What You Need To Know Before Opening A Roth Ira Mini

You Need To Know This Before Opening A Roth Ira Youtube Steps to open a roth ira. to open a roth ira, follow these steps: 1. determine your eligibility. the first step to opening a roth ira is finding out if you're eligible. the criteria for roth ira. For 2020, the maximum contribution to a roth ira is $6,000 per year. but if you’re 50 or older, that increases to $7,000 per year. there is a bit of a catch with that contribution. it’s only.

What You Need To Know Before Establishing A Roth Ira For Your Ki 4. select a provider to open your roth ira. opening a roth ira as a 'do it yourself' investor. for people who want to pick their own investments, opening a roth ira at an online broker makes a lot. The short answer is yes, their child can have an ira. there are no minimum age limits on who can an ira. but there are some things you’ll need to know before opening an account for a minor. to contribute to an ira, everyone, including minors, must have eligible compensation. the irs defines eligible compensation as taxable income, including. That means you can let the money keep growing until you need it, or even leave tax free income to your beneficiaries. the steps to open a roth ira are simple: make sure you're eligible. decide. 3. open the account. to open a roth ira, you’ll need to provide personal information like your name, address, date of birth and social security number. you’ll also need to choose a beneficiary.

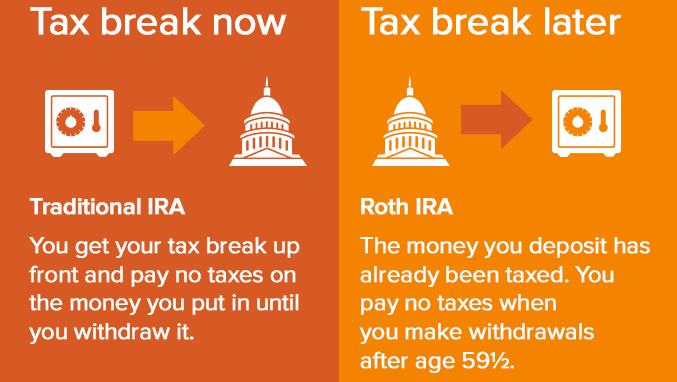

4 Things You Need To Know Before Opening A Roth Ira Youtub That means you can let the money keep growing until you need it, or even leave tax free income to your beneficiaries. the steps to open a roth ira are simple: make sure you're eligible. decide. 3. open the account. to open a roth ira, you’ll need to provide personal information like your name, address, date of birth and social security number. you’ll also need to choose a beneficiary. These are the documents that you need. once you’ve determined your eligibility status, opening a roth ira is relatively simple. most banking or investing platforms require just a few key pieces. Please understand these before opening your account. roth ira earnings can be withdrawn tax free after age 59½, if you've held the account for at least five years. if you take a distribution of roth ira earnings before you reach age 59½ and before the account is five years old, the earnings may be subject to taxes and a 10% federal tax penalty.

Four Things You Must Know Before Opening A Roth Ira Market Trade These are the documents that you need. once you’ve determined your eligibility status, opening a roth ira is relatively simple. most banking or investing platforms require just a few key pieces. Please understand these before opening your account. roth ira earnings can be withdrawn tax free after age 59½, if you've held the account for at least five years. if you take a distribution of roth ira earnings before you reach age 59½ and before the account is five years old, the earnings may be subject to taxes and a 10% federal tax penalty.

Comments are closed.