What Is An Ira And How Does It Work 2024

What Is An Ira And How Does It Work 2024 Here’s how the Roth IRA works, what it offers and how it compares to a traditional IRA If you already know you want a Roth IRA, it’s tremendously easy to open one and get sta There's an implication that these beneficiaries are born with silver spoons in their mouths, are overly privileged, and don't have to work to earn a living Trust funds can indeed provide

What Is An Ira And How Does It Work 2024 Determining the return of a broad account category such as a Roth IRA is difficult because the underlying investments will vary Historically, the average annual return for a Roth IRA or any other Saving for retirement takes some planning Read on to find out why you don't need to be an investing genius to generate wealth Cope Moyers writes many other Baby Boomers who grew up in the recovery movement have now developed an addiction to painkillers Vanguard reports that the average 401 (k) balance among Americans aged 55 to 64 is $244,750 However, the median 401 (k) balance among that age group is $87,571 And when you have a median that's

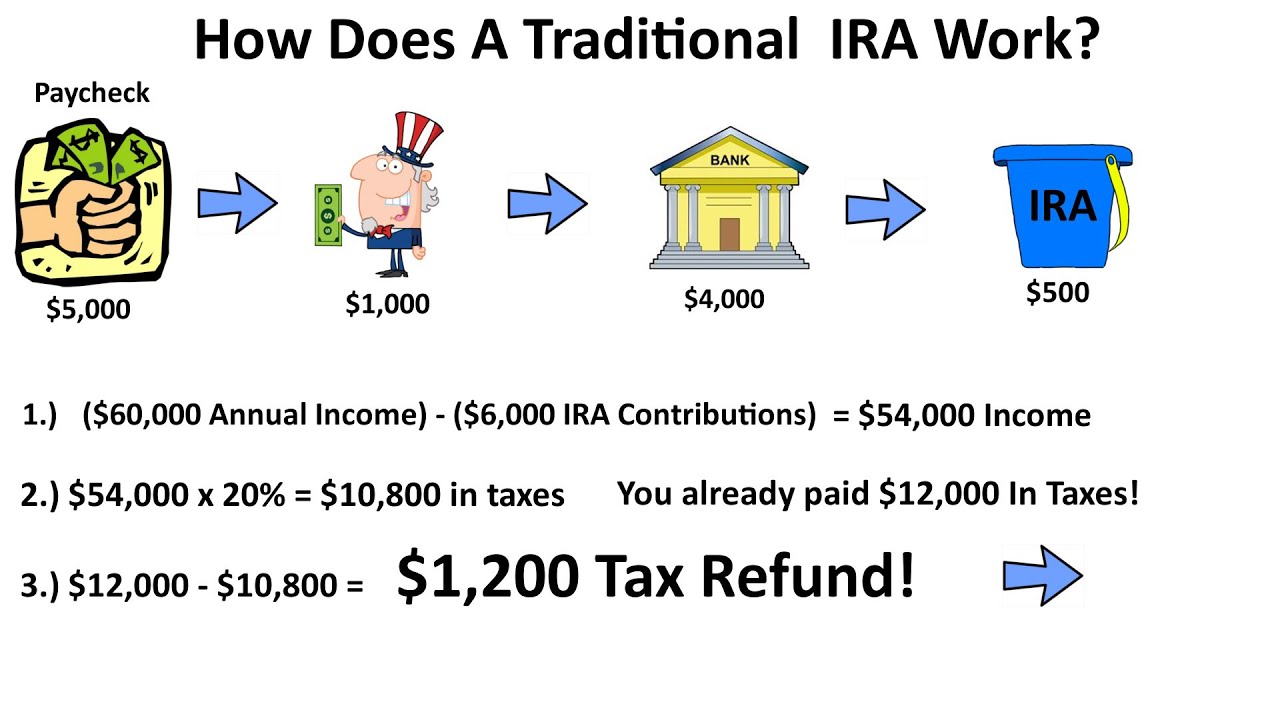

How Does An Ira Work Traditional Ira Explained In A Flow Chart Tax Cope Moyers writes many other Baby Boomers who grew up in the recovery movement have now developed an addiction to painkillers Vanguard reports that the average 401 (k) balance among Americans aged 55 to 64 is $244,750 However, the median 401 (k) balance among that age group is $87,571 And when you have a median that's It takes more due diligence and work by the investor to set up a gold IRA than it does to set up an IRA that holds traditional assets Before you invest, consider the benefits and risks of a gold IRA Worse still, market watchers warn, in many cases employers are required to withhold 20% of 401 (k) withdrawals for potential taxes For the indirect rollover to satisfy the IRS, however, the full The IRS places contribution limits on 401 (k)s: For 2024, the contribution limit is $23,000, with an additional $7,500 allowed in catch-up contributions for workers who are age 50 or older There are so many other critical energy policies where the vice president’s perspective remains an open question," said one industry advocate

Comments are closed.