What Is Overtime Guide To Laws And Calculations

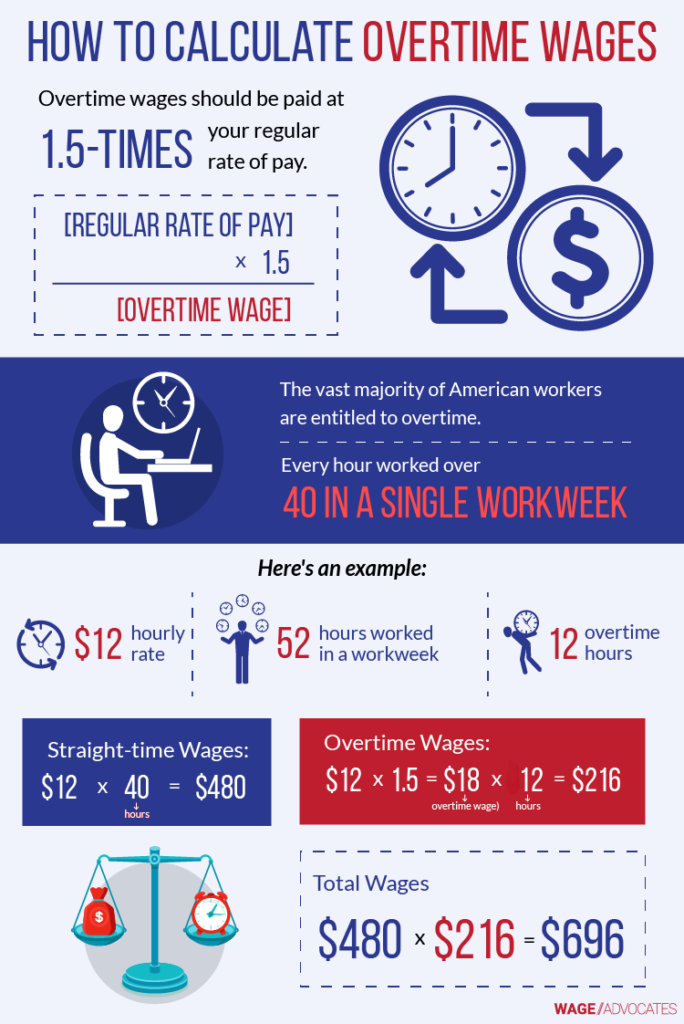

How To Calculate Overtime Pay Easy Overtime Calculator A Basic Guide Next, calculate the employee’s regular pay and overtime pay separately. 40 hours x $10 = $400 (regular pay) 10 hours x $15 = $150 (overtime pay) finally, add together the two wages to get the employee’s gross pay. $400 $150 = $550. your employee’s gross wages are $550. The federal overtime provisions are contained in the fair labor standards act (flsa). unless exempt, employees covered by the act must receive overtime pay for hours worked over 40 in a workweek at a rate not less than time and one half their regular rates of pay. there is no limit in the act on the number of hours employees aged 16 and older.

What Is Overtime Guide To Laws And Calculations In addition, section 7(g)(2) of the flsa allows, under specified conditions, the computation of overtime pay based on one and one half times the hourly rate in effect when the overtime work is performed. the requirements for computing overtime pay pursuant to section 7(g)(2) are prescribed in 29 cfr 778.415 through 778.421 . Daily overtime calculation. daily overtime calculation in alaska, california, colorado, and nevada. in these states, overtime pay is mandated for hours worked beyond 8 in a single workday. example: daily overtime calculation. let's illustrate a daily overtime calculation using this state specific rule: suppose an employee's regular rate is $20. Multiply the overtime rate by one and a half. in the example, multiply $20 by one and a half to get $30. multiply the number of hours over 40 by the rate. in our example, the worker had five hours. Calculating overtime pay begins with understanding the employee's regular rate of pay, which serves as the basis for determining the time and a half rate required for overtime hours. this calculation can become complex when considering factors such as commission, bonuses, or shift differentials, which may need to be included in the regular rate.

Employment Law Calculation For Payment Of Overtime Work Chia Lee Multiply the overtime rate by one and a half. in the example, multiply $20 by one and a half to get $30. multiply the number of hours over 40 by the rate. in our example, the worker had five hours. Calculating overtime pay begins with understanding the employee's regular rate of pay, which serves as the basis for determining the time and a half rate required for overtime hours. this calculation can become complex when considering factors such as commission, bonuses, or shift differentials, which may need to be included in the regular rate. To compute overtime, multiply the employee’s regular pay rate by 1.5, then multiply by the total overtime hours worked. for example, an hourly employee making $20 per hour, who works 45 hours in a week would receive $30 per hour for the five hours of overtime. this totals an additional $150 on top of their regular earnings. Nevada. in nevada, employers must provide overtime at 1.5 pay to employees who work more than 40 hours in a workweek (in line with federal law). employees may also receive daily overtime pay if: they work more than 8 hours in a work day, and. their regular wage is less than 1.5 times the nevada minimum wage rate.

Comments are closed.