What S The Difference Between Angel Investors And Venture Capitalis

Should Your Business Pursue Angel Investors Or Venture Capital And Venture capitalists ask for more company equity than angel investors. angel investors fund younger, less established businesses than venture capitalists. venture capitalists look for a bigger return on investment than angel investors. angel investors spend more time working with and mentoring business owners than venture capitalists do. Angel investors invest in a business in their initial stage, i.e. pre revenue stage. as against, venture capitalists invest in a business which is passed through their initial stage, i.e. pre profitability stage. angel investors are well off individuals, who invest their own surplus money in new and high growth potential businesses.

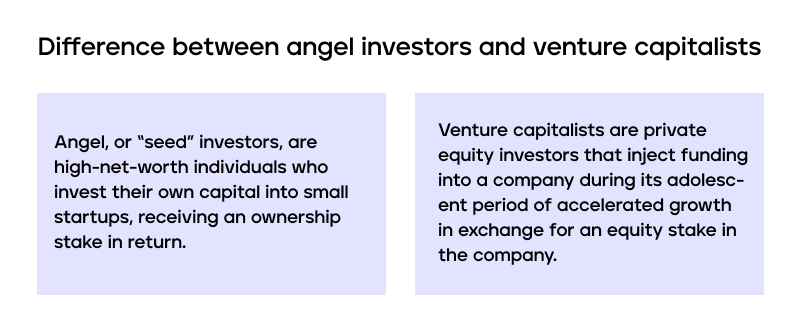

Angel Investors Vs Venture Capitalists What S The Difference Angel investors and venture capitalists are known to fund new or early stage business endeavors. angels are more likely to be passive investors—friends or family—whereas venture capitalists typically work for professional firms. venture capital firms are more likely to take an active role in managing a company, as well as a larger equity stake. One major difference between angel investors vs. venture capitalists is the type of projects they’re looking to invest in. venture capitalists want businesses with very large market caps from whom they predict an immense return—often 10x or more. (this is obviously a bit different from angel investors, who are looking to make a return, but. 2. angel investors and venture capitalists invest different amounts. if you’re looking into approaching a venture capitalist or angel investor, you’ll need an accurate idea of what they’ll be able to provide financially. typically, angels invest between $25,000 and $100,000 of their own money, though sometimes they invest more or less. Angel investors are wealthy individuals (or groups of wealthy individuals) who invest their own money into companies. venture capitalists (vcs) are employees of venture capital firms that invest other people’s money (which they hold in a fund) into companies. now let’s take a closer at the two, before diving into the specific differences.

юааwhatтащsюаб юааthe Differenceюаб юааbetweenюаб юааangelюаб юааinvestorsюаб юааand Ventureюаб Capi 2. angel investors and venture capitalists invest different amounts. if you’re looking into approaching a venture capitalist or angel investor, you’ll need an accurate idea of what they’ll be able to provide financially. typically, angels invest between $25,000 and $100,000 of their own money, though sometimes they invest more or less. Angel investors are wealthy individuals (or groups of wealthy individuals) who invest their own money into companies. venture capitalists (vcs) are employees of venture capital firms that invest other people’s money (which they hold in a fund) into companies. now let’s take a closer at the two, before diving into the specific differences. Angel investors typically provide smaller amounts of funding, valuable advice, and networking opportunities, usually at the seed stage. venture capitalists, on the other hand, invest larger sums, typically in later stages of business development, and offer more structured support, often taking an active role in company management. The key difference between a vc and an angel investor is that a vc operates as a team of individuals with pooled money from private investors, whereas an angel is a single investor. venture capitalists use a structure where firms are formed with limited partnerships between people with expertise and money to make more in depth investment decisions.

Comments are closed.