What Is Invoice Discounting Types Process Benefits

What Is Invoice Discounting Types Process Benefits Types, process, & benefits. invoice discounting is nothing but the practice of letting businesses use unpaid invoices to get short term business loans and fulfil their various operating expenses. it is suitable for enterprises with comparatively high profit margins. this practice is quite common among high profit businesses as they focus on. Invoice discounting is using your business’s unpaid invoices as collateral for loans. lenders give businesses a cash advance, which is a percentage of the invoice’s value. a company that utilizes invoice discounting uses it as a short term borrowing option. essentially, invoice discounting accelerates cash flow from customers.

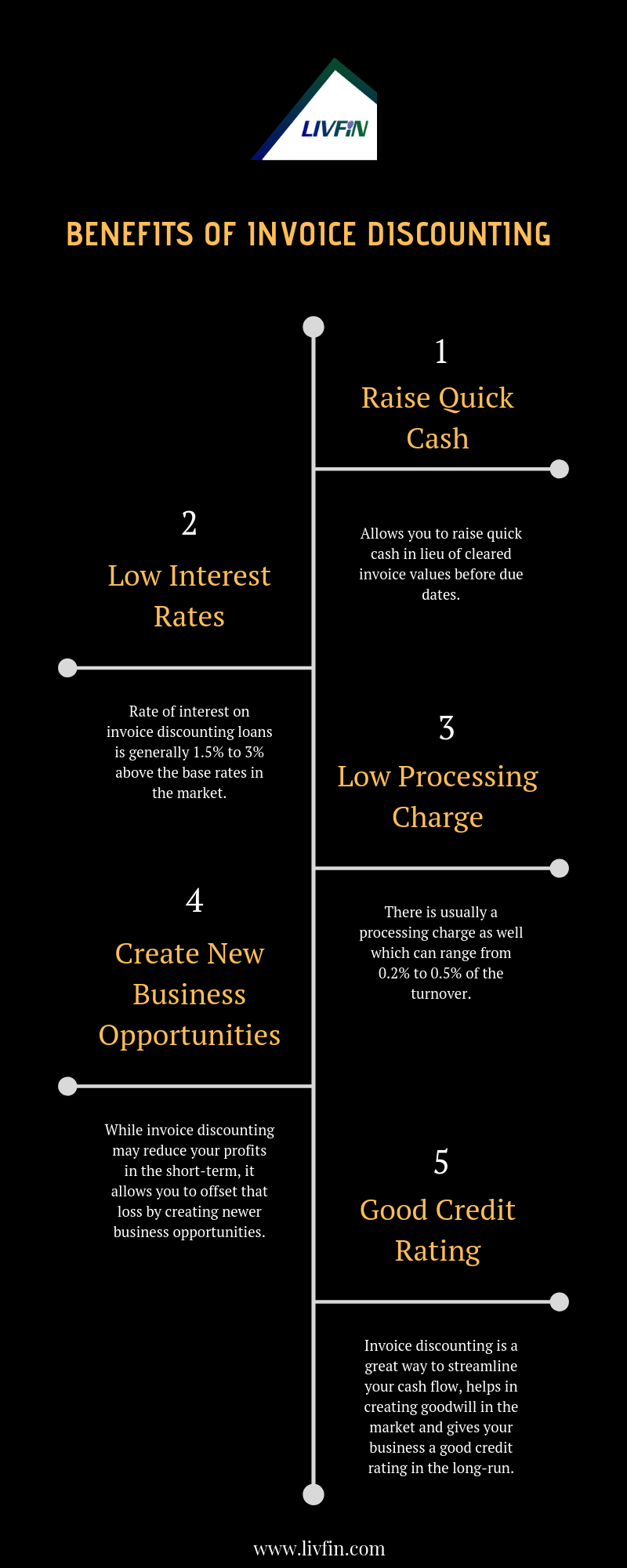

What Is Invoice Discounting And How You Can Benefit From It Invoice discounting, also known as invoice financing or accounts receivable financing, is a method of small business financing that uses unpaid customer invoices, or receivables, as collateral for. Invoice discounting helps you receive a percentage of the total from the lender when you invoice a customer or client, providing your business with a cash flow boost. in short, invoice discounting help you in many ways like: improves your business cash flow. providing flexibility in getting quick cash. Invoice discounting offers plenty of benefits for businesses struggling due to unpaid invoices. here are some of the key benefits. invoice discounting offers a business fast access to its accounts receivable ledger. this invoice financing service secures a more stable cash flow stream. Below are some of the advantages of invoice discounting: availability of cash by using this type of financing, one can easily avail funds within 72 hours of applying. it is beneficial for businesses generating high value invoices. a single unpaid invoice keeps a huge fund tied up.

What Is Invoice Discounting Features And Benefits For Small Businesses Invoice discounting offers plenty of benefits for businesses struggling due to unpaid invoices. here are some of the key benefits. invoice discounting offers a business fast access to its accounts receivable ledger. this invoice financing service secures a more stable cash flow stream. Below are some of the advantages of invoice discounting: availability of cash by using this type of financing, one can easily avail funds within 72 hours of applying. it is beneficial for businesses generating high value invoices. a single unpaid invoice keeps a huge fund tied up. Invoice discounting is a financing technique where a business sells its outstanding invoices to a third party at a discounted rate in exchange for immediate cash. in this type of financing, the third party is a financial institution that provides the loan based on the invoice’s value. this helps businesses to receive a portion of the invoice. Invoice discounting is a form of financing where a company receives a loan based on the value of its accounts receivable. the business repays the loan when it collects payments from its customers. the discount refers to how the invoice finance provider determines the loan amount. it takes the invoice value, applies a discount, and then advances.

Comments are closed.