Why A 401 K Over A Sep Or Simple Ira Mariner Wealth Advisors

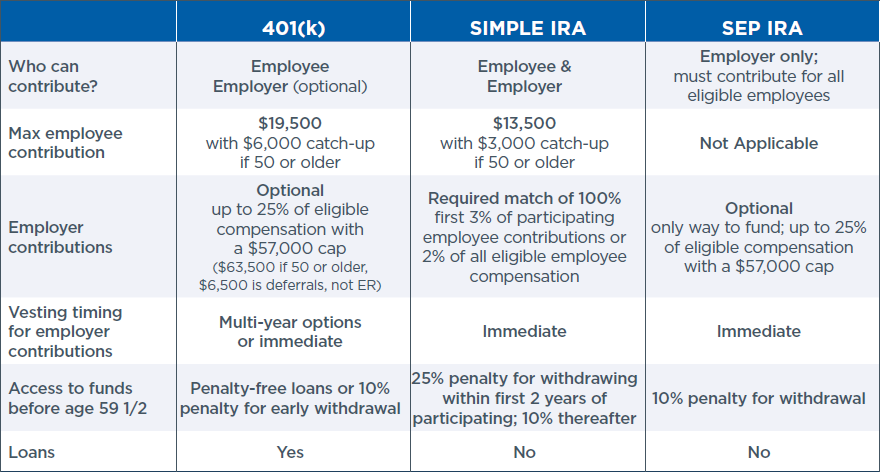

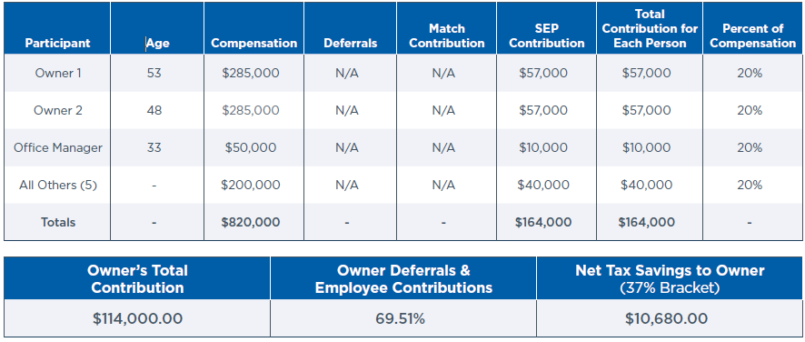

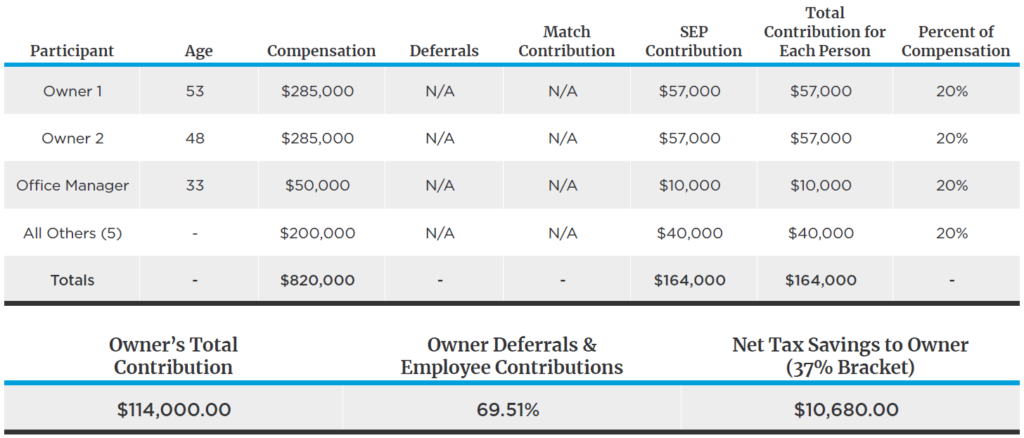

Why A 401 K Over A Sep Or Simple Ira Mariner Wealth Advisors Manage costs and tax deductions better with a 401 (k) plan (vs. a sep or simple ira) while sep and simple iras may be easier initially for plan sponsors to establish over 401 (k) plans, there are clear gaps in the benefit of these plan types for both employers and employees. compared to a simple ira, a 401 (k) plan provides higher contribution. Manage costs and tax deductions better with a 401(k) plan (vs. a sep or simple ira) • while sep and simple iras may be easier initially for plan sponsors to establish over 401(k) plans, there are clear gaps in the benefit of these plan types for both employers and employees. • compared to a simple ira, a 401(k) plan provides higher.

Why A 401 K Over A Sep Or Simple Ira Mariner Wealth Advisors For small companies a simple ira can make sense as a retirement savings option for both the business owner and their employees. but as the company grows, a simple ira might no longer be a fitting solution. by understanding the key diferences between the 2 plans, you can quickly identify if now is the right time to convert to a 401(k) plan. The simple ira vs. 401 (k) decision is, at its core, a choice between simplicity and flexibility for employers. the aptly named simple ira, which stands for savings incentive match plan for. Why a solo 401 (k) may be the better choice: self employed people may be able to save more in a solo 401 (k) than they can in a sep ira. solo 401 (k)s let you make both employee and employer. A simple ira allows employers to make contributions on behalf of their employees. on the other hand, a sep ira only allows employers to make contributions themselves. additionally, a simple ira has an annual contribution limit of $15,500 per employee (as of 2023), while a sep ira has a yearly contribution limit of 25% of each employee's salary.

Discover The Benefits Of Establishing A 401 K Over A Sep Or Simple Why a solo 401 (k) may be the better choice: self employed people may be able to save more in a solo 401 (k) than they can in a sep ira. solo 401 (k)s let you make both employee and employer. A simple ira allows employers to make contributions on behalf of their employees. on the other hand, a sep ira only allows employers to make contributions themselves. additionally, a simple ira has an annual contribution limit of $15,500 per employee (as of 2023), while a sep ira has a yearly contribution limit of 25% of each employee's salary. The maximum compensation that counts for the sep ira is $330,000. and contributions to the sep are limited to the lesser of 25% of compensation or $66,000 (2023 limit). hence, while 25% of. The solo 401 (k) annual contribution maximum in 2023 is $66,000 and $69,000 in 2024. unlike sep iras, people age 50 and older can make additional catch up contributions of up to $7,500 a year to a.

Discover The Benefits Of Establishing A 401 K Over A Sep Or Simple The maximum compensation that counts for the sep ira is $330,000. and contributions to the sep are limited to the lesser of 25% of compensation or $66,000 (2023 limit). hence, while 25% of. The solo 401 (k) annual contribution maximum in 2023 is $66,000 and $69,000 in 2024. unlike sep iras, people age 50 and older can make additional catch up contributions of up to $7,500 a year to a.

Discover The Benefits Of Establishing A 401 K Over A Sep Or Simple

Comments are closed.