What Hurts Your Credit Score The Most Tdecu

What Hurts Your Credit Score The Most Tdecu Tdecu is here to help you achieve your credit goals. if you’re wondering what hurts your credit score the most, the top financial experts agree that it comes down to two things: having a high balance on one or more cards without a lot of available credit, along with a history of late or missed payments on your accounts. The second most important part of your credit score is the level of debt, measured by credit utilization. having high credit card balances (relative to your credit limit) increases your credit utilization and decreases your credit score. in other words, if your limit is $10,000 and your balance is $9,500, you will not have a good score.

Seven Signs You Re Hurting Your Credit Score Savvyadvisor Here are some of the less common ways you could be hurting your credit score without realizing it. 1. maxing out your credit cards each month. let’s say you pay your bills early every single. 10. canceling a credit card. closing a card account can decrease your overall credit utilization ratio, potentially lowering your credit score. 11. being an authorized user on someone’s ‘bad’ account. when added as an authorized user on someone else’s credit card account, you inherit the payment history of that card. The minimum payment is the lowest amount of money that you are required to pay on your credit card statement each month. it is 2% of the total balance of your card (with a minimum of $18.00). it's important to make on time payments, even if it is a minimum payment, to maintain a higher rate of repayment and to build your credit score. Myth. increasingly, consumers' credit reports are being accessed by entities with no plans to lend you money. employers, insurers, and landlords can check on your credit, but these inquiries have.

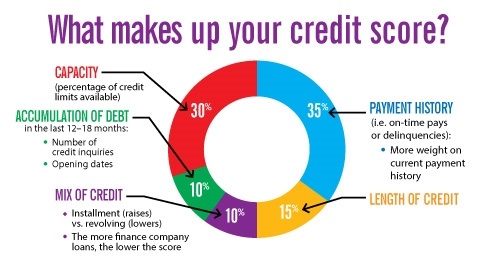

What Affects Your Credit Score Crg Financial Services Inc The minimum payment is the lowest amount of money that you are required to pay on your credit card statement each month. it is 2% of the total balance of your card (with a minimum of $18.00). it's important to make on time payments, even if it is a minimum payment, to maintain a higher rate of repayment and to build your credit score. Myth. increasingly, consumers' credit reports are being accessed by entities with no plans to lend you money. employers, insurers, and landlords can check on your credit, but these inquiries have. 3. length of credit history: 15%. it makes intuitive sense that experience with credit accounts will tend to make you better at managing debt, and that's borne out by statistical analysis. for that reason, all else being equal, the longer your credit history, the higher your credit score will tend to be. There’s no defined line for “good” vs “bad” credit, but generally over 700 indicates a good score, according to experian, one of three major credit bureaus. both credit cards and loans.

5 Weighted Factors That Affect Your Credit Score Credit Score Credi 3. length of credit history: 15%. it makes intuitive sense that experience with credit accounts will tend to make you better at managing debt, and that's borne out by statistical analysis. for that reason, all else being equal, the longer your credit history, the higher your credit score will tend to be. There’s no defined line for “good” vs “bad” credit, but generally over 700 indicates a good score, according to experian, one of three major credit bureaus. both credit cards and loans.

What Affects Your Credit Score The Most Knowyourcreditscore Net

Comments are closed.