Whats The Difference Between Volatility And Implied Volatility

Implied Volatility Basics Factors Importance Chart Example Implied, or projected, volatility is a forward looking metric used by options traders to calculate probability. implied volatility, as its name suggests, uses supply and demand, and represents the. Implied volatility is the expected price movement in a security over a period of time. implied volatility is forward looking and represents the expected volatility in the future. iv estimates the potential price range for a defined time period. options traders reference several different types of volatility.

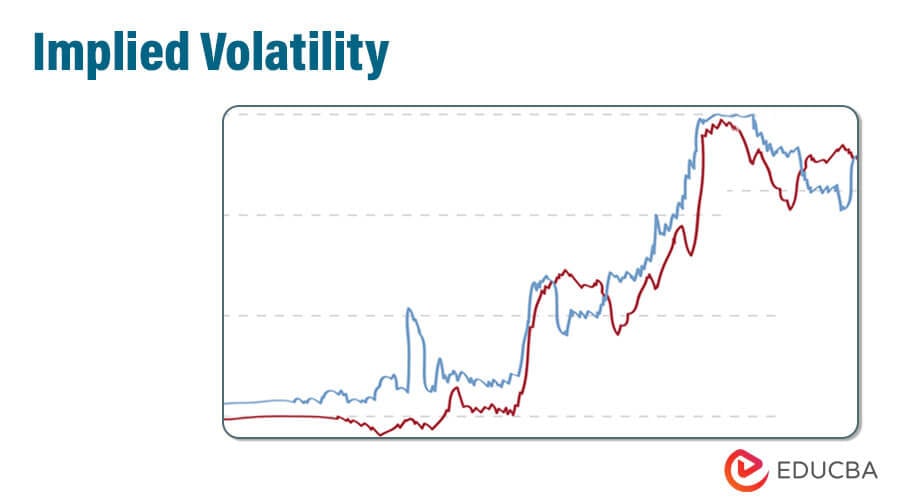

What Is Implied Volatility Iv Rank And Why It Matters Youtube Implied volatility iv: implied volatility is the estimated volatility of a security's price. in general, implied volatility increases when the market is bearish , when investors believe that the. Implied volatility. expressed as a percentage, implied volatility (iv) is computed using an options pricing model and reflects the market's expectations for the future volatility of the underlying stock. for example, if the iv of xyz 30 day options is 25% and similar options on zyx have iv of 50%, zyx shares are expected to see greater. Implied volatility rank (aka iv rank or ivr) is a statistic measurement used when trading options, and reports how the current level of implied volatility in a given underlying compares to the last 52 weeks of historical data. ivr is on a scale between 0 100, where 0 represents the low iv% print for the year, and 100 represents the high iv% print. This is how we calculate implied volatility – from option prices. therefore, implied volatility is the future volatility expected by the options market. this expectation may be correct, or it may not. realized volatility is what you get – it is the volatility actually realized in the underlying market. it can be calculated from underlying.

What Is Implied Volatility Iv Options Explained Implied volatility rank (aka iv rank or ivr) is a statistic measurement used when trading options, and reports how the current level of implied volatility in a given underlying compares to the last 52 weeks of historical data. ivr is on a scale between 0 100, where 0 represents the low iv% print for the year, and 100 represents the high iv% print. This is how we calculate implied volatility – from option prices. therefore, implied volatility is the future volatility expected by the options market. this expectation may be correct, or it may not. realized volatility is what you get – it is the volatility actually realized in the underlying market. it can be calculated from underlying. Trying 0.45 for implied volatility yields $3.20 for the price of the option, and so the implied volatility is between 0.45 and 0.6. the iterative search procedure can be done multiple times to. Implied volatility is a statistical measure of the expected amount of price movements in a given stock or other financial asset over a set future time frame. traders use iv for several reasons.

Comments are closed.