What Is Indemnity Insurance How It Works And Examples

:max_bytes(150000):strip_icc()/indemnity_insurance.asp-finalv2-2e2d190b2b94472c81af5d2b549c975a.png)

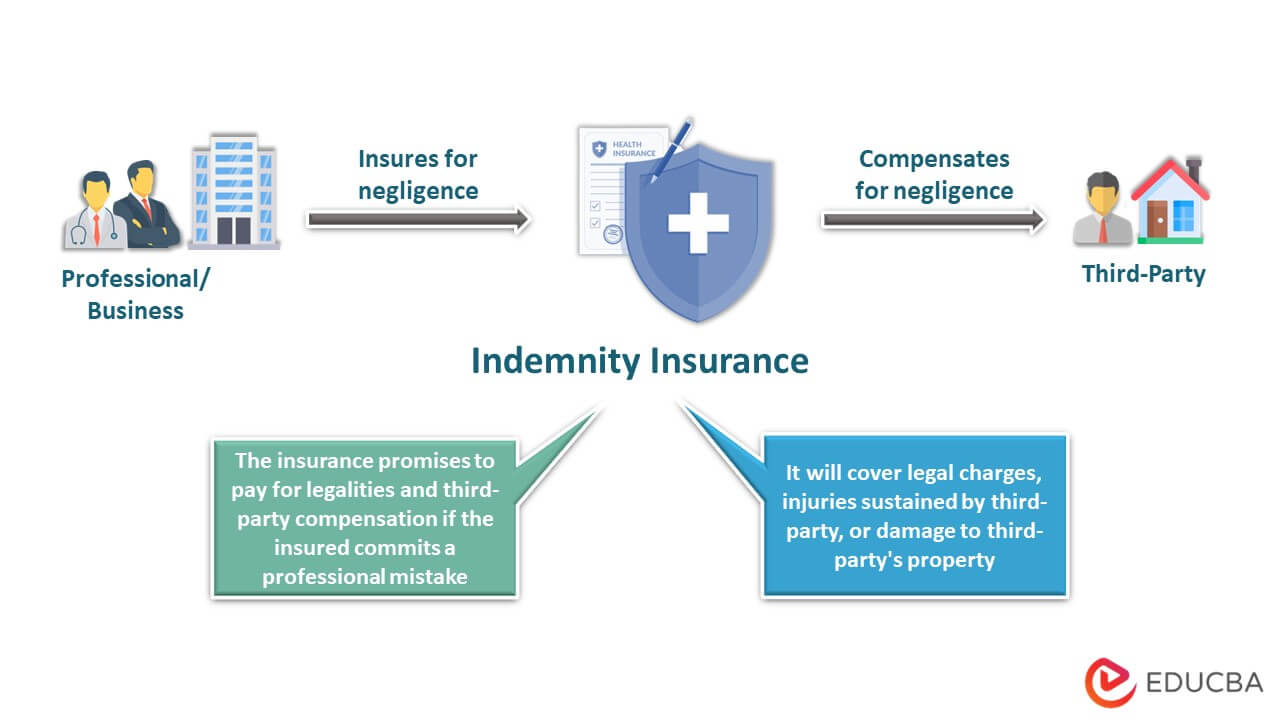

What Is Indemnity Insurance How It Works And Examples Indemnity insurance is designed to protect professionals and business owners when found to be at fault for a specific event such as misjudgment. certain professionals must carry indemnity. Indemnity insurance is a specialized type of insurance policy that provides compensation to insured parties for unexpected damages or losses. this coverage extends up to a predetermined limit, often matching the value of the loss itself. insurance companies offer indemnity insurance in exchange for regular premium payments.

Indemnity Insurance Meaning Types Features Examples Most insurance policies utilize a concept of indemnity when an insured experiences a loss and files a claim. learn what this means and how it works in various examples. Many companies make indemnity insurance a requirement, as lawsuits are common. associate in claims (aic): what it is, how it works, and example. an associate in claims (aic) is a professional. Indemnity insurance is a crucial tool for businesses and professionals seeking to protect themselves from the financial risks associated with claims made against them. it offers numerous benefits, such as financial security, peace of mind, and protection against lawsuits. however, there are also drawbacks, including premium costs, coverage. Indemnity is an agreement between two parties in which one party is responsible for compensating another for damages or losses they may incur. therefore, indemnity insurance can help protect a.

Professional Indemnity Insurance What Is It And How Does It Work Indemnity insurance is a crucial tool for businesses and professionals seeking to protect themselves from the financial risks associated with claims made against them. it offers numerous benefits, such as financial security, peace of mind, and protection against lawsuits. however, there are also drawbacks, including premium costs, coverage. Indemnity is an agreement between two parties in which one party is responsible for compensating another for damages or losses they may incur. therefore, indemnity insurance can help protect a. Indemnity insurance has a single purpose: to protect you against liability claims associated with misjudgments, malpractice or professional errors. it’s comprehensive coverage that pays out compensation for damages or losses when someone brings a liability claim against you. specifically, that means claims that are brought when someone. Indemnity is a contract in which one party agrees to compensate another party for any losses or damages they may experience. essentially, indemnity provides a form of insurance for a specific event or situation. the indemnifying party agrees to cover any costs or damages that the other party incurs as a result of a specific event or situation.

Comments are closed.