What Is Invoice Finance And How Does It Work Youtube

Invoice Finance How Does It Work A Guide To Invoice Finance Y Invoice finance allows you to leverage your invoices as security for a loan. it's a finance facility which enables your business to access funds tied up in o. If you need to improve your cash flow to help grow your business, invoice finance may be a great option for you. in this video we explain all about invoice f.

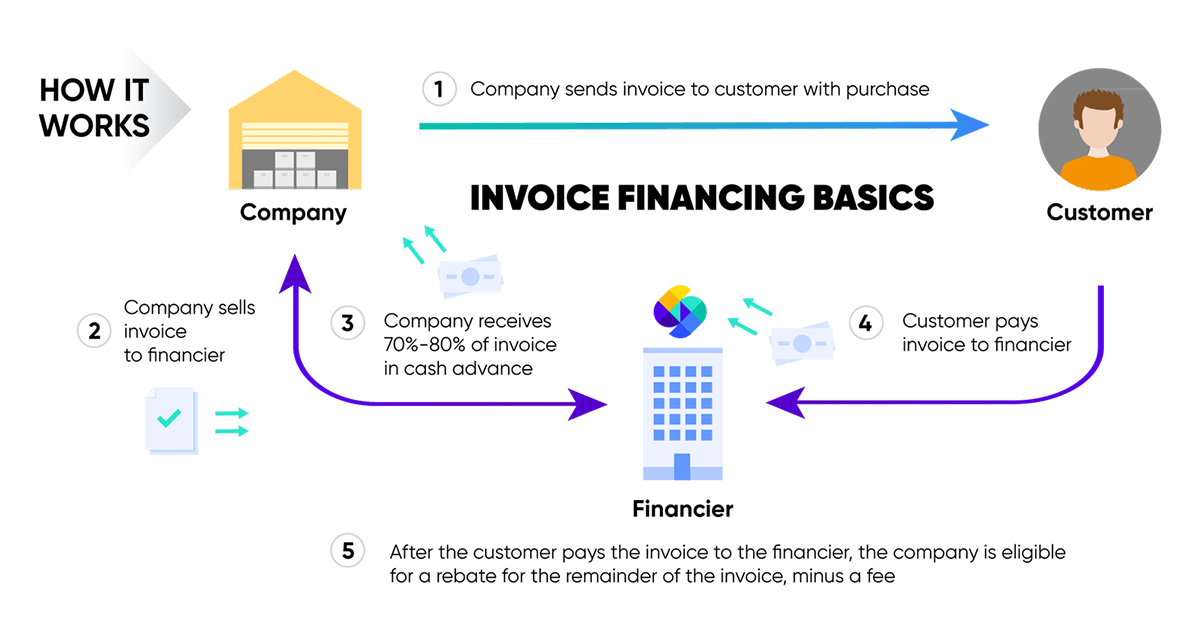

What Is Invoice Finance Youtube Cliqvid invoice finance or invoice discounting is a form of short term borrowing often used to improve a company's cash flow.a business will en. Invoice factoring. invoice factoring is a financial transaction where a business sells its accounts receivable (invoices) to a third party financial company, known as a factor, at a discount. the factor advances a significant portion of the invoice value upfront, typically around 70 90%, and then collects payments directly from the business’s. Simply put, invoice financing is the process of turning outstanding invoices that you have issued to your customers into cash. rather than having to wait for 30, 60, or even 90 days (depending on your terms) for a customer to make a payment, just send a copy of the invoice to your invoice financing provider. they will give you a cash advance. Invoice financing, sometimes referred to as debtor finance or accounts receivable finance, allows businesses to borrow money against their outstanding invoices. if approved, businesses generally receive up to 85 per cent of the value of their invoices, with the remaining 15 per cent paid upon receipt of payment from the customer.

How Does Invoice Financing Work Youtube Simply put, invoice financing is the process of turning outstanding invoices that you have issued to your customers into cash. rather than having to wait for 30, 60, or even 90 days (depending on your terms) for a customer to make a payment, just send a copy of the invoice to your invoice financing provider. they will give you a cash advance. Invoice financing, sometimes referred to as debtor finance or accounts receivable finance, allows businesses to borrow money against their outstanding invoices. if approved, businesses generally receive up to 85 per cent of the value of their invoices, with the remaining 15 per cent paid upon receipt of payment from the customer. Invoice financing is a form of short term borrowing that is extended by a lender to its business customers based on unpaid invoices. through invoice factoring, a company sells its accounts. The invoice financing company approves the invoice and provides you with a cash advance of 90% of the invoice ($45,000). the lender charges a 3% fee for each month the invoice is outstanding. your customer pays the $50,000 invoice in three weeks, so your total fee for the advance is $1,350. once you receive the customer’s payment, you repay.

What Is Invoice Finance And How Does It Work In 2023 Youtube Invoice financing is a form of short term borrowing that is extended by a lender to its business customers based on unpaid invoices. through invoice factoring, a company sells its accounts. The invoice financing company approves the invoice and provides you with a cash advance of 90% of the invoice ($45,000). the lender charges a 3% fee for each month the invoice is outstanding. your customer pays the $50,000 invoice in three weeks, so your total fee for the advance is $1,350. once you receive the customer’s payment, you repay.

What Is Invoice Financing How Does It Work Yubi

Comments are closed.