What Is Capital Budgeting Capital Budgeting In A Nutshell Fourweekmba

Capital Budgeting What Is It Types Methods Process Examples Capital budgeting in a nutshell fourweekmba. business by gennaro cuofano march 17, 2024. capital budgeting is the process used by a company to determine whether a long term investment is worth pursuing. unlike similar methods that focus on profit, capital budgeting focuses on cash flow. capital budgeting is used to determine which fixed. Companies with complex capital structures, including various types of debt and equity securities, may face challenges in accurately calculating the cost of capital. conclusion. the cost of capital is a fundamental concept in finance that underpins investment decisions, capital budgeting, valuation, and capital structure choices.

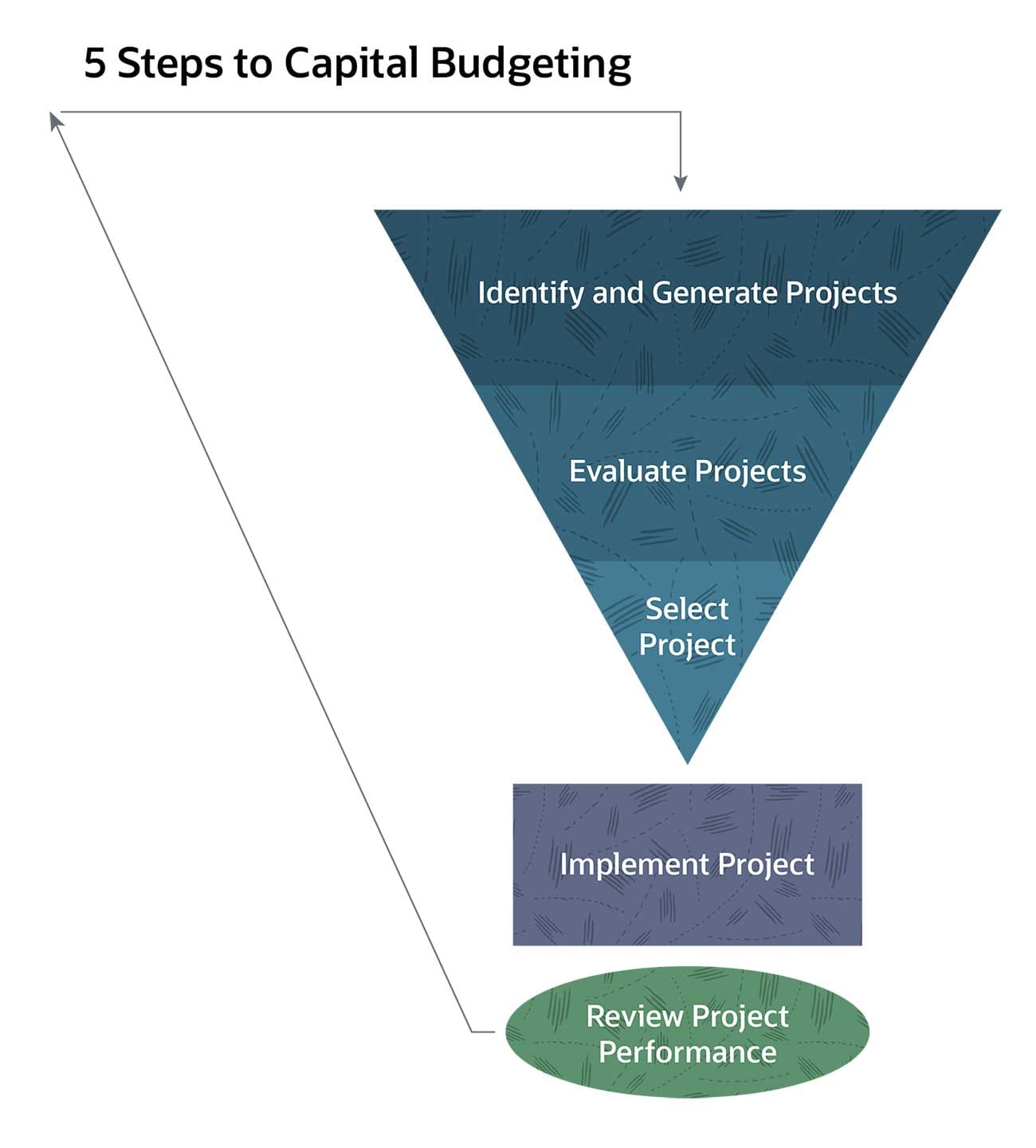

Capital Budgeting Definition Benefits Process Rrgraph Blog Capital budgeting is the process in which a business determines and evaluates potential expenses or investments that are large in nature. these expenditures and investments include projects such. Capital budgeting is a critical financial process that involves evaluating and selecting long term investments that are worth more than their cost. this method prioritizes projects based on their potential to increase a company’s value, focusing on cash flows, timing, and risk analysis. let’s dive into the world of capital budgeting. Definition. the weighted average cost of capital (wacc) is a financial metric that represents the average cost a company incurs to finance its operations and investments. it takes into account the cost of debt, cost of equity, and cost of preferred stock, each weighted by its respective proportion in the company’s capital structure. The capital budgeting process helps business leaders make better informed decisions about how to invest their company’s capital. the quality of the data used in the process is important to ensure the best analyses are made. netsuite planning and budgeting can help.

Capital Budgeting What Is It And Best Practices Netsuite Definition. the weighted average cost of capital (wacc) is a financial metric that represents the average cost a company incurs to finance its operations and investments. it takes into account the cost of debt, cost of equity, and cost of preferred stock, each weighted by its respective proportion in the company’s capital structure. The capital budgeting process helps business leaders make better informed decisions about how to invest their company’s capital. the quality of the data used in the process is important to ensure the best analyses are made. netsuite planning and budgeting can help. Capital budgeting is defined as the process by which a business determines which fixed asset purchases or project investments are acceptable and which are not. using this approach, each proposed investment is given a quantitative analysis, allowing rational judgment to be made by the business owners. capital asset management requires a lot of. Capital budgeting explained. capital budgeting process is a decision making process where a company plans and determines any long term capex whose returns in terms of cash flows are expected to be received beyond a year. investment decisions may include any of the below: expansion. acquisition.

What Is Capital Budgeting Definition Process Methods Formula Capital budgeting is defined as the process by which a business determines which fixed asset purchases or project investments are acceptable and which are not. using this approach, each proposed investment is given a quantitative analysis, allowing rational judgment to be made by the business owners. capital asset management requires a lot of. Capital budgeting explained. capital budgeting process is a decision making process where a company plans and determines any long term capex whose returns in terms of cash flows are expected to be received beyond a year. investment decisions may include any of the below: expansion. acquisition.

Comments are closed.