What Are The Different Ranges Of Credit Scores Equifax

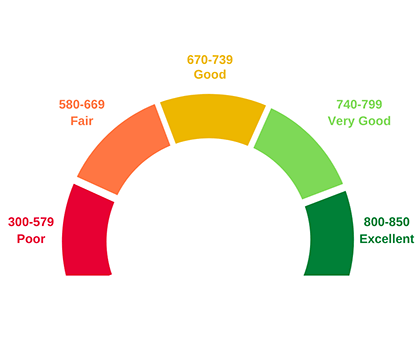

What Are The Different Ranges Of Credit Scores Equifax 740 to 799: very good credit score. individuals in this range have demonstrated a history of positive credit behavior and may have an easier time being approved for additional credit. 670 to 739: good credit score. lenders generally view those with credit scores of 670 and up as acceptable or lower risk borrowers. There are several reasons why credit scores may differ. these include: differences between credit bureaus: as mentioned, not every lender and creditor reports to both credit bureaus – they may report to only one, or none at all. in addition, lenders and creditors may report to the credit bureau or bureaus at different times, meaning one.

What Is A Credit Score Guide to credit score ranges in canada. credit scores in canada are three digit numbers that range from 300 900, and are rated from poor to excellent. credit score ranges in canada vary based on. There are some differences around how the various data elements on a credit report factor into the score calculations. although credit scoring models vary, generally, credit scores from 660 to 724 are considered good; 725 to 759 are considered very good; and 760 and up are considered excellent. higher credit scores mean you have demonstrated. Highlights: a credit score is a three digit number designed to represent the likelihood you will pay your bills on time. there are many different types of credit scores and scoring models. higher credit scores generally result in more favorable credit terms. a credit score is a three digit number, typically between 300 and 850, designed to. A credit score is a three digit number, typically between 300 and 900, which is designed to represent your credit risk, or the likelihood you will pay your bills on time. a credit score is calculated based on the information in your credit report. the way your credit score is calculated and the contents of your consumer file may vary between.

Equifax S Credit Score Scale Infogram Highlights: a credit score is a three digit number designed to represent the likelihood you will pay your bills on time. there are many different types of credit scores and scoring models. higher credit scores generally result in more favorable credit terms. a credit score is a three digit number, typically between 300 and 850, designed to. A credit score is a three digit number, typically between 300 and 900, which is designed to represent your credit risk, or the likelihood you will pay your bills on time. a credit score is calculated based on the information in your credit report. the way your credit score is calculated and the contents of your consumer file may vary between. But both use a credit score range of 300 to 850. these are the general guidelines: a score of 720 or higher is generally considered excellent credit. a score of 690 to 719 is considered good. That means the same credit score could represent something different depending on which credit model a lender uses. a vantagescore 3.0 score of 661 could put you in the good range for example, while a 661 fico score may be considered fair. and lenders create or use their own standards when making credit based decisions.

Equifax Credit Report Score Explained вђ Card Insider But both use a credit score range of 300 to 850. these are the general guidelines: a score of 720 or higher is generally considered excellent credit. a score of 690 to 719 is considered good. That means the same credit score could represent something different depending on which credit model a lender uses. a vantagescore 3.0 score of 661 could put you in the good range for example, while a 661 fico score may be considered fair. and lenders create or use their own standards when making credit based decisions.

Comments are closed.