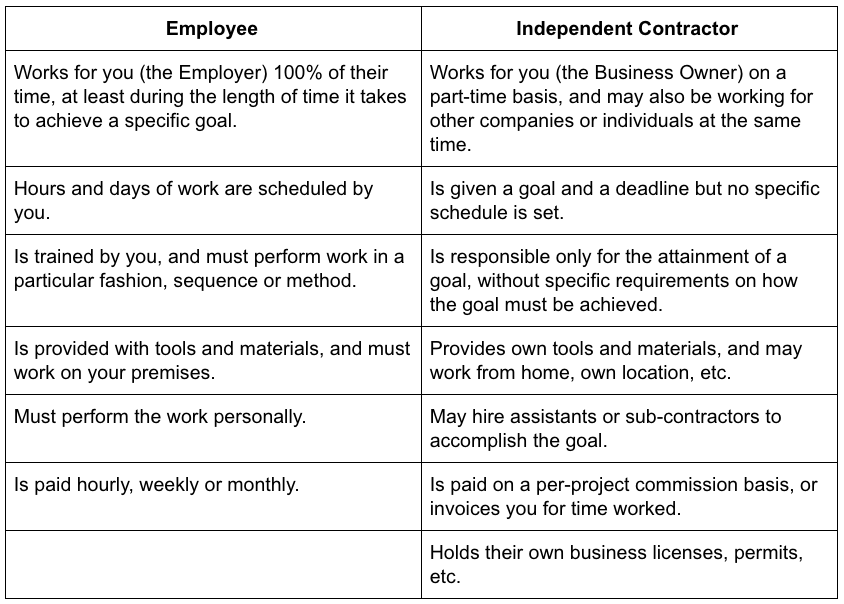

Independent Contractor Vs Employee Key Differences it is crucial to understand the differences between W-2 and W-9 forms to ensure compliance with tax laws and proper classification of workers These forms are used to report income and taxes withheld Knowing the characteristics and test of employment relationships and independent contracts is key for employers, as is understanding the pros and cons of these relationships

Employee Vs Independent Contractorвђ Which Is Better For Your Business As National Trucking Week unfolds, Employment and Social Development Canada (ESDC) is highlighting the trucking industry's contributions while focusing on Generally speaking, W-2 employees have taxes withheld from their paychecks by their employer, while 1099 contractors are responsible for paying taxes on their own The difference between 1099 work These app-based services may seem interchangeable, but there are differences between “AB-5 Worker Status: Employees and Independent Contractors: Assembly Bill No 5: Chapter 296” The Bureau of Labor Statistics announced a major downward revision of its reported payroll job gains, effectively wiping out 28 percent of the past year’s reported gains These overstated job gains

Comments are closed.