What Is Invoice Discounting The Number 1 Financing Solution

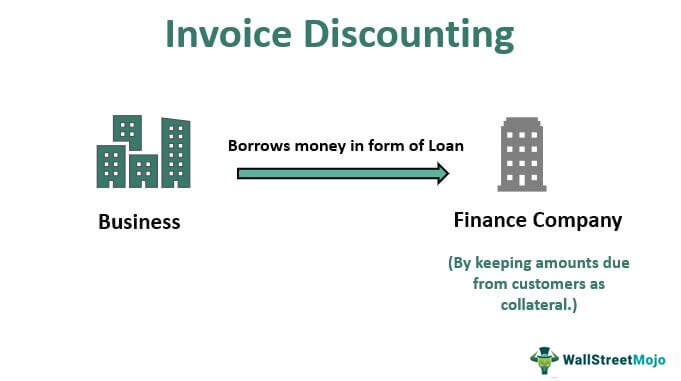

What Is Invoice Discounting The Number 1 Financing Solution Invoice discounting is a process in which a business sells an invoice to a financing company to access cash tied in unpaid invoices. discounting invoices allows businesses to get future cash flow discounted at today’s value. this is a type of invoice financing solution offered by financial intermediaries based on the invoice issued to the buyer. Invoice discounting allows a company to receive funds soon after sending out an invoice and can be done on a batch or single invoice basis. this allows capital to be used in the business for general cash flow or expansion purposes. it also removes pressure from the company in looking for alternative types of funding and having additional assets.

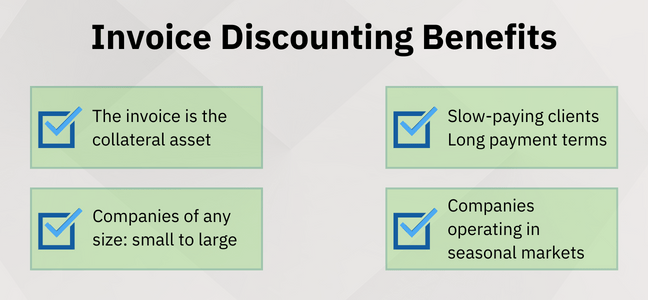

What Is Invoice Discounting The Number 1 Financing Solution Invoice discounting is a financing technique where a business sells its outstanding invoices to a third party at a discounted rate in exchange for immediate cash. in this type of financing, the third party is a financial institution that provides the loan based on the invoice’s value. this helps businesses to receive a portion of the invoice. Invoice discounting helps you receive a percentage of the total from the lender when you invoice a customer or client, providing your business with a cash flow boost. in short, invoice discounting help you in many ways like: improves your business cash flow. providing flexibility in getting quick cash. Invoicing discounting is a loan secured against outstanding invoices. invoice factoring, on the other hand, serves as an alternative approach that involves selling the invoices to a factoring company. the factoring company deals with the customers directly, which keeps a business from hunting down late payers. Our invoice discounting solution. when it comes to finding a flexible funding solution for businesses, invoice finance is a great way to continue reaching those all important goals – without worrying about continuous cash flow management. for many smes, outstanding invoices from customers can cause a number of problems.

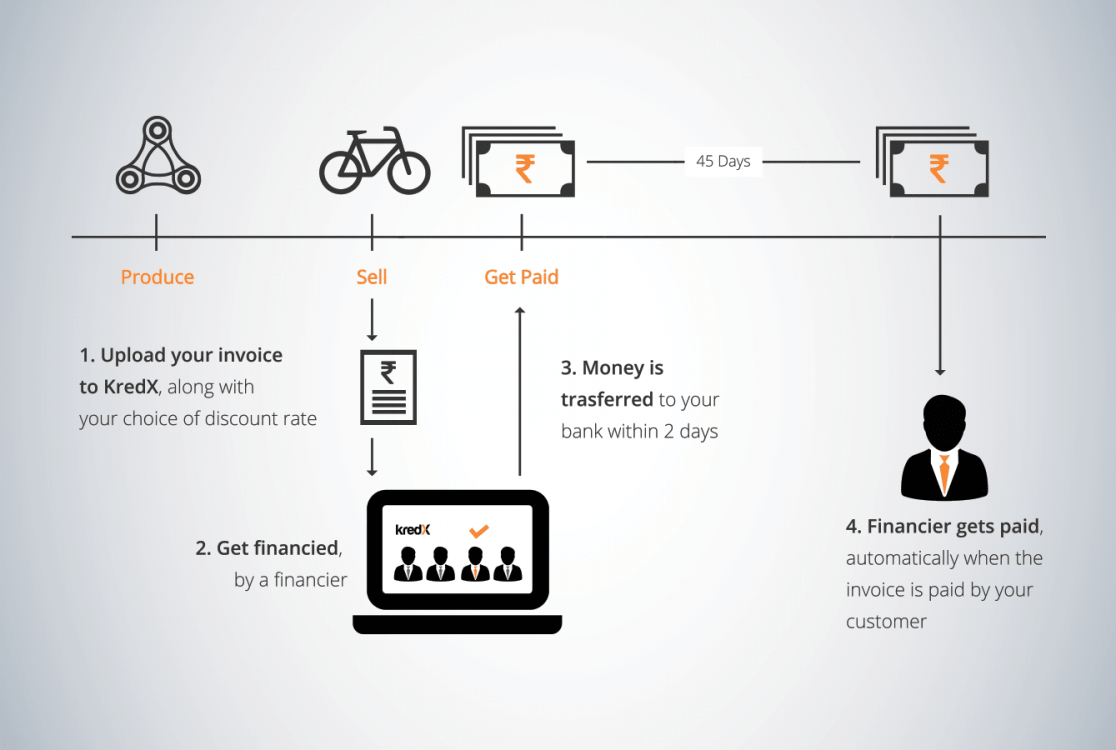

What Is Invoice Discounting And How Does It Work Kredx Blog Invoicing discounting is a loan secured against outstanding invoices. invoice factoring, on the other hand, serves as an alternative approach that involves selling the invoices to a factoring company. the factoring company deals with the customers directly, which keeps a business from hunting down late payers. Our invoice discounting solution. when it comes to finding a flexible funding solution for businesses, invoice finance is a great way to continue reaching those all important goals – without worrying about continuous cash flow management. for many smes, outstanding invoices from customers can cause a number of problems. Invoice financing (also known as accounts receivable financing) is a type of short term loan that allows businesses to borrow money against their unpaid invoices. the unpaid invoices serve as collateral, and once the invoices are paid off, you can pay back the loan, minus any fees owed to the lender. it’s common for companies, especially. Invoice discounting is a financial solution that enables businesses to receive cash upfront on their outstanding sales invoices by pledging them as collateral with an invoice bill discounting company. this allows businesses to generate regular cash flows and receive payment faster than waiting for the due date.

Invoice Discounting What Is It Vs Factoring Advantages Invoice financing (also known as accounts receivable financing) is a type of short term loan that allows businesses to borrow money against their unpaid invoices. the unpaid invoices serve as collateral, and once the invoices are paid off, you can pay back the loan, minus any fees owed to the lender. it’s common for companies, especially. Invoice discounting is a financial solution that enables businesses to receive cash upfront on their outstanding sales invoices by pledging them as collateral with an invoice bill discounting company. this allows businesses to generate regular cash flows and receive payment faster than waiting for the due date.

What Is Invoice Discounting And How You Can Benefit From It

Comments are closed.